Stock Analysis

Exploring Three TSX Stocks With Intrinsic Discounts Ranging From 23.7% To 37.6%

Reviewed by Simply Wall St

The Canadian market has shown robust performance, with a 10% increase over the past year and earnings expected to grow by 15% annually. In this environment, identifying stocks that are trading below their intrinsic value could present appealing opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$43.79 | CA$79.84 | 45.2% |

| Decisive Dividend (TSXV:DE) | CA$7.06 | CA$11.76 | 40% |

| Kraken Robotics (TSXV:PNG) | CA$1.12 | CA$2.24 | 49.9% |

| Endeavour Mining (TSX:EDV) | CA$30.87 | CA$50.22 | 38.5% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.53 | CA$2.75 | 44.3% |

| Hamilton Thorne (TSX:HTL) | CA$2.14 | CA$4.07 | 47.4% |

| Green Thumb Industries (CNSX:GTII) | CA$15.44 | CA$30.22 | 48.9% |

| Pan American Silver (TSX:PAAS) | CA$31.35 | CA$60.50 | 48.2% |

| Kits Eyecare (TSX:KITS) | CA$9.80 | CA$16.83 | 41.8% |

Let's dive into some prime choices out of from the screener.

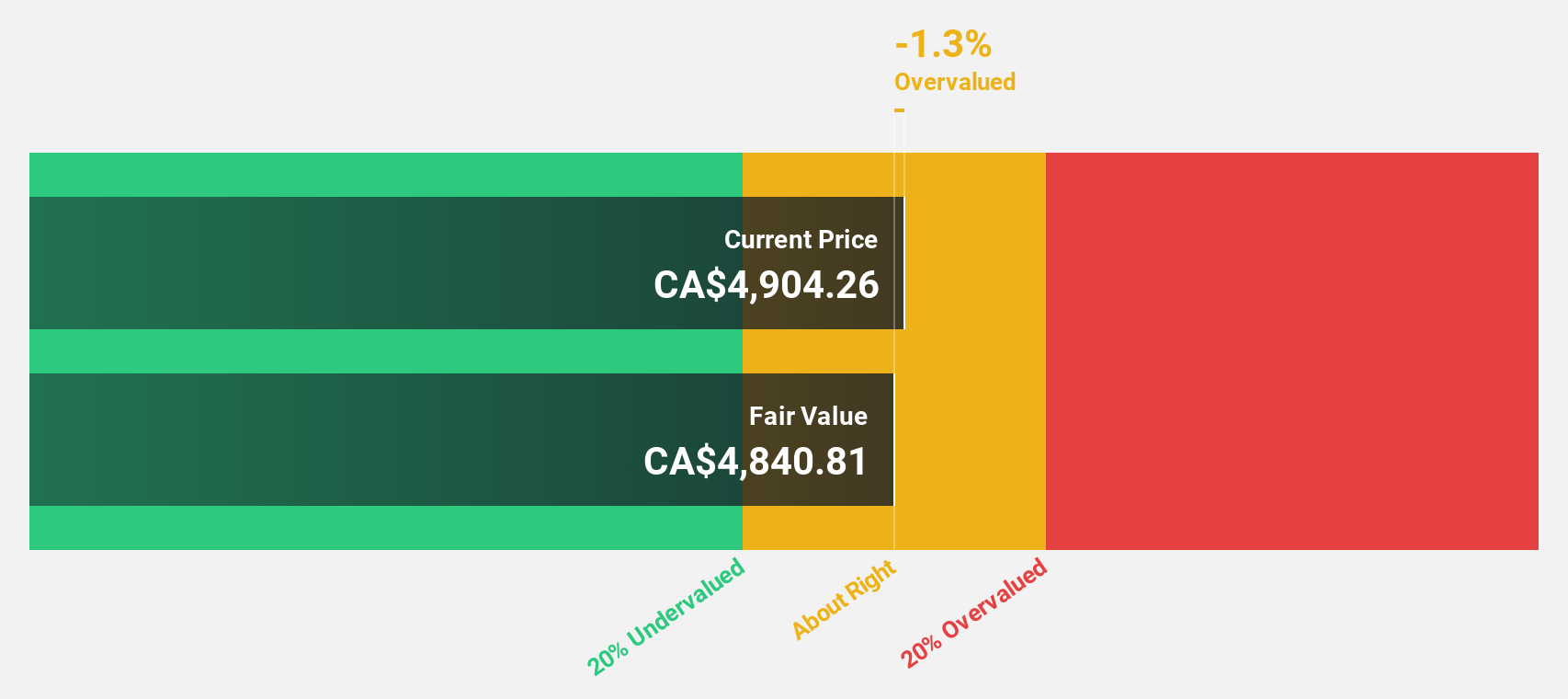

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe with a market cap of approximately CA$91.33 billion.

Operations: The company generates CA$8.84 billion in revenue from its software and programming segment.

Estimated Discount To Fair Value: 23.7%

Constellation Software, priced at CA$4304.21, trades below its fair value estimate of CA$5641.68, indicating a significant undervaluation based on discounted cash flows. Despite this, the company carries a high level of debt and has seen considerable insider selling recently. However, it shows robust growth prospects with earnings expected to grow by 24.43% annually and revenue forecasted to increase by 16.1% per year—outpacing the Canadian market's 7.3%. Recent strategic expansions include launching Omegro, enhancing global software service capabilities across diverse sectors.

- Upon reviewing our latest growth report, Constellation Software's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Constellation Software's balance sheet by reading our health report here.

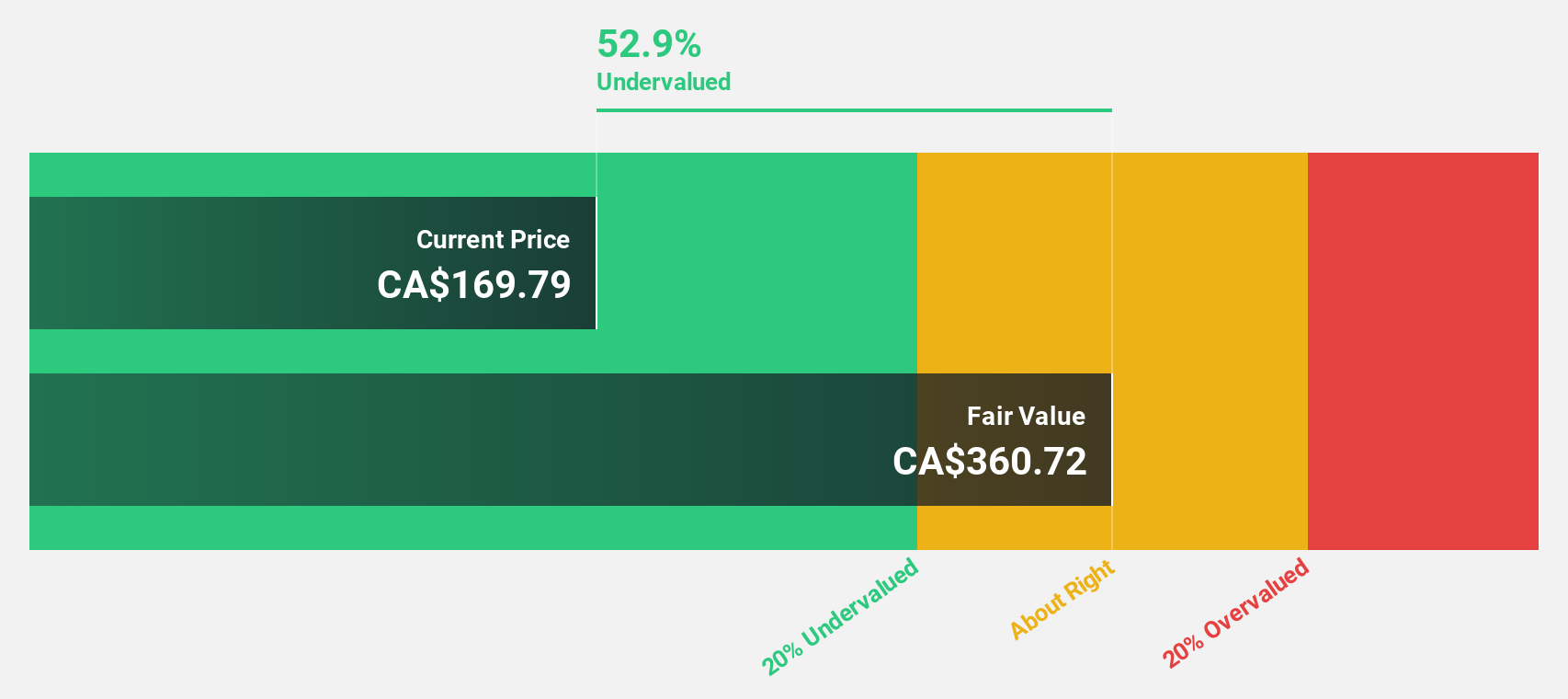

goeasy (TSX:GSY)

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market capitalization of CA$3.37 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Estimated Discount To Fair Value: 37.6%

goeasy Ltd., with a current trading price of CA$195.82, appears undervalued against a fair value estimate of CA$313.94, reflecting significant potential based on discounted cash flows. The company's earnings are expected to grow by 15.77% annually, and revenue growth is projected at 32.6% per year—substantially outpacing the Canadian market average of 7.3%. However, its debt levels are concerning as they are not well covered by operating cash flow, posing risks to financial stability despite robust growth forecasts.

- The analysis detailed in our goeasy growth report hints at robust future financial performance.

- Take a closer look at goeasy's balance sheet health here in our report.

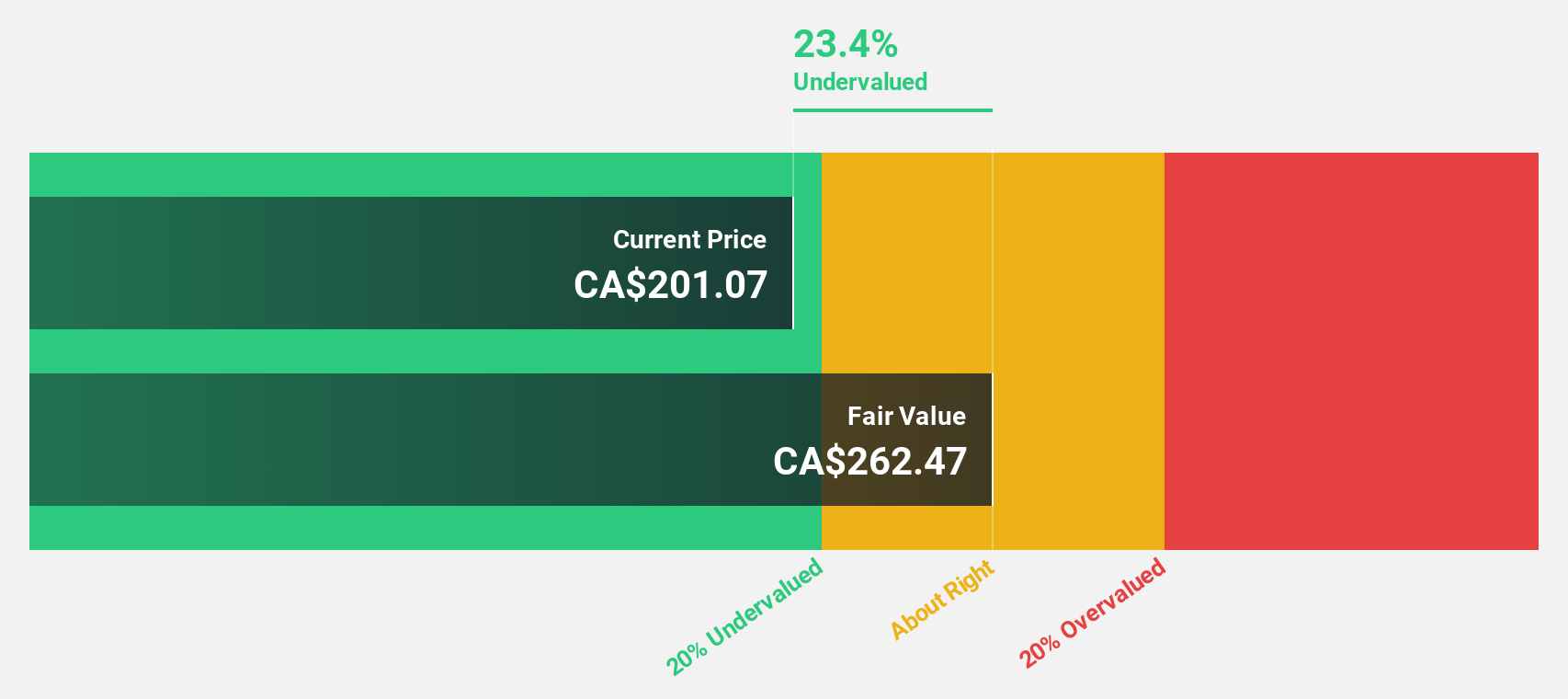

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market capitalization of approximately CA$4.81 billion.

Operations: The company generates CA$445.21 million in revenue from its software and programming segment.

Estimated Discount To Fair Value: 36.4%

Kinaxis, priced at CA$168.92, is considered undervalued by more than 20% compared to its fair value of CA$265.72 based on discounted cash flow analysis. The company's recent introduction of the Maestro platform and strategic client acquisitions underscore its robust position in AI-enhanced supply chain management. With earnings growth forecasted at 51.14% annually and revenue expected to increase by 14.7% per year—surpassing the Canadian market average—Kinaxis demonstrates strong growth potential despite some concerns over insider selling trends in the past quarter.

- Our comprehensive growth report raises the possibility that Kinaxis is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Kinaxis' balance sheet health report.

Summing It All Up

- Discover the full array of 25 Undervalued TSX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

High growth potential with proven track record.