Exploring High Growth Tech Stocks And 2 More Innovators In The Sector

Reviewed by Simply Wall St

Global markets have recently experienced a pullback, with key indices such as the S&P 500 and Nasdaq Composite showing declines amidst uncertainty surrounding policy changes from the incoming Trump administration. In this climate of fluctuating market sentiment, identifying high growth tech stocks requires a focus on innovation and adaptability, qualities that can help companies thrive despite broader economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

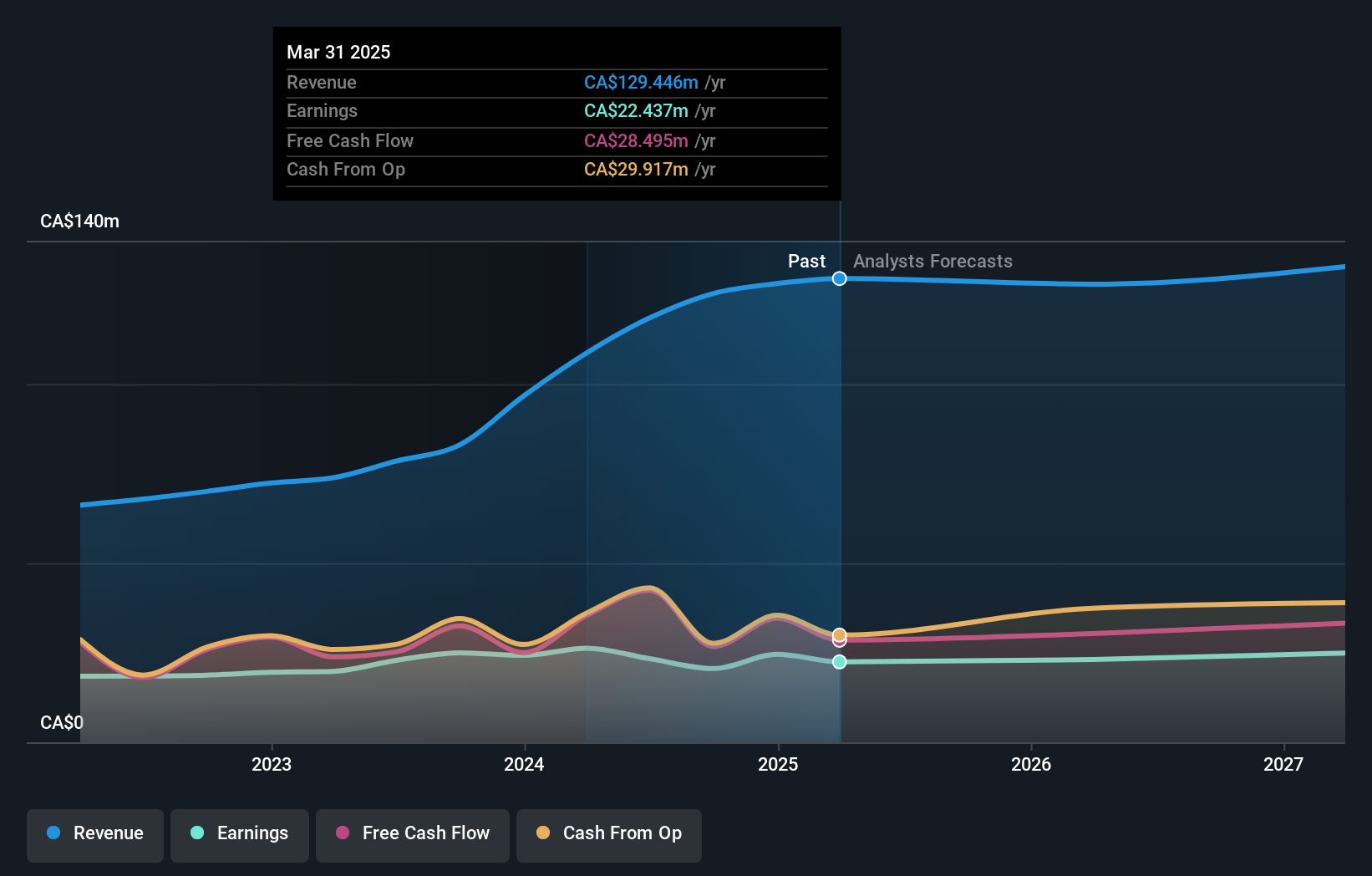

Overview: Computer Modelling Group Ltd. is a software and consulting technology company focused on developing and licensing reservoir simulation and seismic interpretation software, with a market cap of CA$825.23 million.

Operations: The company generates revenue primarily through the licensing of reservoir simulation and seismic interpretation software, with significant contributions from segments BHV (CA$34.74 million) and CMG (CA$90.55 million).

Despite a recent downturn in net income, Computer Modelling Group (CMG) has demonstrated resilience with a 36% increase in sales to CAD 59.99 million over six months, signaling robust demand for its specialized simulation solutions. The company's strategic collaboration with NVIDIA enhances CMG’s technical capabilities in high-performance computing, crucial for advancing energy transition projects like carbon capture and storage (CCS). This partnership not only boosts computational efficiency but also aligns with sustainability goals by potentially reducing energy consumption. Moreover, the introduction of Focus CCS exemplifies CMG's commitment to innovation, providing tools that expedite CO2 storage site selection and validation—essential steps towards achieving global net-zero targets. These developments could position CMG favorably as industries increasingly prioritize environmental impact alongside operational efficiency.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$2.01 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $209.17 million.

Docebo, a player in the e-learning sector, has shown remarkable financial and operational growth. With a revenue increase forecast at 14.1% annually, it outpaces the Canadian market's 7% growth rate. This surge is supported by an impressive earnings spike of 1381.8% over the past year, significantly exceeding its industry's average of 1.9%. Moreover, Docebo's commitment to innovation is evident from its R&D expenses aimed at enhancing AI-driven learning platforms—critical as businesses increasingly rely on digital training solutions. The firm recently uplifted its fiscal projections following robust quarterly performances and strategic partnerships like with TEDAI Vienna, emphasizing AI in corporate learning environments which could set new standards in educational technology applications.

- Unlock comprehensive insights into our analysis of Docebo stock in this health report.

Review our historical performance report to gain insights into Docebo's's past performance.

HIVE Digital Technologies (TSXV:HIVE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market capitalization of CA$760.96 million.

Operations: HIVE Digital Technologies Ltd. focuses on mining and selling digital currencies, generating revenue primarily from this activity, with reported earnings of $123.02 million.

Despite a challenging market, HIVE Digital Technologies has demonstrated resilience with a projected revenue growth of 45.1% annually, significantly outstripping the broader Canadian market's 7% growth expectation. This growth is underpinned by strategic expansions like the acquisition of 6,500 Canaan Avalon A1566 ASIC Miners and advancements in its Paraguay facility aimed at boosting its mining capacity to a targeted hashrate of 12.5 EH/s by Q3 2025. However, it's important to note that while HIVE navigates towards profitability with an anticipated profit surge of 89.62% per year over the next three years, current R&D expenditures remain crucial for sustaining innovation and competitiveness in the rapidly evolving tech landscape.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1306 High Growth Tech and AI Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Very undervalued with flawless balance sheet.