- Canada

- /

- Energy Services

- /

- TSX:WRG

TSX Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the Canadian market celebrates the third anniversary of its bull run, investors are assessing where opportunities might lie amidst easing inflation and shifting trade dynamics. Penny stocks, while often seen as a relic from past eras, continue to offer intriguing prospects for those seeking affordability and growth potential in smaller or newer companies. In this article, we explore three penny stocks that stand out for their financial resilience and potential to perform well in the current economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.46 | CA$263.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.38 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$798.36M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.03 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$1.90 | CA$838.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.67 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.43 | CA$173.58M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$197.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing tailored to the banking and merchant industries in North America, with a market cap of CA$36.09 million.

Operations: The company's revenue is primarily derived from software-related sales and services, totaling CA$7.72 million.

Market Cap: CA$36.09M

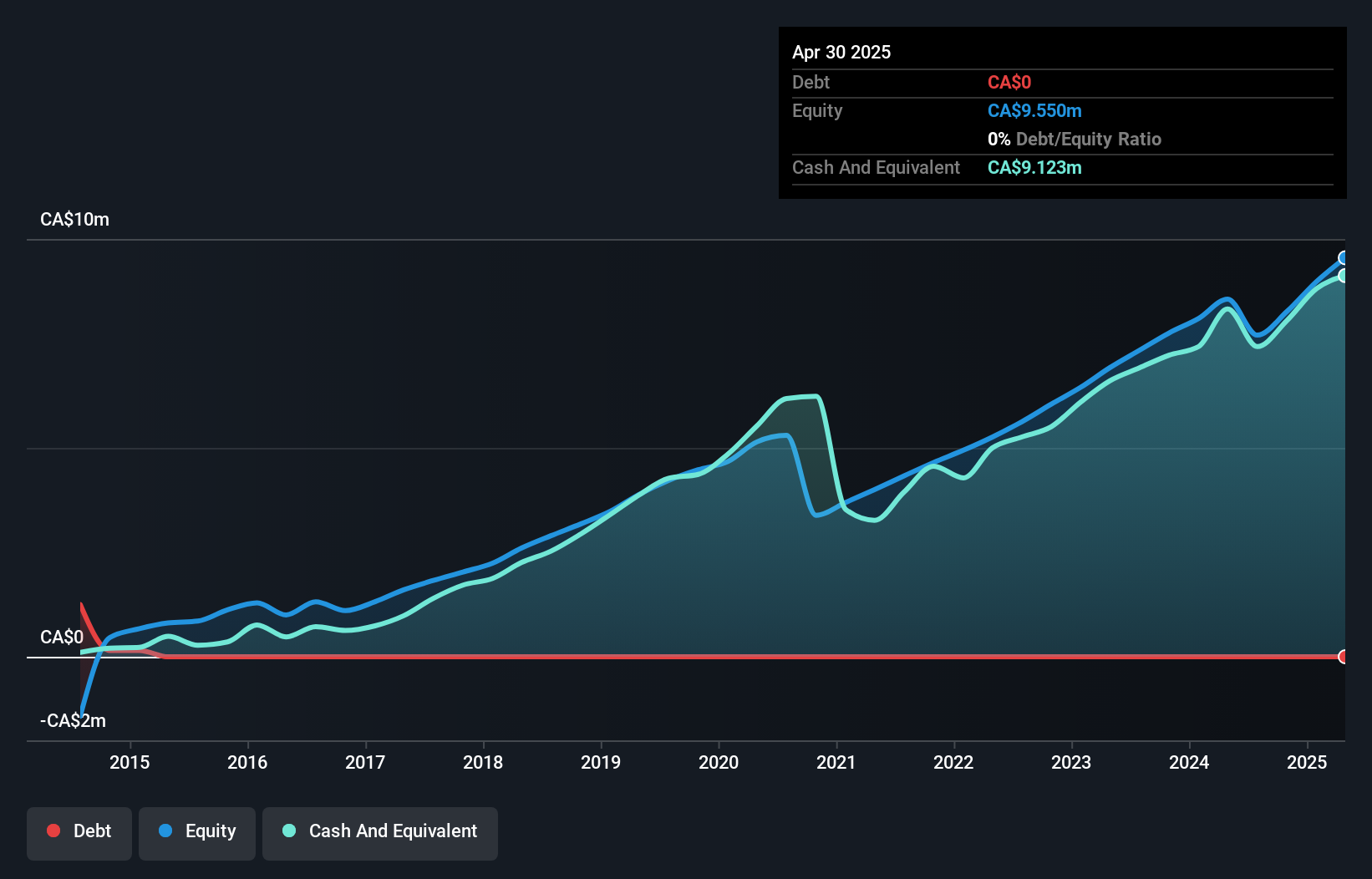

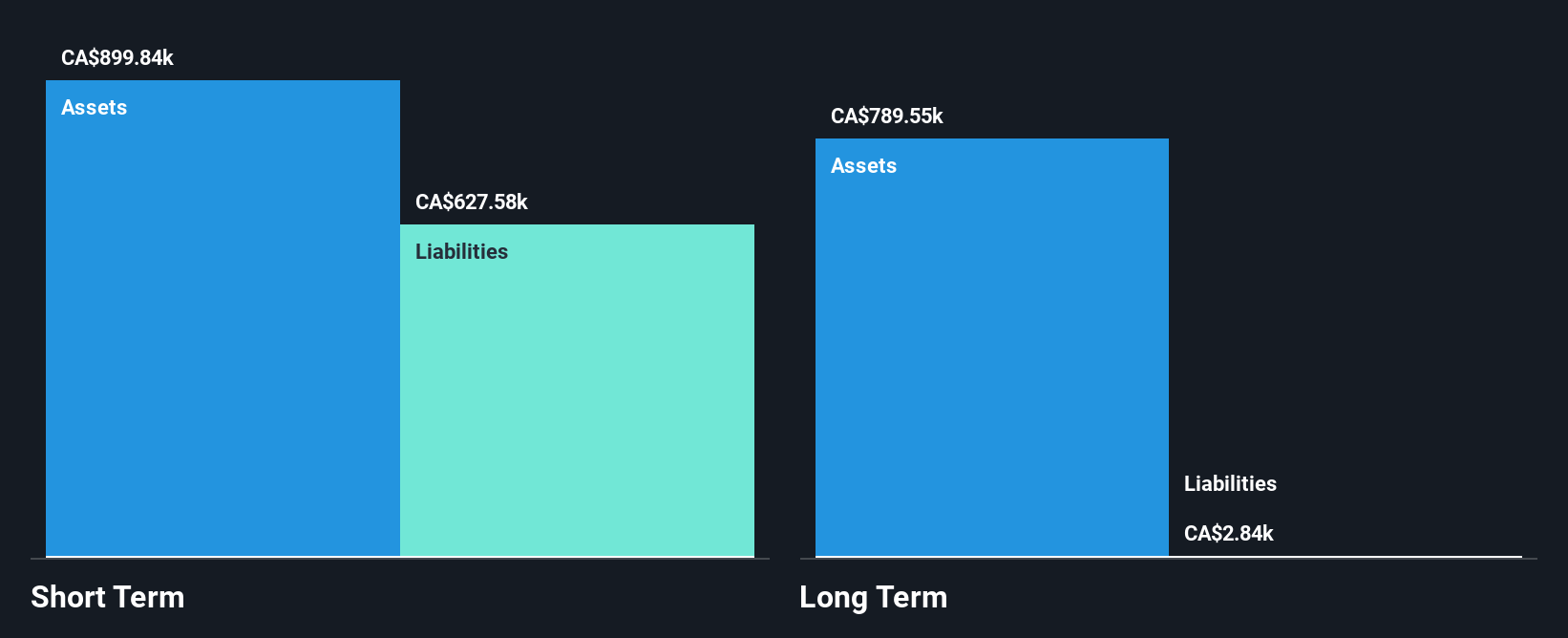

NamSys Inc., with a market cap of CA$36.09 million, stands out for its strong financial health and consistent earnings growth. The company boasts no debt, high non-cash earnings quality, and a robust return on equity at 23.8%. Its short-term assets significantly exceed liabilities, ensuring liquidity stability. Recent earnings reports indicate steady revenue growth; third-quarter sales increased to CA$1.92 million from CA$1.74 million year-on-year, with net income improving to CA$0.61 million from CA$0.58 million in the same period last year. Despite these strengths, NamSys's recent buyback program saw no share repurchases completed as planned.

- Take a closer look at NamSys' potential here in our financial health report.

- Assess NamSys' previous results with our detailed historical performance reports.

Wilton Resources (TSXV:WIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wilton Resources Inc. is a Canadian company focused on oil and gas exploration and development, with a market cap of CA$27.72 million.

Operations: The company generates revenue from its oil and gas exploration and development activities, amounting to CA$0.01 million.

Market Cap: CA$27.72M

Wilton Resources Inc., with a market cap of CA$27.72 million, is pre-revenue, generating minimal income from its oil and gas activities. The company remains debt-free but faces challenges with short-term liabilities exceeding its assets. Recent private placements raised CA$782,669.90 to bolster financial stability, though only 92% of the offering was subscribed. Despite seasoned management and board members providing experienced leadership, Wilton's profitability remains elusive as losses have increased over the past five years at a rate of 7.7% annually. The company's cash runway is limited to one month based on free cash flow estimates before recent capital raises.

- Click to explore a detailed breakdown of our findings in Wilton Resources' financial health report.

- Examine Wilton Resources' past performance report to understand how it has performed in prior years.

Western Energy Services (TSX:WRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Energy Services Corp. is an oilfield service company operating in Canada and the United States with a market cap of CA$71.75 million.

Operations: The company's revenue is derived from two main segments: Contract Drilling, contributing CA$162.23 million, and Production Services, adding CA$56.86 million.

Market Cap: CA$71.75M

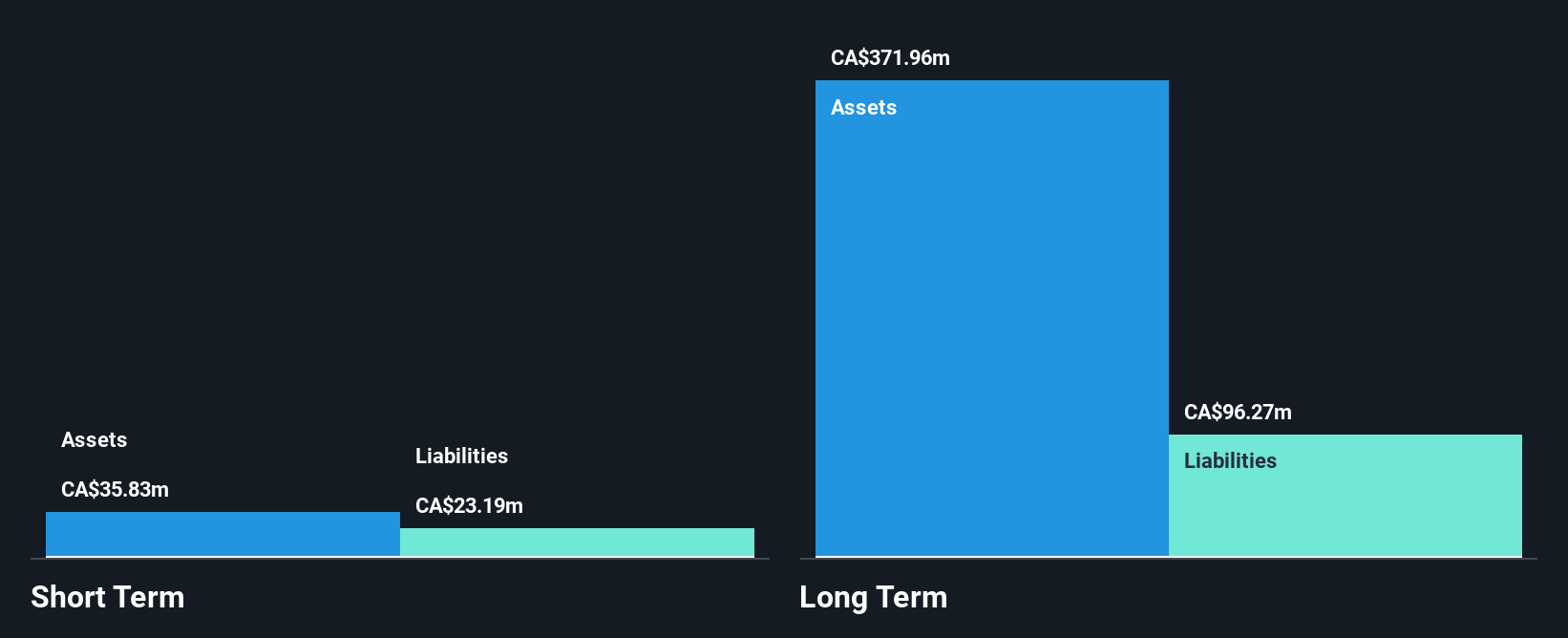

Western Energy Services Corp., with a market cap of CA$71.75 million, operates in the oilfield service sector across Canada and the U.S. Despite being unprofitable, it has reduced losses by 40.1% annually over five years and maintains a satisfactory net debt to equity ratio of 30.4%. Recent earnings show a decline in sales to CA$50.04 million for Q3 2025, with a net loss of CA$2.35 million compared to the previous year. The company benefits from stable weekly volatility and sufficient cash runway for over three years due to positive free cash flow growth.

- Get an in-depth perspective on Western Energy Services' performance by reading our balance sheet health report here.

- Understand Western Energy Services' earnings outlook by examining our growth report.

Taking Advantage

- Click here to access our complete index of 408 TSX Penny Stocks.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Western Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WRG

Western Energy Services

Operates as an oilfield service company in Canada and the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion