- Canada

- /

- Metals and Mining

- /

- TSX:DC.A

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market remained flat over the last week but has shown a robust 21% increase over the past year, with earnings expected to grow by 16% annually. Investing in penny stocks—often associated with smaller or newer companies—can still offer intriguing growth opportunities, especially when these stocks are backed by strong financial health. Let's take a closer look at several penny stocks that combine balance sheet strength with long-term potential, making them noteworthy options for investors seeking promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.74 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.39 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$584.03M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$204.54 million.

Operations: Avino Silver & Gold Mines Ltd. has not reported any specific revenue segments.

Market Cap: CA$204.54M

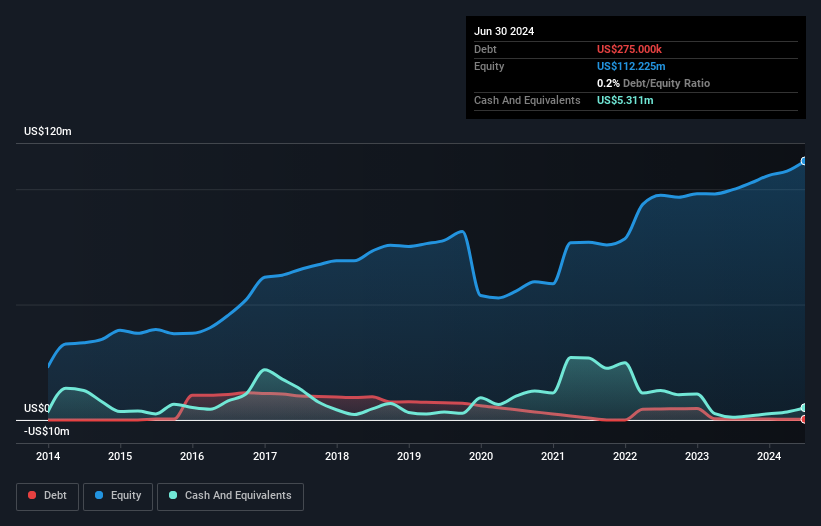

Avino Silver & Gold Mines Ltd., with a market cap of CA$204.54 million, has demonstrated strong financial health, as its operating cash flow significantly covers its debt, and it maintains more cash than total debt. The company reported substantial earnings growth of 180.1% over the past year, outpacing the industry average. Recent results show improved profitability with net income rising to US$1.17 million for Q3 2024 from a loss in the previous year, alongside increased production metrics in copper and silver output. However, shareholder dilution occurred recently with an increase in shares outstanding by 7.7%.

- Jump into the full analysis health report here for a deeper understanding of Avino Silver & Gold Mines.

- Review our growth performance report to gain insights into Avino Silver & Gold Mines' future.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$157.33 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$157.33M

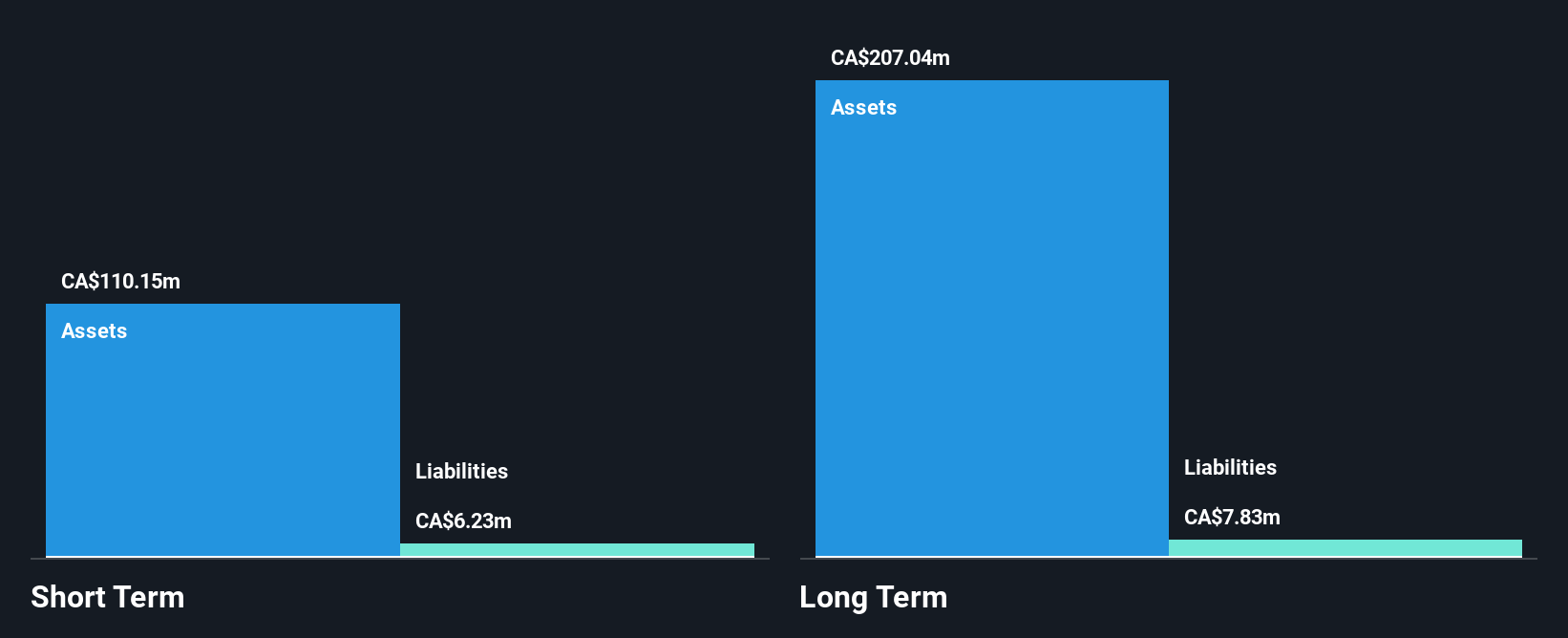

Dundee Corporation, with a market cap of CA$157.33 million, has shown significant financial improvement. It recently became profitable, reporting net income of CA$7.25 million for Q3 2024 compared to a loss last year. Despite limited revenue (CA$1.72 million for the quarter), its return on equity is high at 22.2%, and it maintains more cash than total debt, indicating strong balance sheet management. The company completed preferred stock buybacks, reflecting strategic capital management without shareholder dilution over the past year. However, negative operating cash flow suggests challenges in covering debt through operations alone remain.

- Click here to discover the nuances of Dundee with our detailed analytical financial health report.

- Explore historical data to track Dundee's performance over time in our past results report.

Forsys Metals (TSX:FSY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Forsys Metals Corp., with a market cap of CA$133.87 million, is involved in the acquisition, exploration, and development of mineral properties in Africa through its subsidiaries.

Operations: Forsys Metals Corp. currently does not report any revenue segments.

Market Cap: CA$133.87M

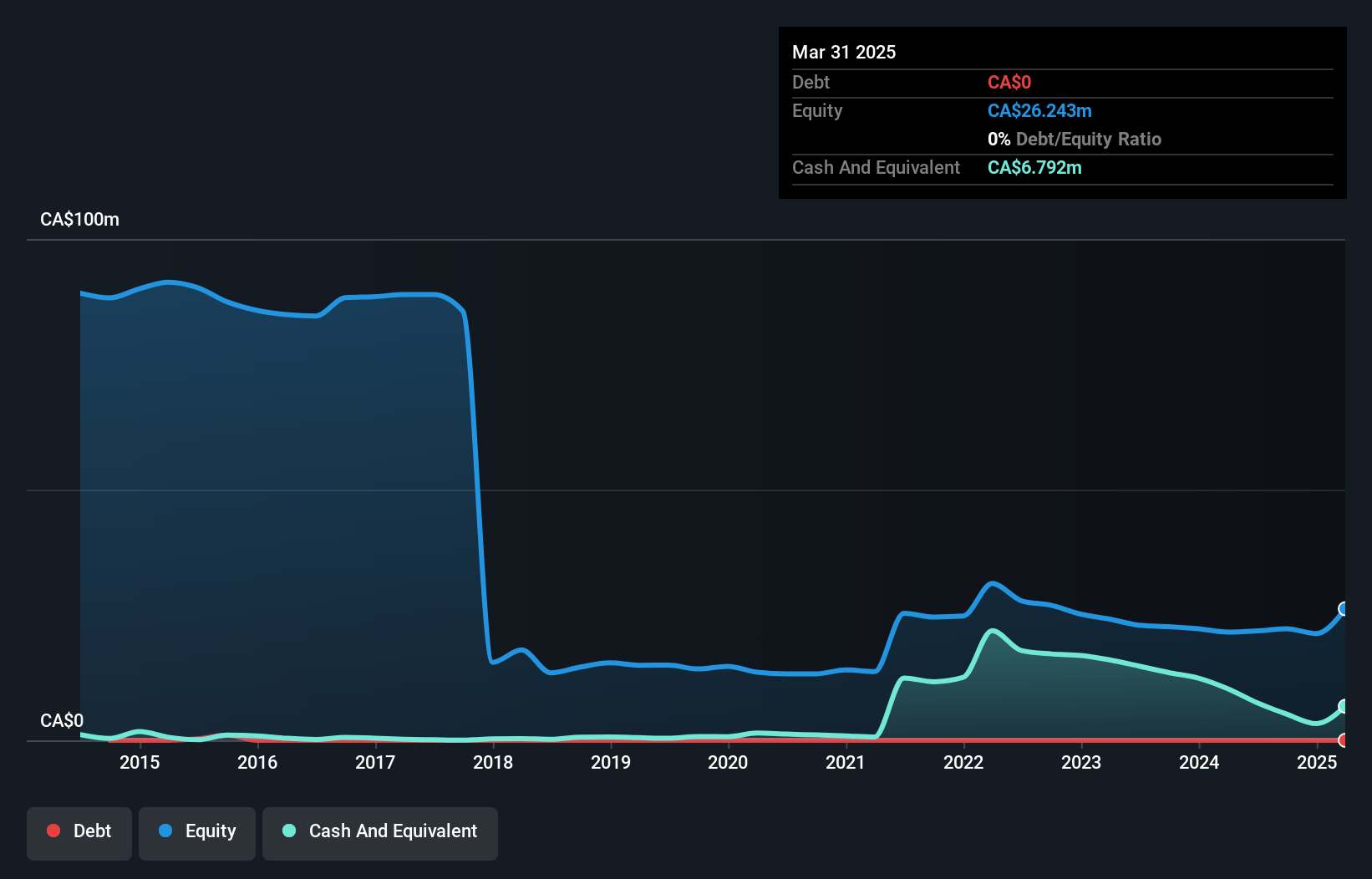

Forsys Metals Corp., with a market cap of CA$133.87 million, remains pre-revenue and unprofitable, with no significant revenue streams reported. The company has managed to reduce its net loss in recent quarters, reporting a net loss of CA$0.51 million for Q3 2024 compared to CA$2.76 million the previous year. Despite having no long-term liabilities and being debt-free, Forsys faces financial challenges with less than one year of cash runway based on current free cash flow trends. Recent insider selling over the past three months may indicate potential concerns among stakeholders regarding future prospects.

- Get an in-depth perspective on Forsys Metals' performance by reading our balance sheet health report here.

- Gain insights into Forsys Metals' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Embark on your investment journey to our 964 TSX Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DC.A

Adequate balance sheet with acceptable track record.