Will Constellation Software’s (TSX:CSU) AI Integration Shift Its Long-Term Competitive Positioning?

- Earlier in September 2025, Constellation Software held a rare conference call to address investor concerns about the business impact of artificial intelligence, with founder Mark Leonard and senior leaders clarifying how AI is being integrated across the company’s operations.

- The event highlighted both opportunities for efficiency gains through AI and uncertainties about how new technology could change programming and customer behaviors in Constellation’s markets.

- We’ll explore how Constellation Software’s proactive AI integration strategy could influence its longer-term investment story and positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Constellation Software's Investment Narrative?

For me, to be a shareholder in Constellation Software, the essential thesis centers on its proven ability to acquire and efficiently run a wide range of software businesses, leveraging scale, experience, and cross-portfolio insights. The company has consistently communicated that operational discipline and long-term value creation are guiding principles, even amid recent share price volatility. The recent AI-focused conference call was useful in underscoring management's readiness to address investor anxieties following the sharp decline in the stock. However, based on subsequent analyst commentary, the event appears unlikely to materially change the near-term catalysts, which still hinge on the company’s acquisition pipeline, execution across new business verticals like Omegro, and continued cash flow generation. Key risks, now brought into sharper relief, revolve around how AI could impact customer demand, software development costs, and competitive threats if clients turn to in-house solutions. In the short term, the company’s response to AI looks prudent but does not fundamentally alter the main risks or growth drivers identified prior to the call, and recent price declines may reflect elevated sensitivity to these uncertainties. On the other hand, the growing risk from AI-driven disruption is something investors should keep top of mind.

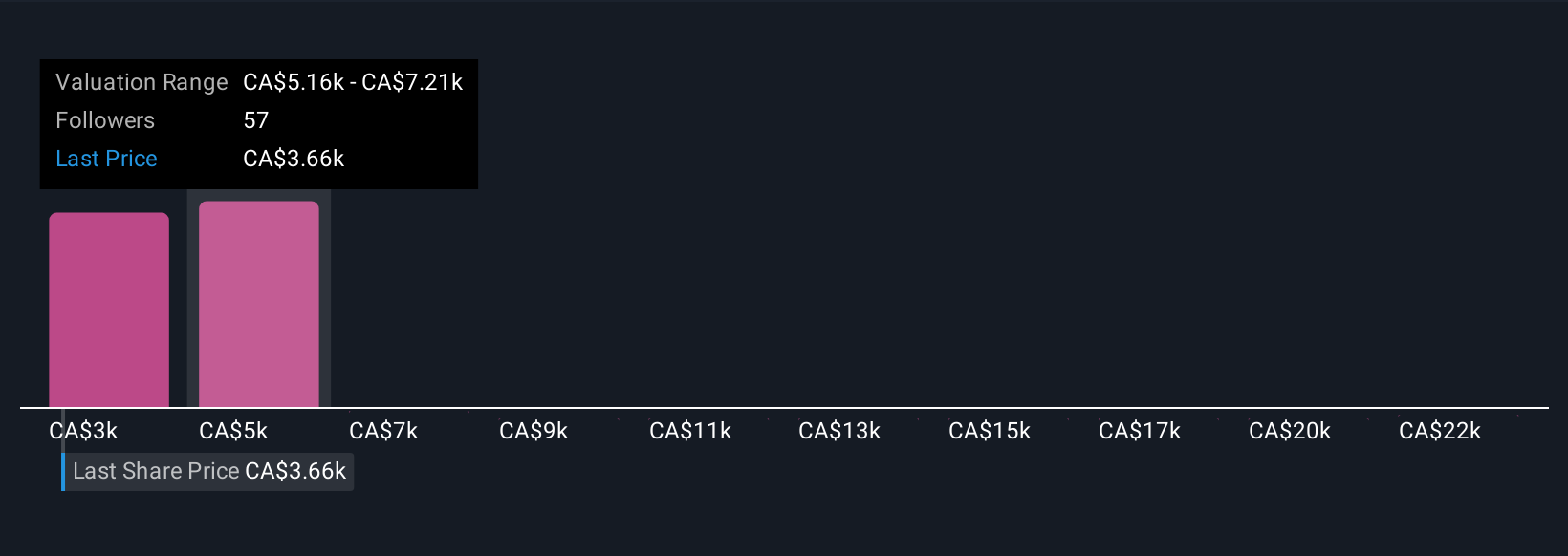

Despite retreating, Constellation Software's shares might still be trading 19% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 19 other fair value estimates on Constellation Software - why the stock might be worth as much as 98% more than the current price!

Build Your Own Constellation Software Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Software's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.