Descartes Systems Group (TSX:DSG): Evaluating Valuation Following FTSE Index Addition and New Sellercloud Adoption

Reviewed by Kshitija Bhandaru

Descartes Systems Group (TSX:DSG) was recently added to the FTSE All-World Index, a move that often attracts interest from institutional investors. The company also just highlighted meaningful adoption of its Sellercloud platform.

See our latest analysis for Descartes Systems Group.

On the heels of its FTSE All-World Index addition and fresh customer wins, Descartes Systems Group has attracted growing attention, though this has not yet translated into a significant rally. While recent conference appearances and new enterprise adoptions highlight ongoing growth, the share price remains relatively stable, with a nearly flat 1-year total shareholder return. Its five-year total shareholder return of more than 73% shows steady long-term value generation.

If recent momentum in logistics tech excites you, this is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

Given these tailwinds and an impressive long-term track record, is Descartes trading at an attractive entry point? Or have recent gains and attention already incorporated future growth into the share price?

Most Popular Narrative: 2.3% Undervalued

With the current fair value from the most-followed narrative sitting just above Descartes Systems Group's last close, debate swirls around whether further upside is still on the table. The tension between bullish catalysts and future expectations is front and center.

Ongoing digital transformation and automation initiatives in transportation and supply chain sectors, combined with Descartes' leadership in real-time shipment tracking (MacroPoint) and AI-driven optimization, are enhancing customer stickiness and differentiation. These factors are likely supporting net margin expansion and increasing share in flat or declining end-markets.

Want to know what’s behind this valuation? The narrative banks on a bold mix of future margin gains and rising revenue, driven by logistics technology shifts. Curious about which financial assumptions power this price target? Dive deeper to unpack the growth engine that could redefine Descartes’ long-term market value.

Result: Fair Value of $131.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global trade uncertainty or a slowdown in successful acquisitions could limit Descartes’ ability to maintain long-term growth and profitability momentum.

Find out about the key risks to this Descartes Systems Group narrative.

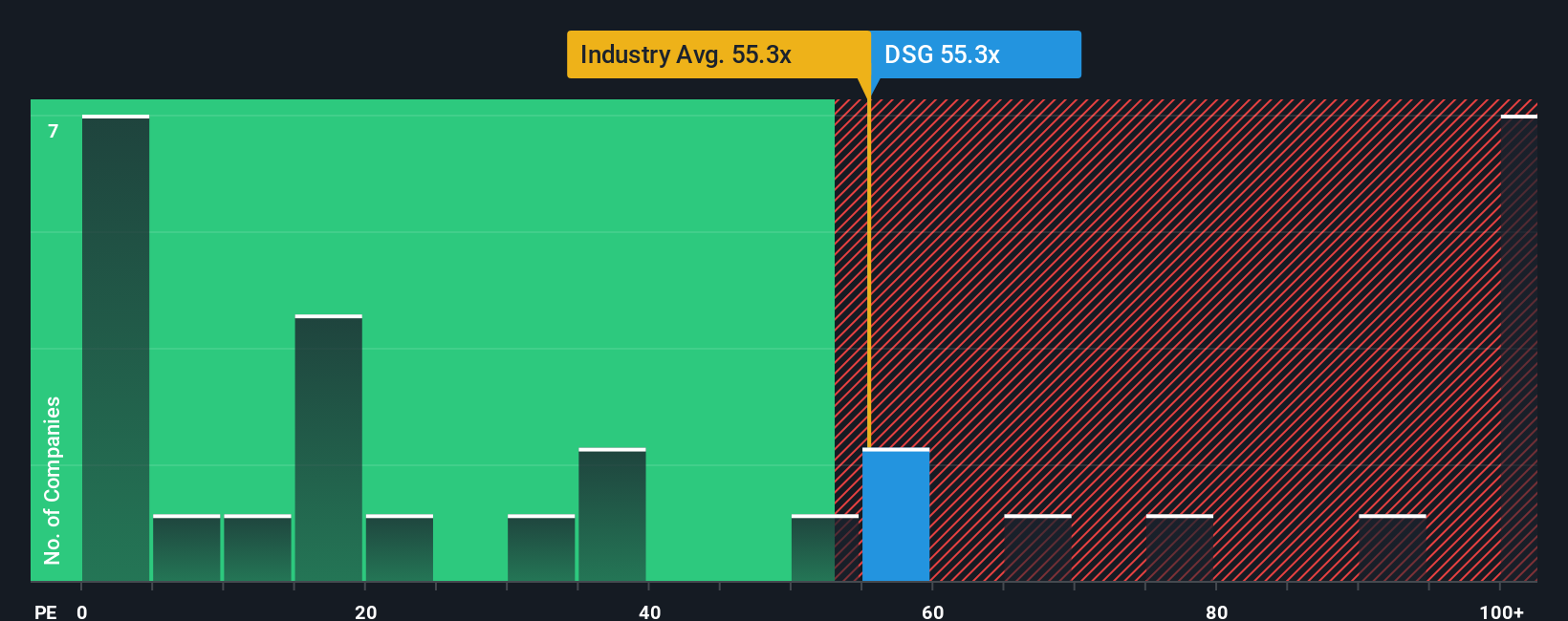

Another View: How Do the Earnings Multiples Stack Up?

Looking at Descartes through the lens of earnings multiples shows the shares trade at 53.5 times earnings, which is similar to the Canadian software sector average of 53.1, but much cheaper than its peer group at 96.2. However, this is still well above its fair ratio of 33.8, suggesting the stock could face some valuation pressure if sentiment shifts. Does this premium reflect true quality, or signal caution for potential buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Descartes Systems Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Descartes Systems Group Narrative

If you see things differently or want to explore the numbers for yourself, you can craft a personalized perspective on Descartes in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Descartes Systems Group.

Looking for More Smart Investment Ideas?

Don’t limit your potential returns to just one company. Open up a world of fresh opportunities with Simply Wall Street’s powerful screener tools that spotlight real winners.

- Tap into income streams with steady yields by checking out these 19 dividend stocks with yields > 3%, designed for investors who value strong long-term payouts.

- Get ahead of the AI curve and evaluate groundbreaking opportunities through these 24 AI penny stocks, featuring companies driving the next wave of technological change.

- Maximize value for your portfolio by targeting these 900 undervalued stocks based on cash flows, which market watchers believe are trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives