How Investors May Respond To Descartes Systems Group (TSX:DSG) Expanding E-Commerce Solutions with Crystal Art Gallery

Reviewed by Sasha Jovanovic

- On September 22, 2025, Descartes Systems Group announced that Crystal Art Gallery is using its Sellercloud and warehouse management system module to centralize and enhance e-commerce operations, enabling the company to boost order fulfillment, increase efficiency, and lower shipping costs across multiple sales channels and brands.

- This adoption highlights how Descartes’ e-commerce solutions can deliver measurable operational improvements for clients, supporting their growth and efficiency objectives in a competitive retail environment.

- We’ll now explore how increased client adoption of Descartes Sellercloud could influence the company’s investment narrative and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Descartes Systems Group Investment Narrative Recap

Owning Descartes Systems Group shares comes down to confidence in the company's ability to scale recurring revenues, leverage e-commerce and compliance trends, and execute on integration of acquisitions. The recent Crystal Art Gallery adoption of Descartes Sellercloud positively reinforces demand for omnichannel solutions, but does not materially impact the key short-term catalyst: sustained organic services revenue growth, or the major risk of volatile shipping volumes tied to global trade uncertainties.

Of the latest announcements, Crystal Art Gallery’s implementation is most directly relevant, as it highlights the measurable operational efficiencies Descartes can bring to clients in the fast-growing e-commerce segment, a pillar supporting potential future growth and cross-sell opportunities if momentum continues within the client base. Several other customer wins, such as the Golf Superstore’s Sellercloud integration, also showcase ongoing traction in omnichannel fulfillment that could feed into recurring revenue expansion, should current adoption trends persist.

In contrast, investors should also be aware that if global shipping volumes stagnate or weaken, even robust e-commerce wins may not fully offset...

Read the full narrative on Descartes Systems Group (it's free!)

Descartes Systems Group is projected to reach $899.6 million in revenue and $240.4 million in earnings by 2028. This forecast is based on an assumed annual revenue growth rate of 10.4% and reflects a $95.6 million increase in earnings from the current $144.8 million.

Uncover how Descartes Systems Group's forecasts yield a CA$131.93 fair value, in line with its current price.

Exploring Other Perspectives

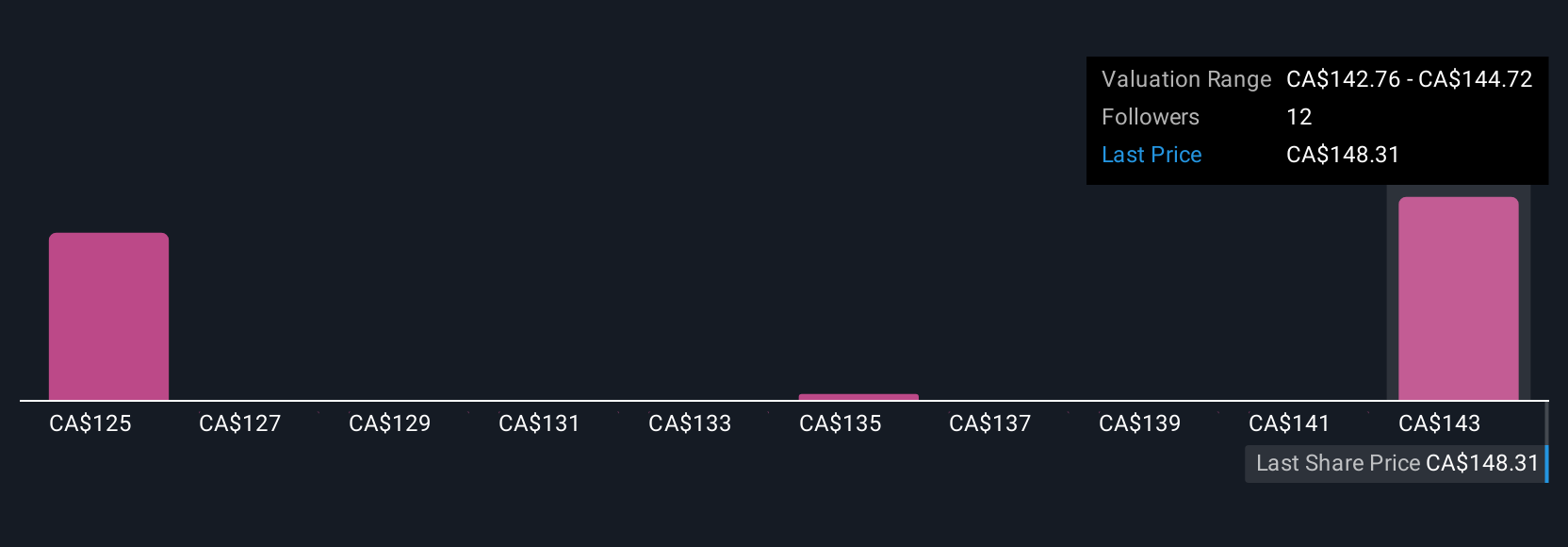

Simply Wall St Community members contributed 4 fair value estimates for Descartes, ranging from CA$124.76 to CA$135.41 per share. While opinions diverge, the risk of sustained volatility in global trade volumes remains front of mind for many and may shape the company's revenue exposure regardless of ongoing e-commerce client wins.

Explore 4 other fair value estimates on Descartes Systems Group - why the stock might be worth as much as CA$135.41!

Build Your Own Descartes Systems Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Descartes Systems Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Descartes Systems Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Descartes Systems Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives