Stock Analysis

- Canada

- /

- Real Estate

- /

- TSX:CIGI

TSX Growth Companies With High Insider Ownership Showcased In This Trio Of Stocks

Reviewed by Simply Wall St

Over the past year, the Canadian market has shown resilience with an 11% increase, despite a flat performance in the last 7 days. In this context, stocks with high insider ownership can be particularly compelling as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

| goeasy (TSX:GSY) | 21.5% | 15.8% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.3% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 67.2% |

| Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 68.5% |

| Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

| Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

| Almonty Industries (TSX:AII) | 17.7% | 105% |

Below we spotlight a couple of our favorites from our exclusive screener.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

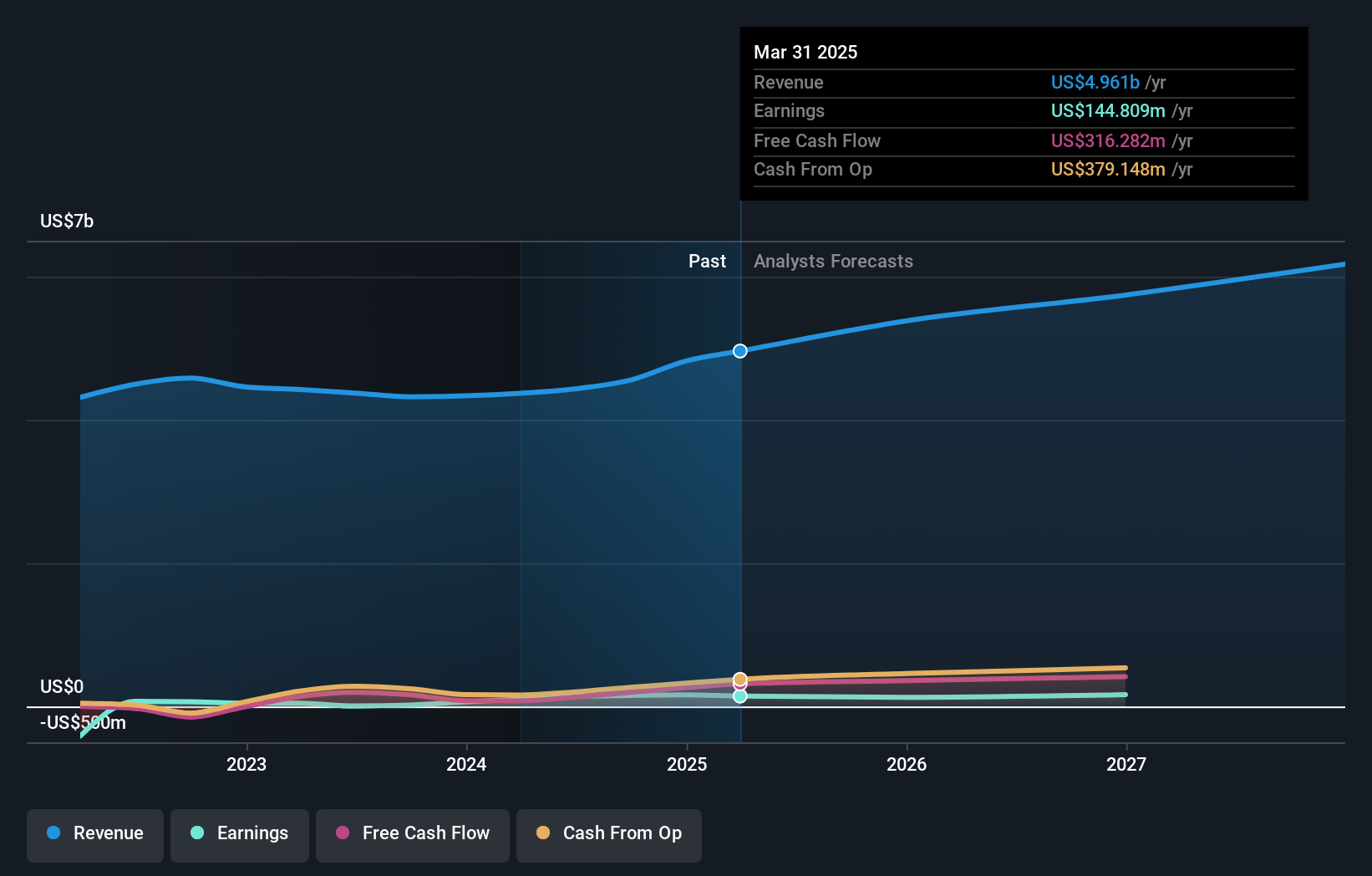

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$9.11 billion.

Operations: The company generates revenue through its operations in the Americas (CA$2.53 billion), Asia Pacific (CA$616.58 million), Investment Management (CA$489.23 million), and Europe, Middle East & Africa (EMEA) at CA$730.10 million.

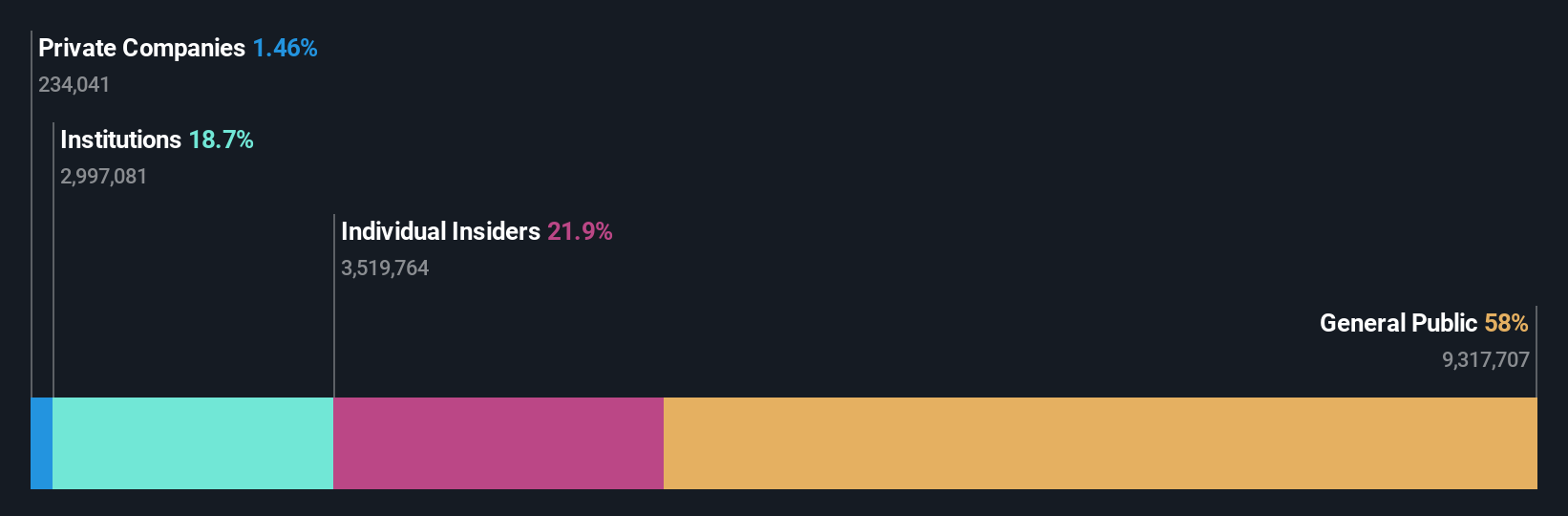

Insider Ownership: 14.2%

Return On Equity Forecast: N/A (2027 estimate)

Colliers International Group, a growth-focused company with significant insider ownership, is enhancing its European operations through a strategic partnership with SPGI Zurich AG to boost its EMEA platform. Despite recent insider selling, Colliers is positioned for notable revenue and earnings growth, outpacing the Canadian market average. However, challenges include shareholder dilution and debt not well covered by operating cash flow. The firm's expansion in Europe and robust earnings forecast underscore its strategic initiatives despite financial leverage concerns.

- Delve into the full analysis future growth report here for a deeper understanding of Colliers International Group.

- In light of our recent valuation report, it seems possible that Colliers International Group is trading beyond its estimated value.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of approximately CA$3.29 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.5%

Return On Equity Forecast: 24% (2027 estimate)

goeasy Ltd., a Canadian growth company, has seen its earnings increase by 54.3% over the past year with forecasts suggesting continued revenue growth at 32.6% annually, outpacing the market significantly. Despite this, challenges include a dividend of 2.38% not well covered by free cash flows and recent substantial insider selling. The firm recently increased debt through a USD 200 million senior unsecured notes offering aimed at general corporate needs and debt repayment, highlighting potential financial leverage issues amidst its expansion efforts.

- Click here to discover the nuances of goeasy with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that goeasy is trading behind its estimated value.

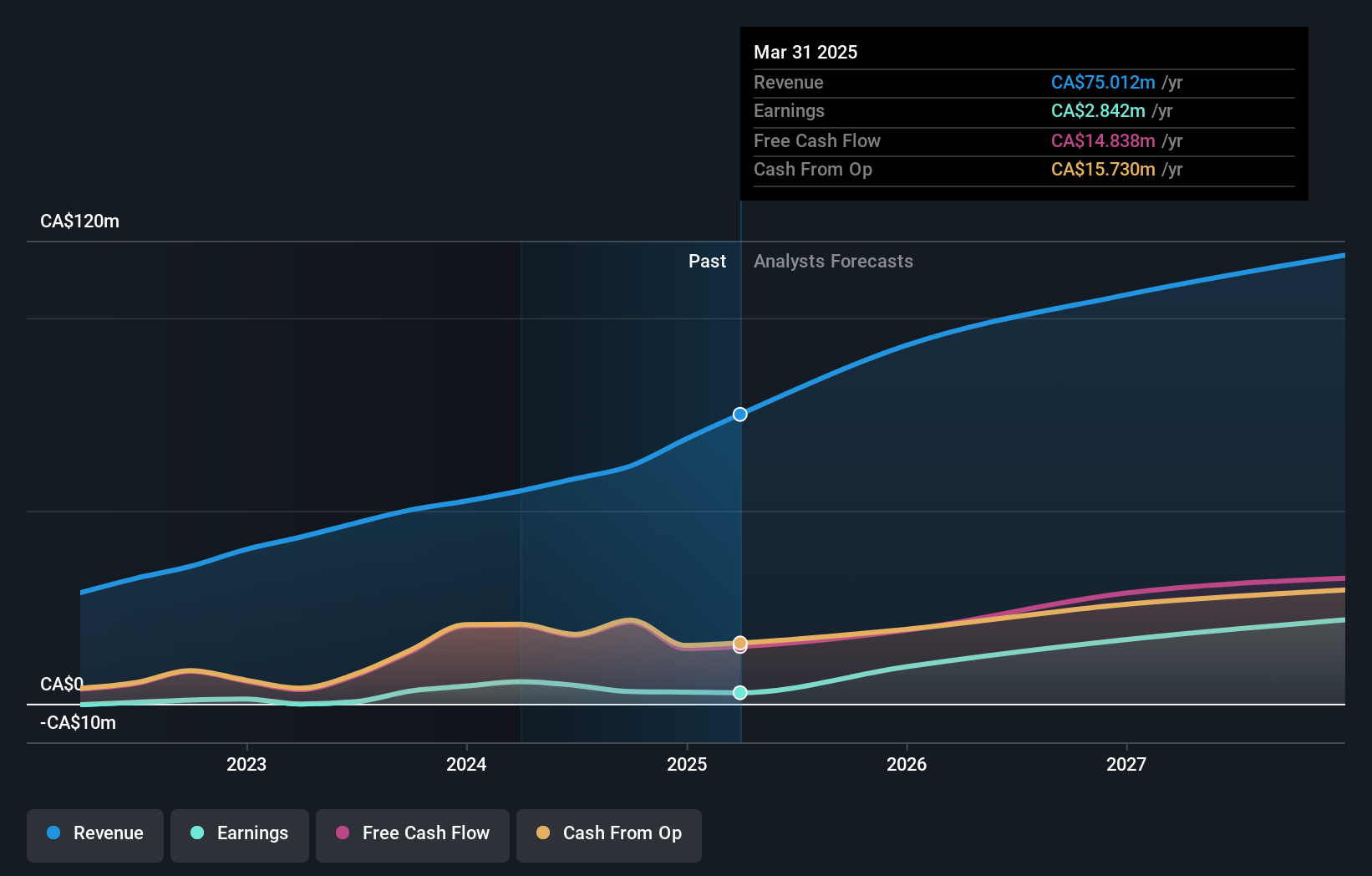

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the U.S., the U.K., Australia, Western Asia, and other international markets, with a market capitalization of approximately CA$364.11 million.

Operations: The company generates CA$55.17 million from its healthcare software segment.

Insider Ownership: 15.1%

Return On Equity Forecast: N/A (2027 estimate)

Vitalhub, a Canadian growth company, recently became profitable with its first-quarter revenue rising to CA$15.26 million from CA$12.6 million year-over-year, and net income increasing to CA$1.32 million from CA$0.162168 million. The company's earnings are expected to grow 38.1% annually over the next three years, outperforming the Canadian market forecast of 14.8%. However, shareholder dilution occurred last year and one-off items have impacted financial results significantly despite trading at 61.7% below estimated fair value.

- Get an in-depth perspective on Vitalhub's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Vitalhub is priced lower than what may be justified by its financials.

Seize The Opportunity

- Access the full spectrum of 28 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.