Little Excitement Around Sylogist Ltd.'s (TSE:SYZ) Revenues As Shares Take 32% Pounding

Sylogist Ltd. (TSE:SYZ) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

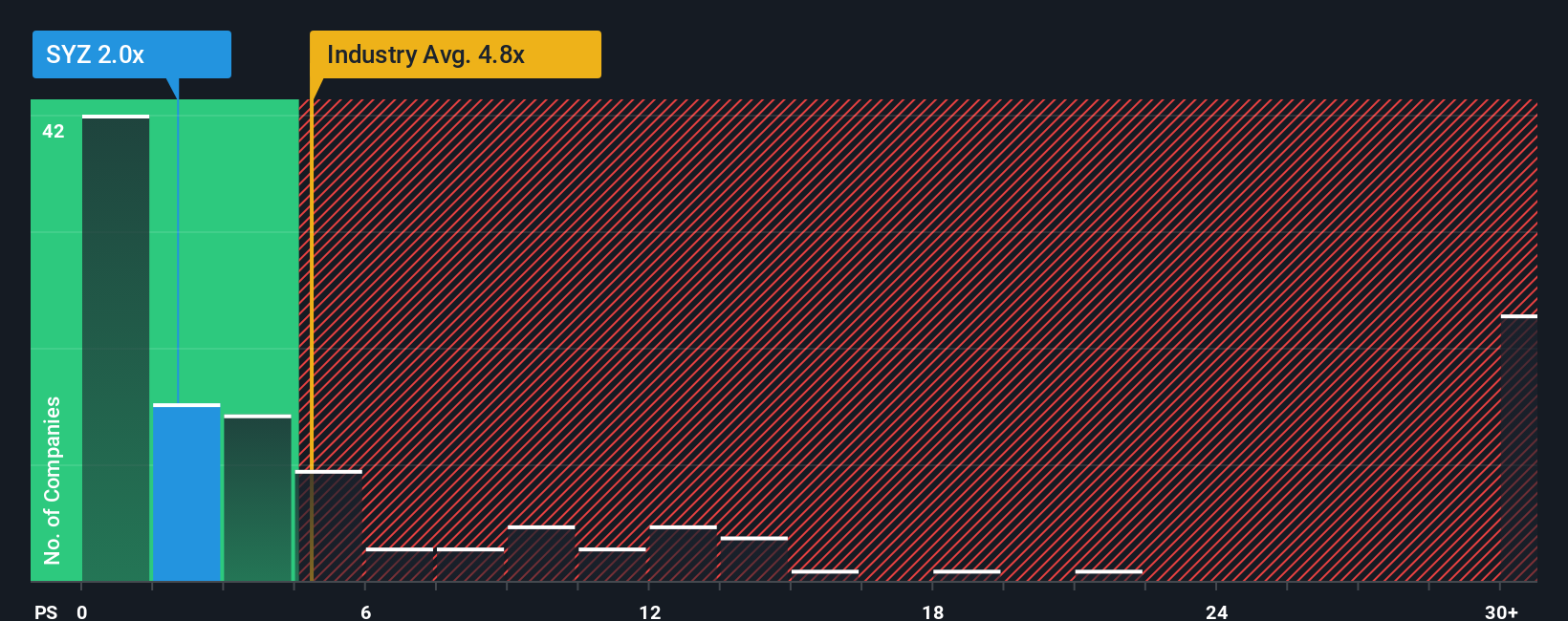

After such a large drop in price, Sylogist may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Software industry in Canada have P/S ratios greater than 4.8x and even P/S higher than 14x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Sylogist

What Does Sylogist's P/S Mean For Shareholders?

Sylogist hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sylogist will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Sylogist?

The only time you'd be truly comfortable seeing a P/S as depressed as Sylogist's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.1%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.3% during the coming year according to the six analysts following the company. With the industry predicted to deliver 29% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Sylogist is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Having almost fallen off a cliff, Sylogist's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Sylogist maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Sylogist (1 makes us a bit uncomfortable!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SYZ

Sylogist

A software company, provides mission-critical software-as-a-service solutions to public sector customers in Canada, the United States, the United Kingdom, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.