As global markets experience mixed performances, with major U.S. indexes like the S&P 500 and Nasdaq Composite hitting record highs while the Russell 2000 sees a decline, investors are closely monitoring economic indicators such as job growth and interest rate expectations ahead of the Federal Reserve's December meeting. In this environment, high-growth tech stocks continue to capture attention due to their potential for significant returns; identifying good stocks involves assessing factors like innovation potential, market demand, and financial health amidst current economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dnake (Xiamen) Intelligent Technology (SZSE:300884)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dnake (Xiamen) Intelligent Technology Co., Ltd. operates in the intelligent technology sector and has a market capitalization of CN¥3.20 billion.

Operations: Dnake (Xiamen) Intelligent Technology focuses on developing and providing intelligent technology solutions. The company generates revenue through its diverse range of products and services in this sector, contributing to its market presence.

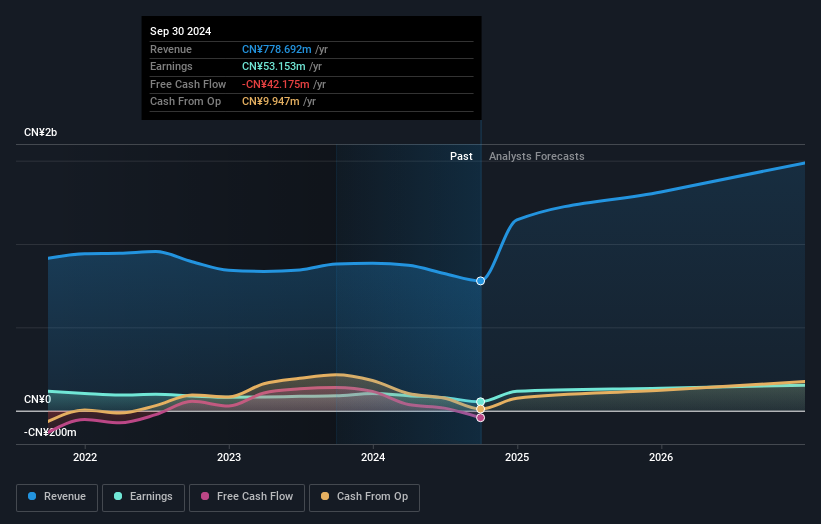

Dnake (Xiamen) Intelligent Technology, despite a challenging year with earnings down by 40.2%, is set to rebound with projected revenue growth of 22.6% annually, outpacing the Chinese market's average of 13.8%. This optimism is bolstered by an expected significant earnings increase of 31% per year over the next three years. However, recent financials show a dip in net income from CNY 66.67 million to CNY 17.56 million and a decrease in sales from CNY 624.21 million to CNY 519.14 million for the nine months ending September 2024, reflecting some short-term hurdles. The company has also actively repurchased shares, buying back over 4.7 million shares for CNY 43.18 million this year, signaling confidence in its future prospects despite current volatility.

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongguan Tarry Electronics Co., Ltd. specializes in the manufacturing and sale of precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China with a market cap of CN¥5.93 billion.

Operations: The company generates revenue primarily from its manufacturing industry segment, amounting to CN¥2.24 billion. Its product range includes precision die cutting products, foam protective film tapes, insulation heat conduction products, and EMI shielding products.

Dongguan Tarry Electronics has demonstrated robust growth, with a 93.4% increase in sales to CNY 1.77 billion and net income soaring by 281% to CNY 182.14 million over the last nine months, reflecting strong market demand and operational efficiency. The company's commitment to innovation is evident from its R&D spending, which supports its dynamic earnings forecast of a 23.5% annual increase. Despite not participating in share repurchases this quarter, the firm's strategic focus on expanding its technological capabilities positions it well within the competitive tech landscape.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada with a market capitalization of CA$5.21 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $471.17 million. Its business model focuses on providing cloud-based solutions for supply chain operations across multiple regions.

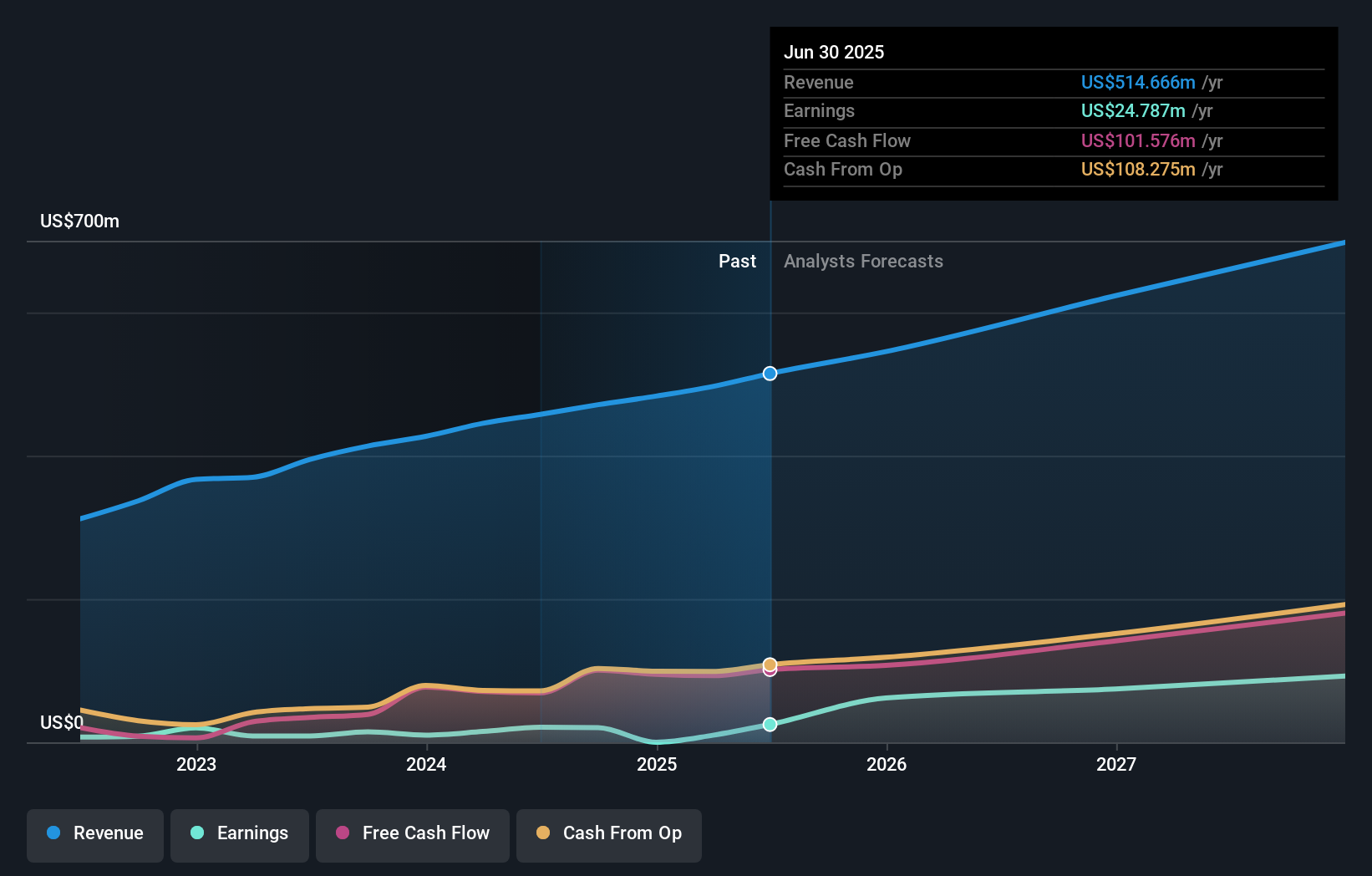

Kinaxis has recently showcased its robust engagement in enhancing supply chain efficiencies, evidenced by new partnerships with Elida Beauty and Stanley 1913, focusing on advanced demand and supply planning through its AI-driven Maestro™ platform. This initiative aligns with a broader industry trend towards digital transformation in supply chain management. Financially, Kinaxis reported a significant uptick in sales to $359.18 million for the nine months ending September 2024, up from $314.98 million the previous year, underscoring a solid growth trajectory. Moreover, the company's commitment to innovation is reflected in its R&D expenses which have strategically bolstered its competitive edge within the tech sector. With recent earnings growth of 42.93% annually and projected revenue increases at an average of 12.9% per year, Kinaxis is positioning itself as a leader in supply chain solutions amidst growing market demands.

- Dive into the specifics of Kinaxis here with our thorough health report.

Gain insights into Kinaxis' historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 1280 High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives