- China

- /

- Electronic Equipment and Components

- /

- SZSE:002139

High Growth Tech Stocks To Watch In December 2025

Reviewed by Simply Wall St

As global markets experience shifts driven by the Federal Reserve's interest rate cuts and mixed economic signals, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming its peers. In this environment of fluctuating indices and renewed scrutiny on tech valuations, identifying high growth tech stocks involves focusing on companies that can navigate interest rate changes while capitalizing on emerging technologies such as artificial intelligence.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.60% | 32.84% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Shenzhen Topband (SZSE:002139)

Simply Wall St Growth Rating: ★★★★☆☆

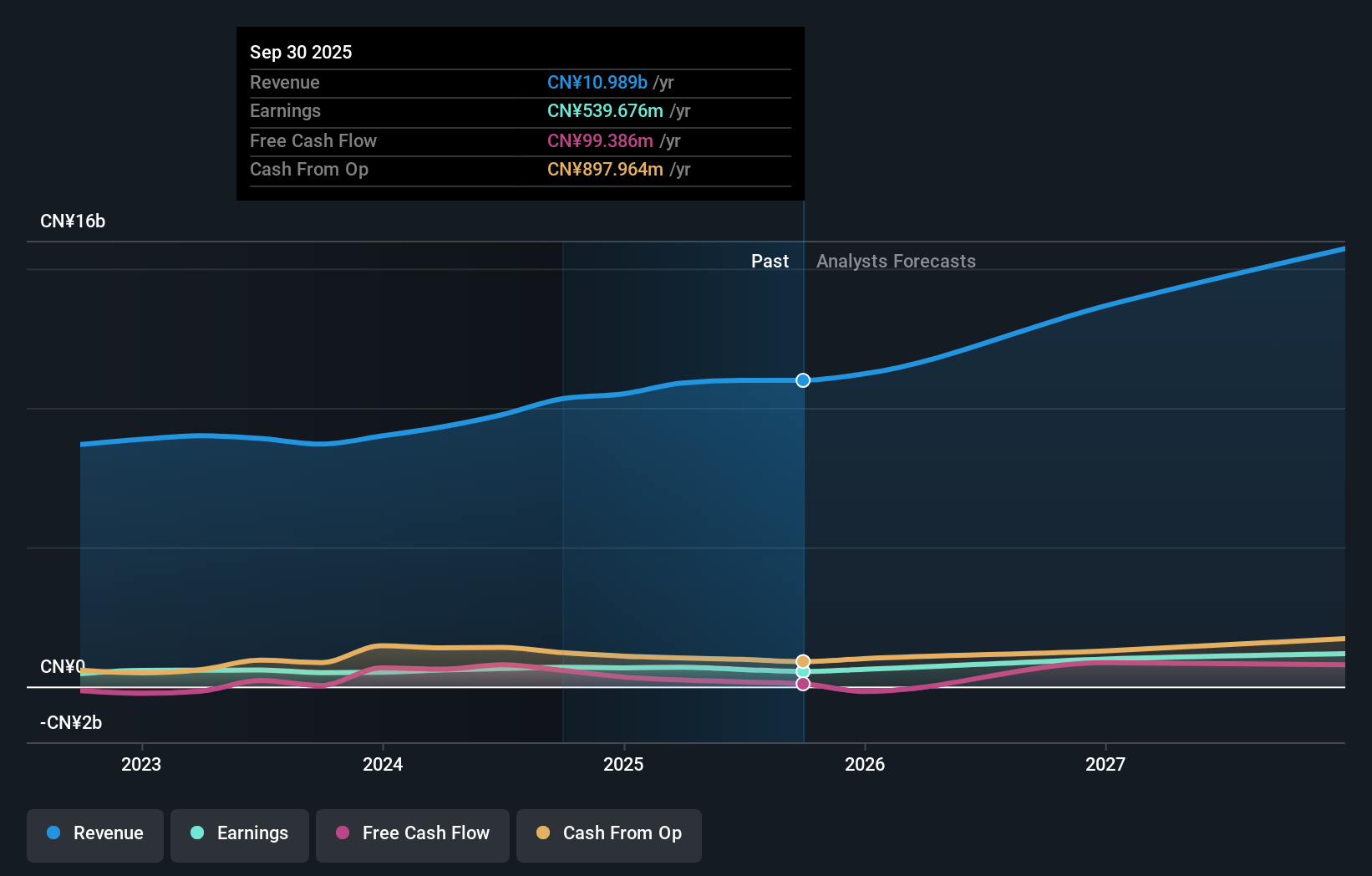

Overview: Shenzhen Topband Co., Ltd. focuses on the research, development, production, and sale of intelligent control system solutions both in China and internationally, with a market cap of approximately CN¥16.39 billion.

Operations: The company generates revenue primarily from the Intelligent Control Electronics Industry, amounting to approximately CN¥10.99 billion.

Shenzhen Topband, a player in the tech sector, recently bolstered its strategic position through a new alliance with WIK Far East Ltd., focusing on smart manufacturing and eco-friendly solutions in home appliances. This partnership is set to enhance product innovation and supply chain efficiencies, crucial as the company navigates a challenging landscape marked by a 6.3% increase in revenue to CNY 8.19 billion but faces a decline in net income by 23.9% year-over-year. Despite these financial headwinds, Topband's commitment to R&D and sustainable practices positions it well for future industry demands, underscored by an anticipated annual earnings growth of 35.4%, significantly outpacing the broader Chinese market forecast of 27.2%.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

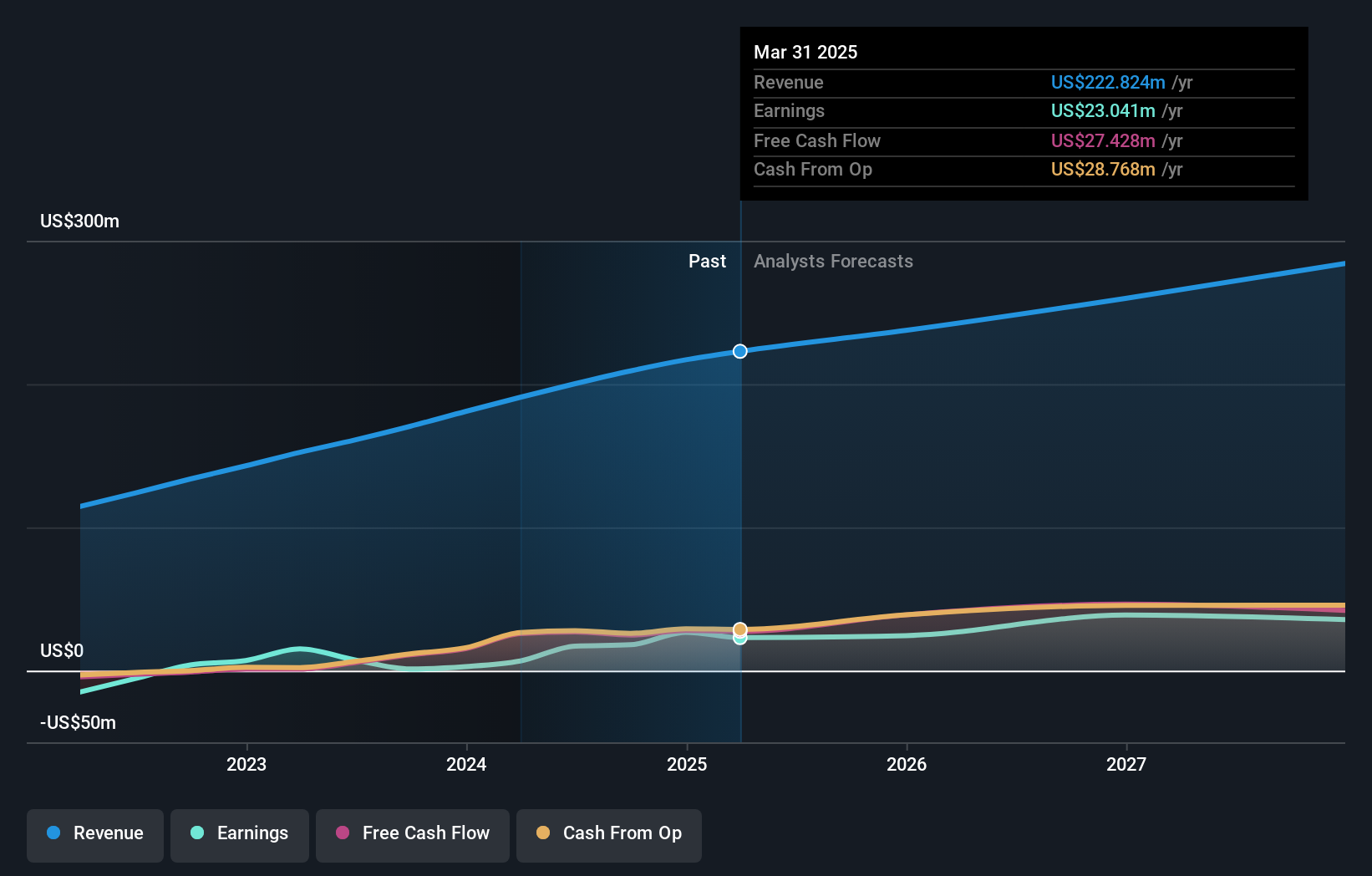

Overview: Docebo Inc. develops and provides a learning management platform for training in North America and internationally, with a market cap of CA$872.10 million.

Operations: The company's primary revenue stream is derived from its educational software segment, generating $236.69 million. It focuses on providing a learning management platform for training across North America and globally.

Docebo's recent strategic maneuvers, including a significant stake acquisition by Intercap Equity, underscore its expanding market presence and investor confidence. With a robust 11.4% forecasted revenue growth for the fiscal year and an impressive 27.8% anticipated annual earnings increase, Docebo is outpacing both the Canadian market and its industry peers. The company's commitment to innovation is evident in its R&D investments which have supported a 25% earnings growth over the past year, positioning it well amidst evolving educational technology demands.

- Get an in-depth perspective on Docebo's performance by reading our health report here.

Gain insights into Docebo's past trends and performance with our Past report.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★☆☆

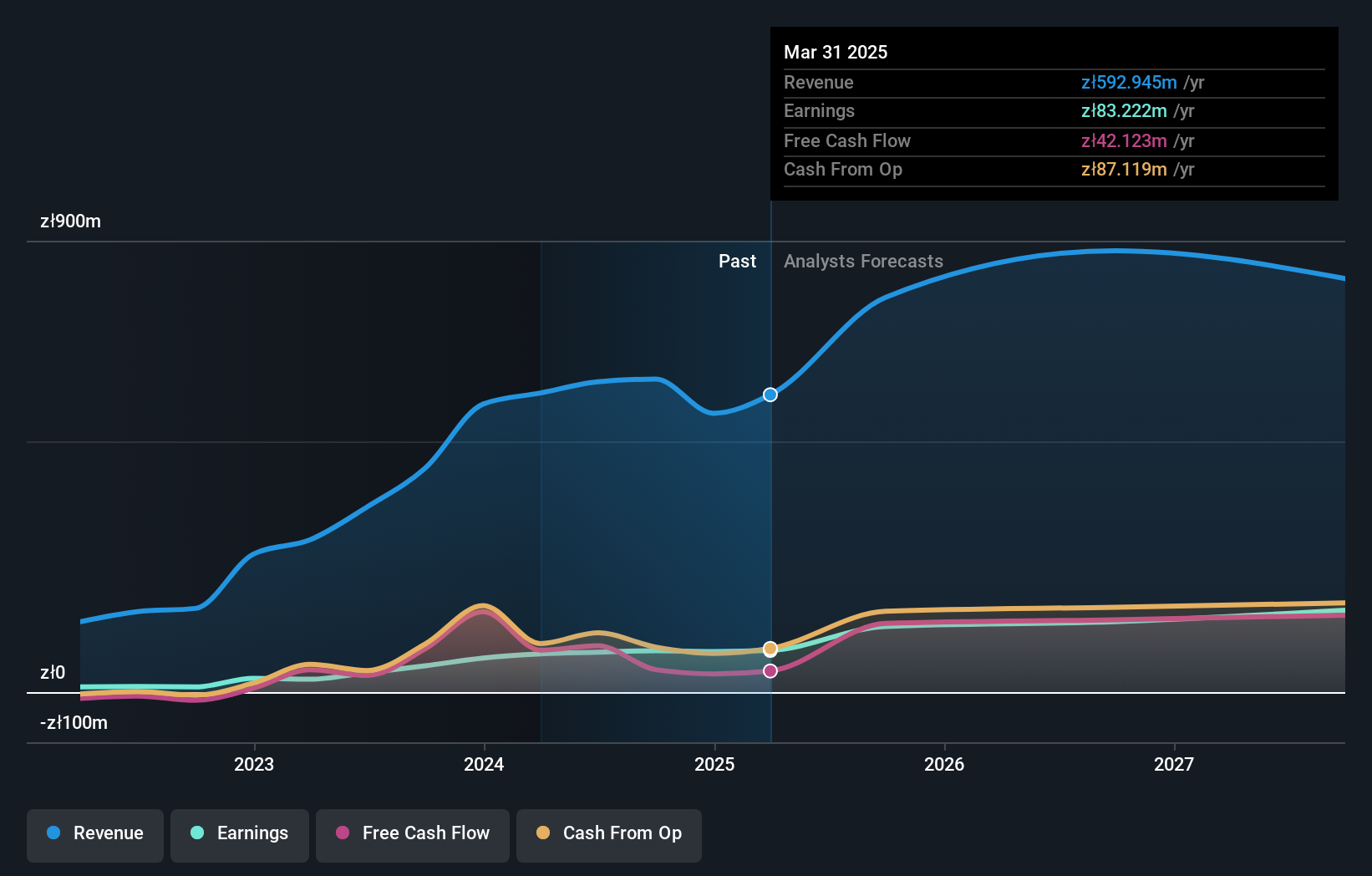

Overview: Synektik Spólka Akcyjna is a Polish company that offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications, with a market capitalization of PLN2.21 billion.

Operations: Synektik Spólka Akcyjna generates revenue primarily from Diagnostic and IT Equipment, contributing PLN57.92 billion, and the Production of Radio Pharmaceuticals, which adds PLN4.67 billion.

Synektik Spólka Akcyjna's recent financial performance indicates robust growth, with a notable 41% increase in quarterly revenue to PLN 199.24 million and a significant leap in net income to PLN 30.92 million, reflecting an annualized earnings growth of 18.2%. This upward trajectory is supported by strategic R&D investments, which have propelled innovations within the tech sector, aligning with industry trends towards enhanced software solutions. These figures underscore Synektik's potential to capitalize on expanding market demands and its ability to outperform average industry growth rates.

- Unlock comprehensive insights into our analysis of Synektik Spólka Akcyjna stock in this health report.

Learn about Synektik Spólka Akcyjna's historical performance.

Key Takeaways

- Unlock our comprehensive list of 247 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002139

Shenzhen Topband

Engages in the research and development, production, and sale of intelligent control system solutions in China and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion