- Canada

- /

- Residential REITs

- /

- TSX:HOM.UN

Insider Activity Highlights These 3 Undervalued Small Caps In Global

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have shown resilience despite mixed performances across major indices, with smaller-cap indexes outperforming others amid geopolitical tensions and economic uncertainties. As the Federal Reserve maintains interest rates and economic indicators present a varied picture, investors are increasingly focused on identifying opportunities within undervalued segments of the market. In such an environment, stocks that exhibit strong fundamentals and strategic insider activity can be particularly appealing to those looking for potential growth opportunities in the small-cap space.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.0x | 0.4x | 49.90% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.6x | 2.9x | 19.57% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 38.90% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.6x | 0.4x | -57.44% | ★★★★☆☆ |

| Italmobiliare | 11.2x | 1.5x | -201.12% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -33.46% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 10.60% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.0x | 0.6x | 9.53% | ★★★☆☆☆ |

| Eastnine | 19.0x | 9.1x | 37.08% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.7x | 38.28% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a biopharmaceutical company focused on developing therapies for neurological disorders, with a market cap of approximately A$2.31 billion.

Operations: Neuren Pharmaceuticals generates revenue primarily from commercial products, with a notable increase in revenue over recent periods. The company's cost of goods sold (COGS) has shown a steady rise, impacting its gross profit margin, which reached 84.79% as of December 2024. Operating expenses are relatively stable compared to the growth in revenue, contributing positively to net income margins that have improved significantly over time.

PE: 11.4x

Neuren Pharmaceuticals, a small company with promising growth potential, recently saw insider confidence as an individual increased their holdings by 14,500 shares for A$153,120. The company's focus on developing NNZ-2591 for hypoxic-ischemic encephalopathy (HIE) highlights its innovative approach in addressing critical unmet medical needs. With anticipated FDA designations and a strategic pre-IND meeting planned for late 2025, Neuren is positioning itself to leverage its therapeutic advancements. Earnings are projected to grow at 3.28% annually despite reliance on external funding sources.

Docebo (TSX:DCBO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Docebo is a company specializing in educational software, with operations focused on providing learning management systems and a market capitalization of approximately $1.53 billion CAD.

Operations: Docebo's revenue is primarily driven by its educational software segment, amounting to $222.82 million. The company has experienced a gross profit margin trend that reached 80.65% as of March 31, 2025. Operating expenses are significant, with sales and marketing as well as research and development being notable cost components.

PE: 34.9x

Docebo, a company with a focus on the public sector, recently achieved FedRAMP Moderate Authorization for its LearnGov platform, enhancing its credibility among U.S. federal agencies. Despite lower net income of US$1.47 million in Q1 2025 compared to US$5.17 million the previous year, insider confidence is evident as Alessio Artuffo increased their holdings by 16%. The company completed a share buyback of 947,298 shares for CAD31.51 million and forecasts revenue growth between 9% and 10% for the year.

- Click here and access our complete valuation analysis report to understand the dynamics of Docebo.

Review our historical performance report to gain insights into Docebo's's past performance.

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★☆☆☆

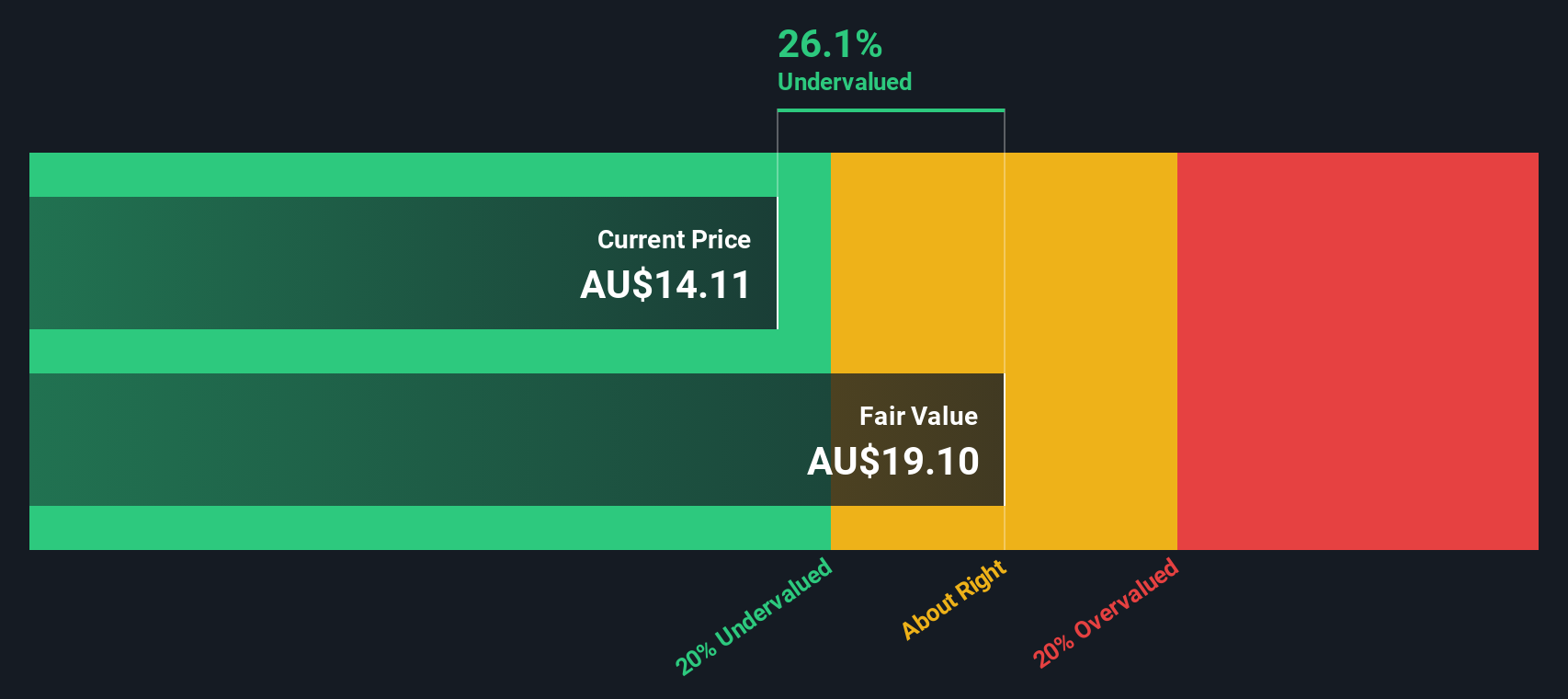

Overview: BSR Real Estate Investment Trust operates primarily in the residential real estate sector, focusing on multifamily properties, with a market capitalization of approximately $1.24 billion CAD.

Operations: BSR Real Estate Investment Trust generates revenue primarily from its residential real estate operations, with recent figures showing $170.16 million. The cost of goods sold (COGS) for the same period was $78.25 million, resulting in a gross profit of $91.92 million and a gross profit margin of 54.02%. Operating expenses are notable, including general and administrative costs amounting to $9.98 million, impacting the net income which recorded at -$79.52 million for the latest period analyzed.

PE: -5.6x

BSR Real Estate Investment Trust, a smaller player in the real estate sector, has shown recent insider confidence with notable share purchases. Despite reporting a net loss of US$40.85 million for Q1 2025, they continue to distribute monthly dividends of US$0.0467 per unit, reflecting an annualized US$0.56 per unit payout. Their acquisition of two Houston communities for $141 million underscores strategic growth ambitions amidst financial challenges, potentially offering future value as market conditions evolve.

Where To Now?

- Get an in-depth perspective on all 164 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BSR Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HOM.UN

BSR Real Estate Investment Trust

An internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives