Investors Aren't Entirely Convinced By Lightspeed Commerce Inc.'s (TSE:LSPD) Revenues

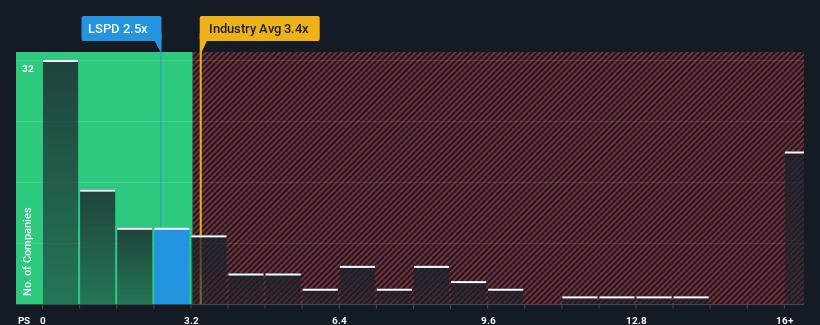

With a price-to-sales (or "P/S") ratio of 2.5x Lightspeed Commerce Inc. (TSE:LSPD) may be sending bullish signals at the moment, given that almost half of all the Software companies in Canada have P/S ratios greater than 3.4x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Lightspeed Commerce

What Does Lightspeed Commerce's P/S Mean For Shareholders?

Lightspeed Commerce could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lightspeed Commerce will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Lightspeed Commerce's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the analysts watching the company. With the industry predicted to deliver 19% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Lightspeed Commerce's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Lightspeed Commerce remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Plus, you should also learn about this 1 warning sign we've spotted with Lightspeed Commerce.

If you're unsure about the strength of Lightspeed Commerce's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LSPD

Lightspeed Commerce

Engages in sale of cloud-based software subscriptions and payments solutions for single and multi-location retailers, restaurants, golf course operators, and other businesses.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives