Exploring None's High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are approaching record highs with growth stocks outperforming value shares, despite small-cap stocks lagging behind their larger counterparts. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to economic changes, positioning themselves well within an evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1206 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a global manufacturer and distributor of molecular diagnostics products with a market capitalization of ₩1.05 trillion.

Operations: Seegene, Inc. generates its revenue primarily from the sale of diagnostic kits and equipment, amounting to ₩399.42 billion. The company focuses on molecular diagnostics products distributed globally.

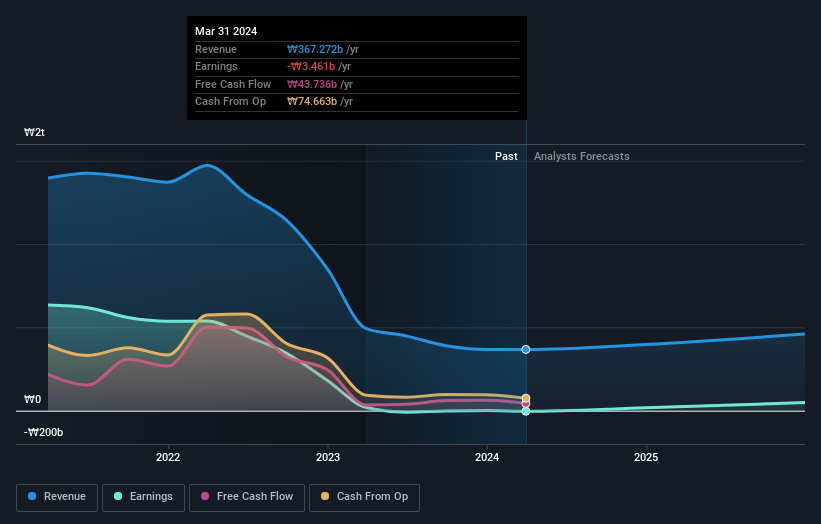

Seegene, a player in the biotech sector, has recently pivoted to profitability, showcasing a robust annual earnings growth forecast of 35.2%. This growth outpaces the broader KR market's average of 25.9%, underscoring Seegene's competitive edge in innovation and market adaptation. With R&D expenses significantly contributing to its strategic positioning—evidenced by its substantial investment relative to revenue—the company is well-poised for sustained advancements. Moreover, Seegene’s ability to generate positive free cash flow enhances its financial stability, providing a solid foundation for future ventures and technological developments within the biotech landscape.

- Unlock comprehensive insights into our analysis of Seegene stock in this health report.

Gain insights into Seegene's historical performance by reviewing our past performance report.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for treating autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of HK$14.19 billion.

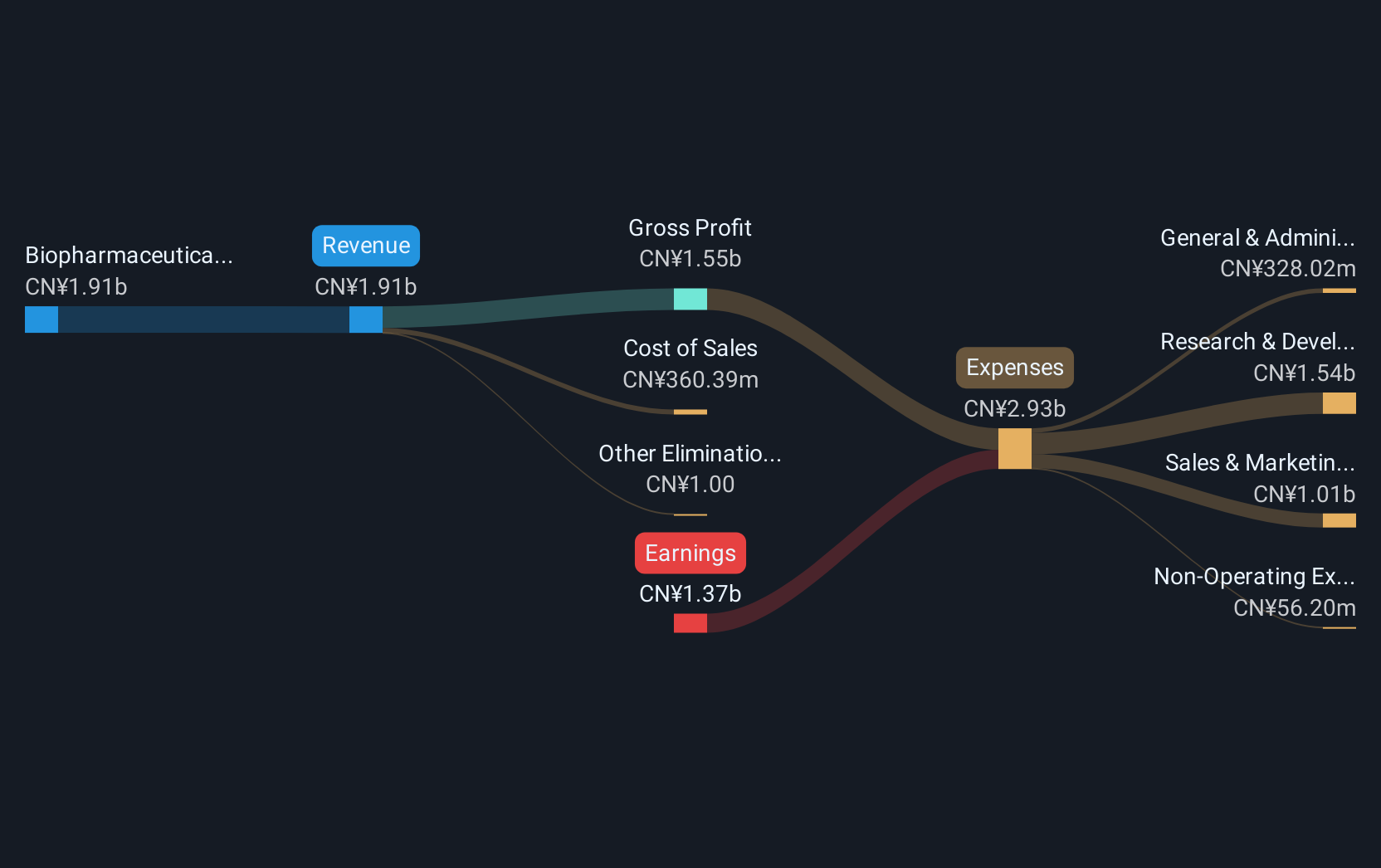

Operations: RemeGen specializes in biologics targeting autoimmune, oncology, and ophthalmic diseases with unmet medical needs. The company's revenue from biopharmaceutical research, service, production, and sales totals CN¥1.52 billion.

RemeGen, a trailblazer in biotechnology, is demonstrating robust growth with an expected annual revenue increase of 23.3% and a forecasted profit surge of 51.9%. These figures signify performance well above the Hong Kong market's average growth rates. The company's commitment to innovation is evident from its R&D expenses, which are substantial yet crucial for its strategic advancements in cancer treatment therapies. Recently, RemeGen received breakthrough therapy designation from China’s National Medical Products Administration for its novel drug, Disitamab Vedotin, highlighting not only its potential impact on bladder cancer treatment but also underscoring the company’s pivotal role in oncological research and development.

- Click here and access our complete health analysis report to understand the dynamics of RemeGen.

Understand RemeGen's track record by examining our Past report.

Converge Technology Solutions (TSX:CTS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Converge Technology Solutions Corp. offers software-enabled IT and cloud solutions across the United States and Canada, with a market capitalization of approximately CA$1.02 billion.

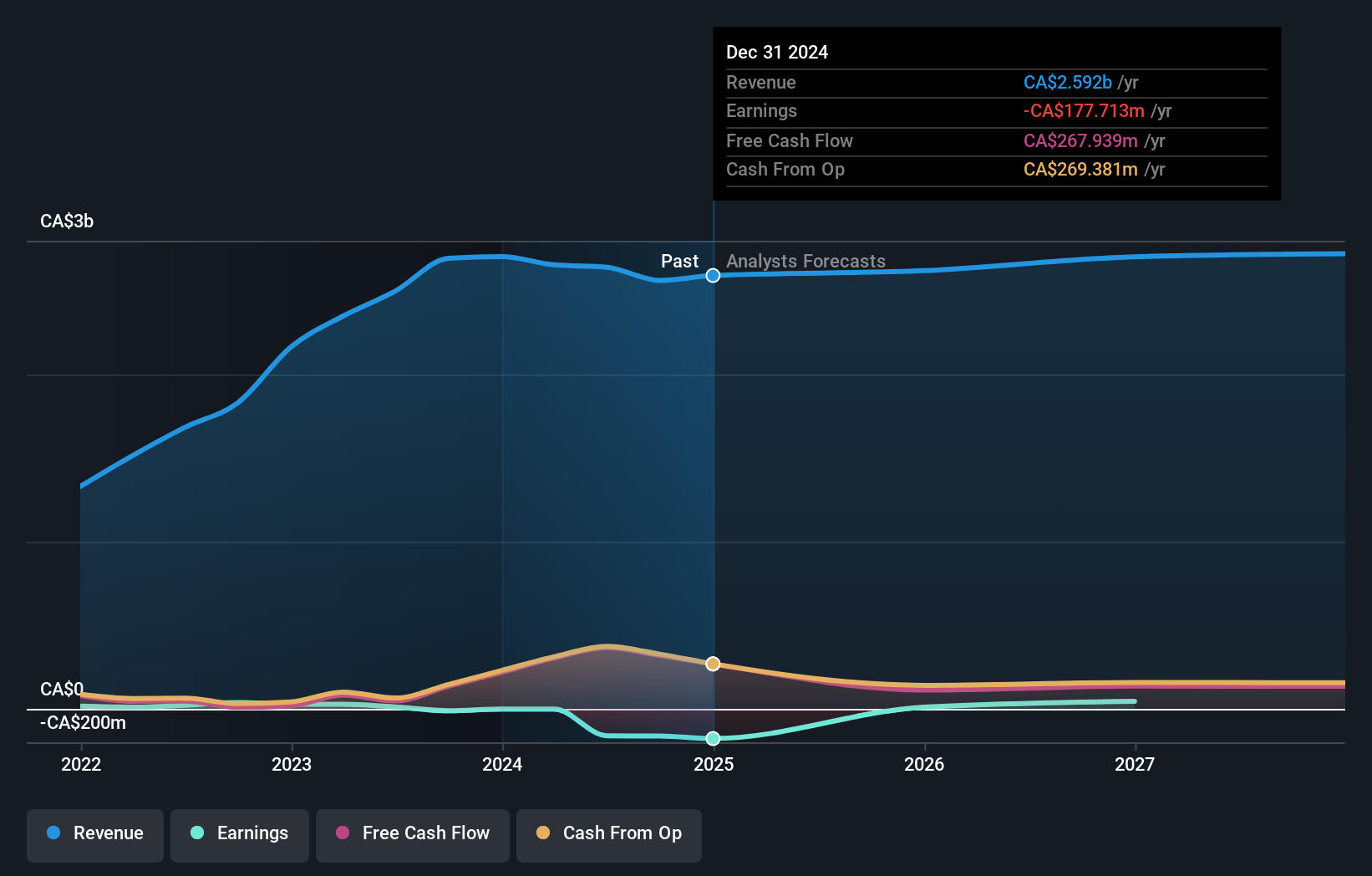

Operations: Converge Technology Solutions generates revenue primarily through its Portage SaaS Solutions segment, which contributes CA$13.69 million. The company focuses on providing IT and cloud solutions in North America.

Converge Technology Solutions, amidst a challenging tech landscape, is set to be acquired by H.I.G. Capital in a deal valuing the firm at approximately CAD 1.3 billion, reflecting a strategic shift as it prepares to delist from public markets. Despite modest revenue growth at 1.3% annually, Converge's anticipated earnings surge of 122.14% per annum underscores potential under new ownership. This transition could catalyze significant operational and market positioning enhancements, leveraging H.I.G.'s resources to potentially accelerate innovation and market penetration in its tech segments.

Make It Happen

- Take a closer look at our High Growth Tech and AI Stocks list of 1206 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTS

Converge Technology Solutions

Provides software-enabled IT and cloud solutions in the United States, Canada, Germany, rest of Europe, the United Kingdom, and Ireland.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion