- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7915

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising U.S. inflation and volatile Treasury yields, the Nasdaq Composite has led gains, with growth stocks outperforming value shares for the second consecutive week. In this environment of economic shifts and cautious optimism, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience to market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1209 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★★☆

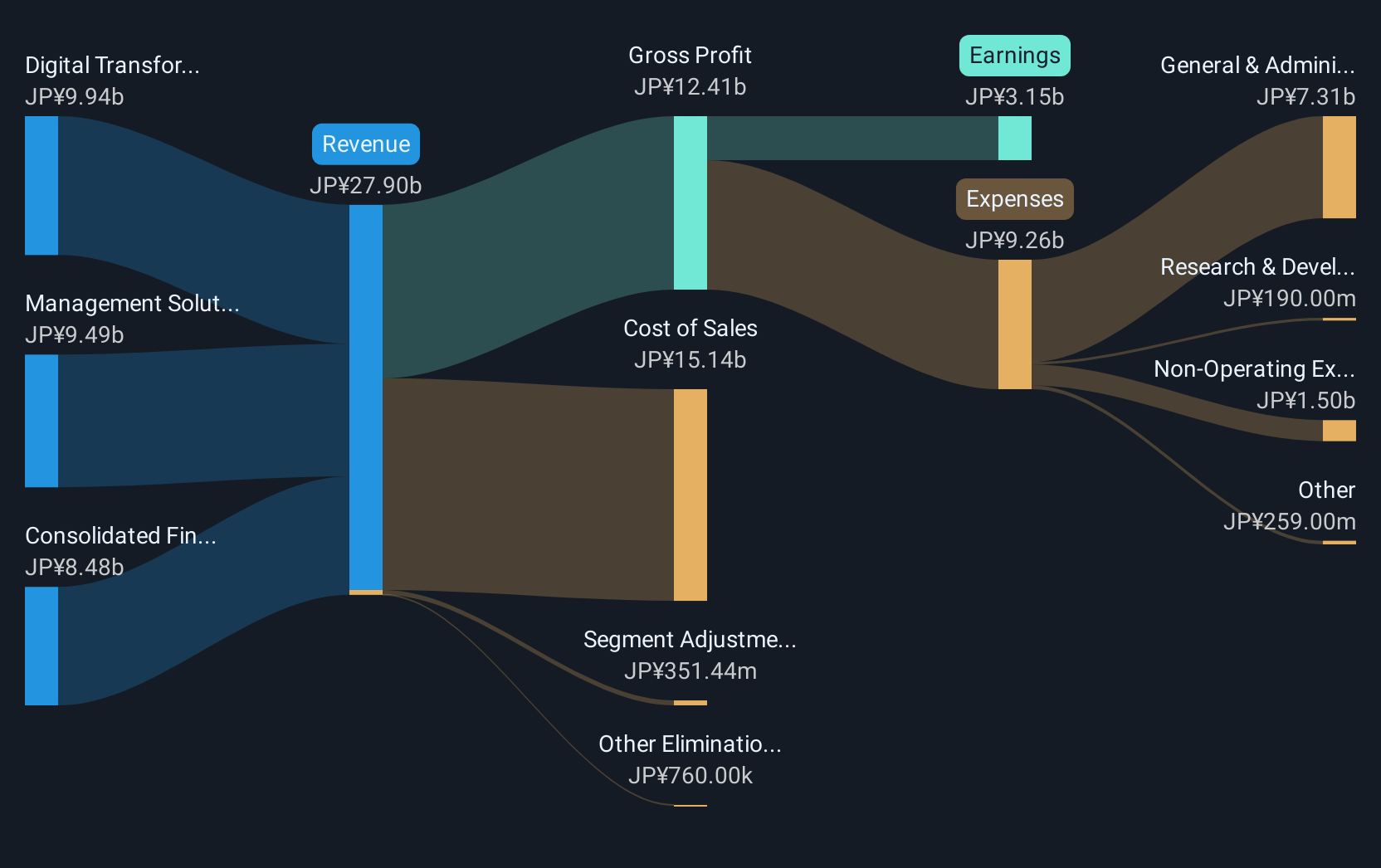

Overview: Avant Group Corporation, with a market cap of ¥71.42 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group generates revenue primarily through its subsidiaries by offering specialized services in accounting, business intelligence, and outsourcing.

Avant Group's strategic maneuvers, including the recent introduction of a stock compensation plan and the completion of a share buyback totaling ¥828.93 million, underscore its commitment to shareholder value and corporate governance. With an annual revenue growth rate of 18.3% and earnings growth outpacing the IT industry at 31.5% over the past year, Avant is positioned favorably against market averages. The company's robust R&D investment not only fuels innovation but also aligns with its impressive forecasted earnings growth of 20.8% per annum, significantly above Japan's market average of 8.1%. This blend of financial health, strategic corporate actions, and strong growth metrics paints a promising picture for Avant Group in a competitive tech landscape.

- Unlock comprehensive insights into our analysis of Avant Group stock in this health report.

Review our historical performance report to gain insights into Avant Group's's past performance.

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

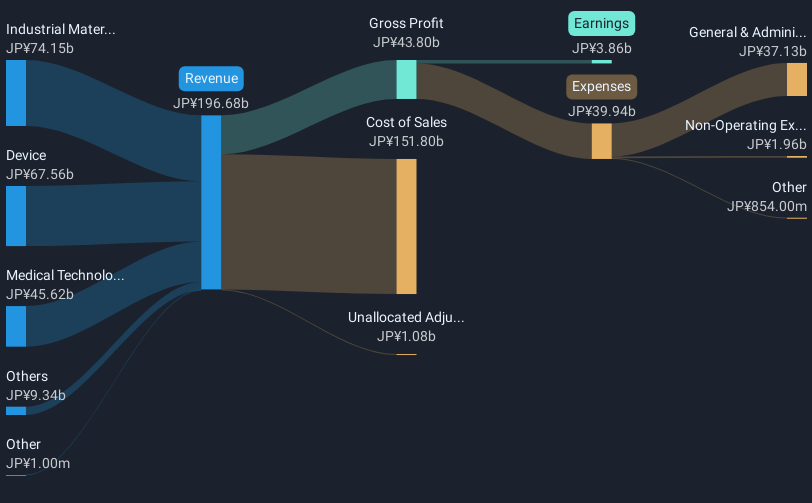

Overview: Nissha Co., Ltd. operates in various sectors including industrial materials, devices, medical technologies, information and communication, and pharmaceuticals and cosmetics on a global scale, with a market capitalization of ¥71.15 billion.

Operations: The company's revenue is primarily driven by its industrial materials and device segments, contributing ¥74.15 billion and ¥67.56 billion, respectively. Medical technology also plays a significant role with ¥45.62 billion in revenue.

Nissha's recent strategic financial activities, including a significant fixed-income offering totaling ¥9 billion, underscore its robust approach to capital management. This aligns with its earnings forecast growth of 20.3% annually, outstripping Japan's market average of 8.1%. The company has also demonstrated a commitment to innovation and growth through R&D investments, which are crucial for maintaining competitive edge in the tech sector. With revenue growth projected at 4.3% per year—slightly above the market average—Nissha is making calculated moves to secure its position in a dynamic industry landscape.

- Navigate through the intricacies of Nissha with our comprehensive health report here.

Evaluate Nissha's historical performance by accessing our past performance report.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

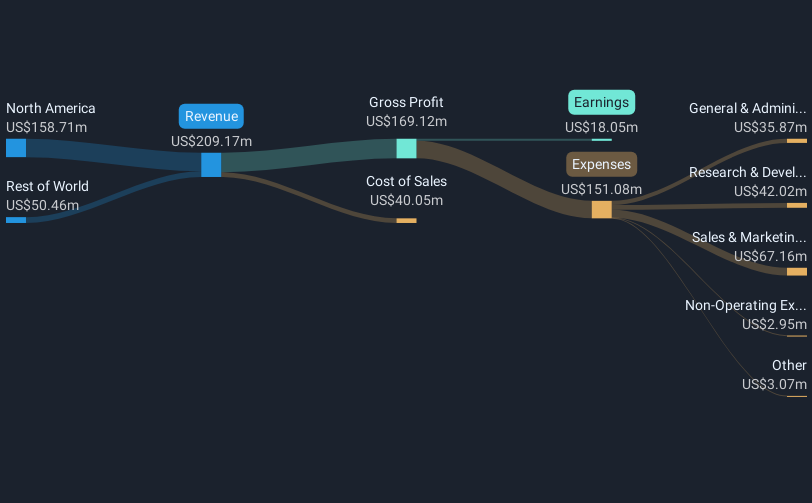

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform, serving clients in North America and internationally, with a market cap of CA$1.81 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $209.17 million. It leverages AI technology to enhance its learning management platform, catering to a global clientele.

Docebo's recent strategic alliances and executive changes underscore its adaptability in the high-growth tech landscape. The partnership with Class Technologies enhances its virtual training capabilities, integrating AI to boost learner engagement—a move that aligns with modern L&D demands. Additionally, the collaboration with Deloitte aims to transform corporate learning environments significantly, emphasizing scalable and impactful solutions. These initiatives complement Docebo's impressive financial trajectory; it has outstripped industry growth with a 1381.8% earnings increase over the past year and forecasts suggest a continued annual earnings rise of 39.2%. This performance is bolstered by an expected revenue growth rate of 14.1%, surpassing Canada's market average.

- Delve into the full analysis health report here for a deeper understanding of Docebo.

Assess Docebo's past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 1209 High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nissha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7915

Nissha

Engages in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics businesses in Japan and internationally.

Good value with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)