As the Canadian market experiences a resurgence in positive sentiment, buoyed by easing inflation and promising economic data, investors are keenly observing potential shifts from both the Federal Reserve and Bank of Canada. With rate cuts anticipated and a broadening of market leadership expected, identifying undervalued stocks becomes crucial for capitalizing on these favorable conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$186.09 | CA$357.99 | 48% |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$9.08 | 44.9% |

| Computer Modelling Group (TSX:CMG) | CA$12.41 | CA$22.26 | 44.3% |

| Kinaxis (TSX:KXS) | CA$151.77 | CA$282.71 | 46.3% |

| Obsidian Energy (TSX:OBE) | CA$9.35 | CA$18.17 | 48.5% |

| Africa Oil (TSX:AOI) | CA$2.07 | CA$3.70 | 44% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kraken Robotics (TSXV:PNG) | CA$1.43 | CA$2.53 | 43.5% |

| NFI Group (TSX:NFI) | CA$19.17 | CA$37.49 | 48.9% |

| NanoXplore (TSX:GRA) | CA$2.26 | CA$4.20 | 46.2% |

Let's uncover some gems from our specialized screener.

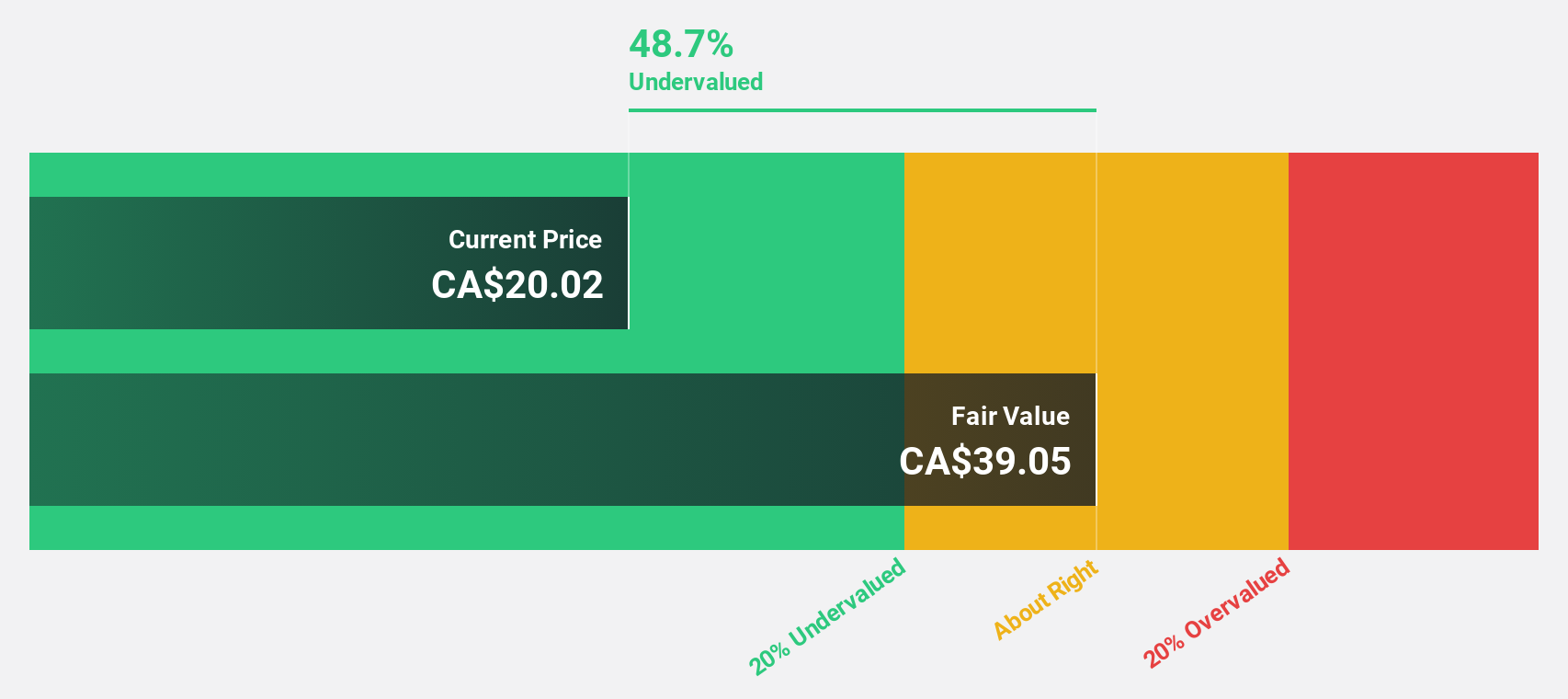

Docebo (TSX:DCBO)

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.75 billion.

Operations: Docebo generates revenue of $200.24 million from its AI-powered educational software platform.

Estimated Discount To Fair Value: 22.4%

Docebo (CA$57.87) is trading at a significant discount to its estimated fair value of CA$74.6, indicating it may be undervalued based on discounted cash flow analysis. The company reported strong financials for Q2 2024, with sales of US$53.05 million and net income of US$4.7 million, reversing a loss from the previous year. Earnings are expected to grow significantly over the next three years, outpacing the Canadian market's growth rate.

- In light of our recent growth report, it seems possible that Docebo's financial performance will exceed current levels.

- Click here to discover the nuances of Docebo with our detailed financial health report.

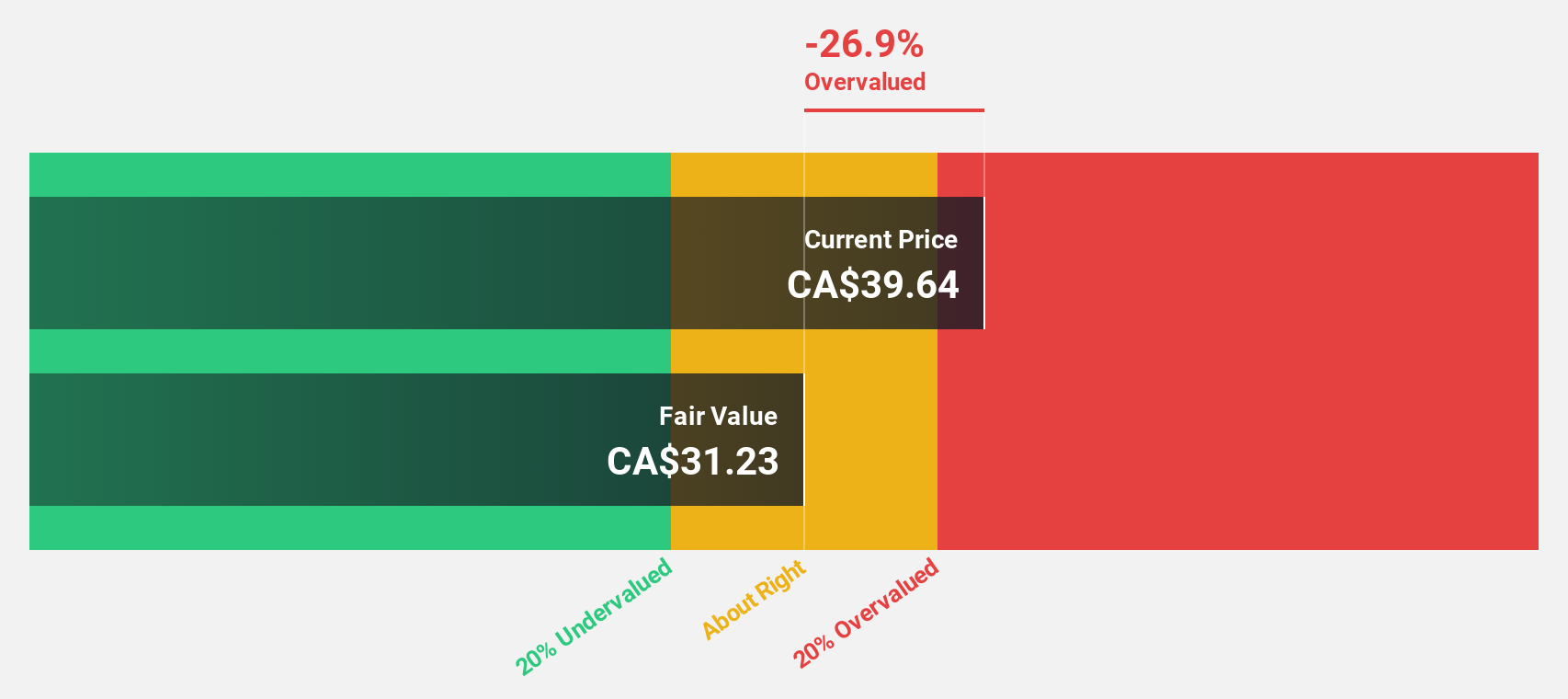

NanoXplore (TSX:GRA)

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets, with a market cap of CA$392.40 million.

Operations: NanoXplore generates revenue from the manufacturing and supply of graphene powder for various industrial markets.

Estimated Discount To Fair Value: 46.2%

NanoXplore (CA$2.26) is trading at 46.2% below its estimated fair value of CA$4.20, suggesting it is significantly undervalued based on discounted cash flow analysis. The company is expected to become profitable within the next three years, with earnings forecasted to grow at an annual rate of 59.35%. Revenue growth is also strong, projected at 22.8% per year, outpacing the Canadian market's average growth rate of 6.6%.

- Our expertly prepared growth report on NanoXplore implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in NanoXplore's balance sheet health report.

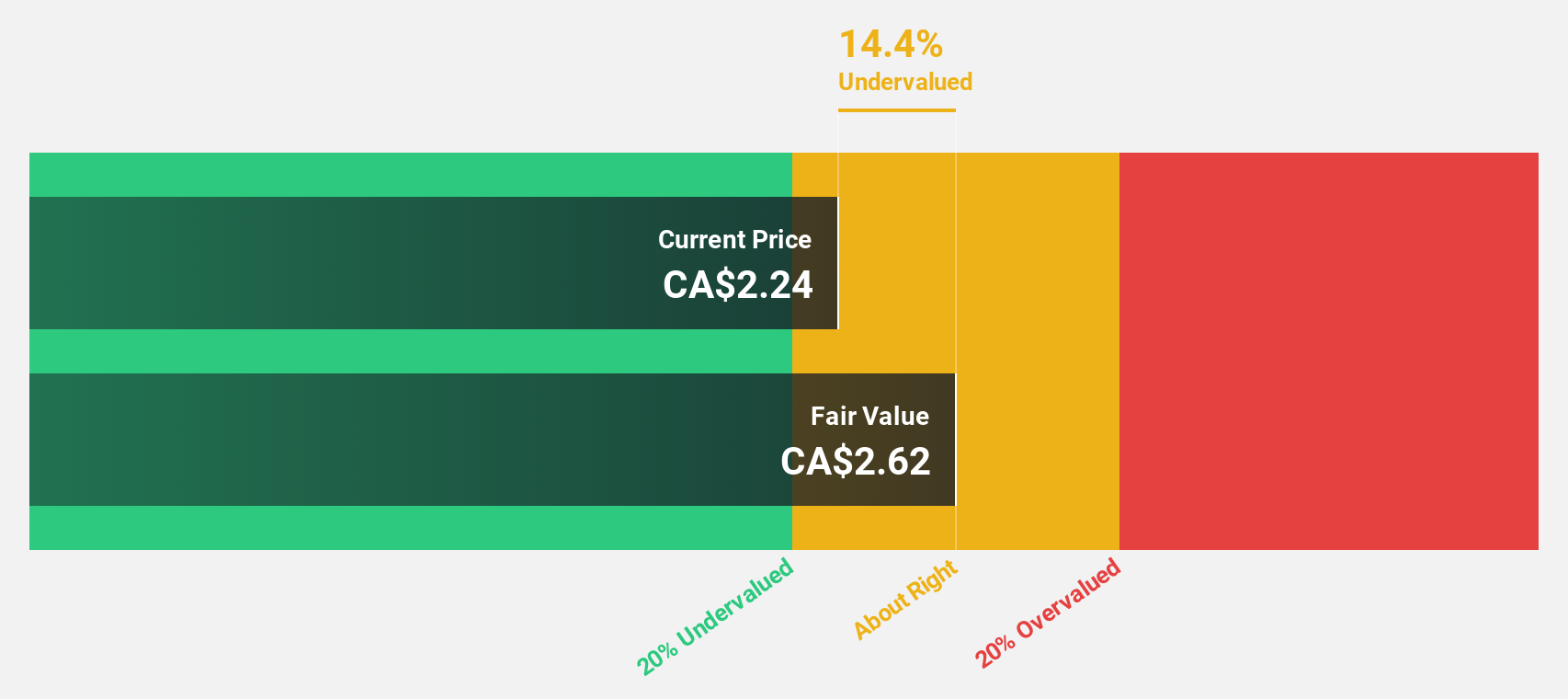

Kits Eyecare (TSX:KITS)

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$363.16 million.

Operations: The company generates revenue primarily through the sale of eyewear products, amounting to CA$135.45 million.

Estimated Discount To Fair Value: 15.7%

Kits Eyecare (CA$11.06) is trading at 15.7% below its estimated fair value of CA$13.12, indicating it is undervalued based on discounted cash flow analysis. The company recently reported a significant turnaround with a net income of CA$0.187 million for Q2 2024, compared to a loss last year, and expects revenue between CA$39 million and CA$41 million for the next quarter. Earnings are forecasted to grow at an annual rate of 92.84%.

- The analysis detailed in our Kits Eyecare growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Kits Eyecare.

Where To Now?

- Embark on your investment journey to our 34 Undervalued TSX Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally.

Outstanding track record with flawless balance sheet.