- Canada

- /

- Capital Markets

- /

- TSX:AD.UN

Top TSX Dividend Stocks To Watch In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, yet it is up 21% over the past year with earnings forecast to grow by 16% annually. In this context, dividend stocks that offer consistent payouts and potential for growth are particularly appealing to investors seeking stability and income in a dynamic market environment.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.04% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.56% | ★★★★★★ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.01% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.92% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.49% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.67% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.45% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.92% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.31% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.95% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alaris Equity Partners Income Trust (TSX:AD.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm focusing on management buyouts, growth capital, and mature investments in the lower and middle market sectors, with a market cap of CA$882.66 million.

Operations: Alaris Equity Partners Income Trust generates revenue from unclassified services amounting to CA$198.46 million.

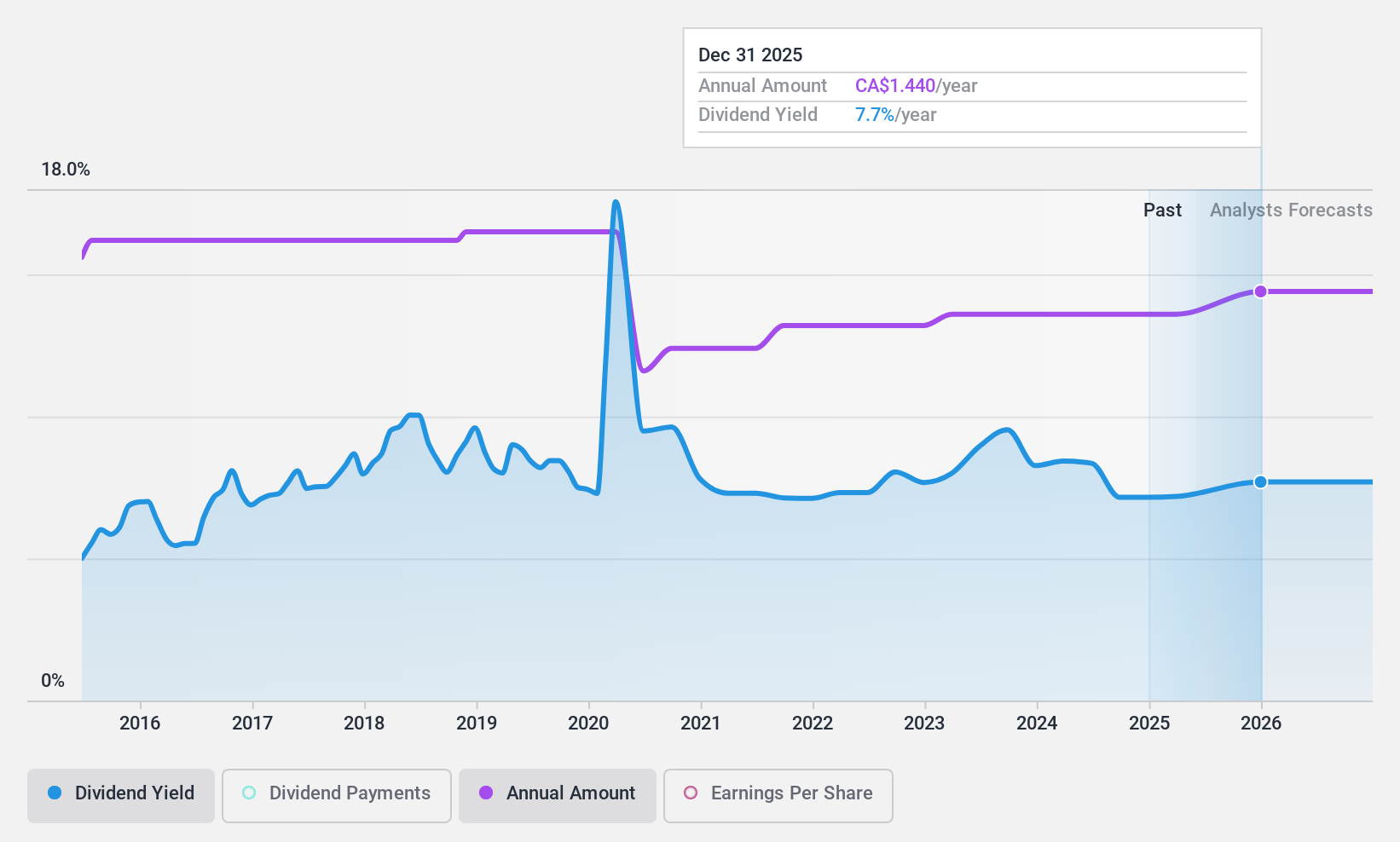

Dividend Yield: 7.1%

Alaris Equity Partners Income Trust offers a high dividend yield of 7.05%, placing it in the top 25% of Canadian dividend payers. Despite recent earnings growth, its dividends have been volatile over the past decade, with historical declines exceeding 20%. The payout ratio is sustainable at 31.4%, but cash flow coverage is tighter at 83.8%. Recent Q3 results showed a decline in revenue to C$69.51 million from C$86.76 million year-over-year, though net income rose significantly over nine months to C$156.48 million from C$97.71 million previously.

- Dive into the specifics of Alaris Equity Partners Income Trust here with our thorough dividend report.

- Upon reviewing our latest valuation report, Alaris Equity Partners Income Trust's share price might be too pessimistic.

Amerigo Resources (TSX:ARG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amerigo Resources Ltd., through its subsidiary Minera Valle Central S.A., produces and sells copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile, with a market cap of CA$275.23 million.

Operations: Amerigo Resources Ltd. generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $184.41 million.

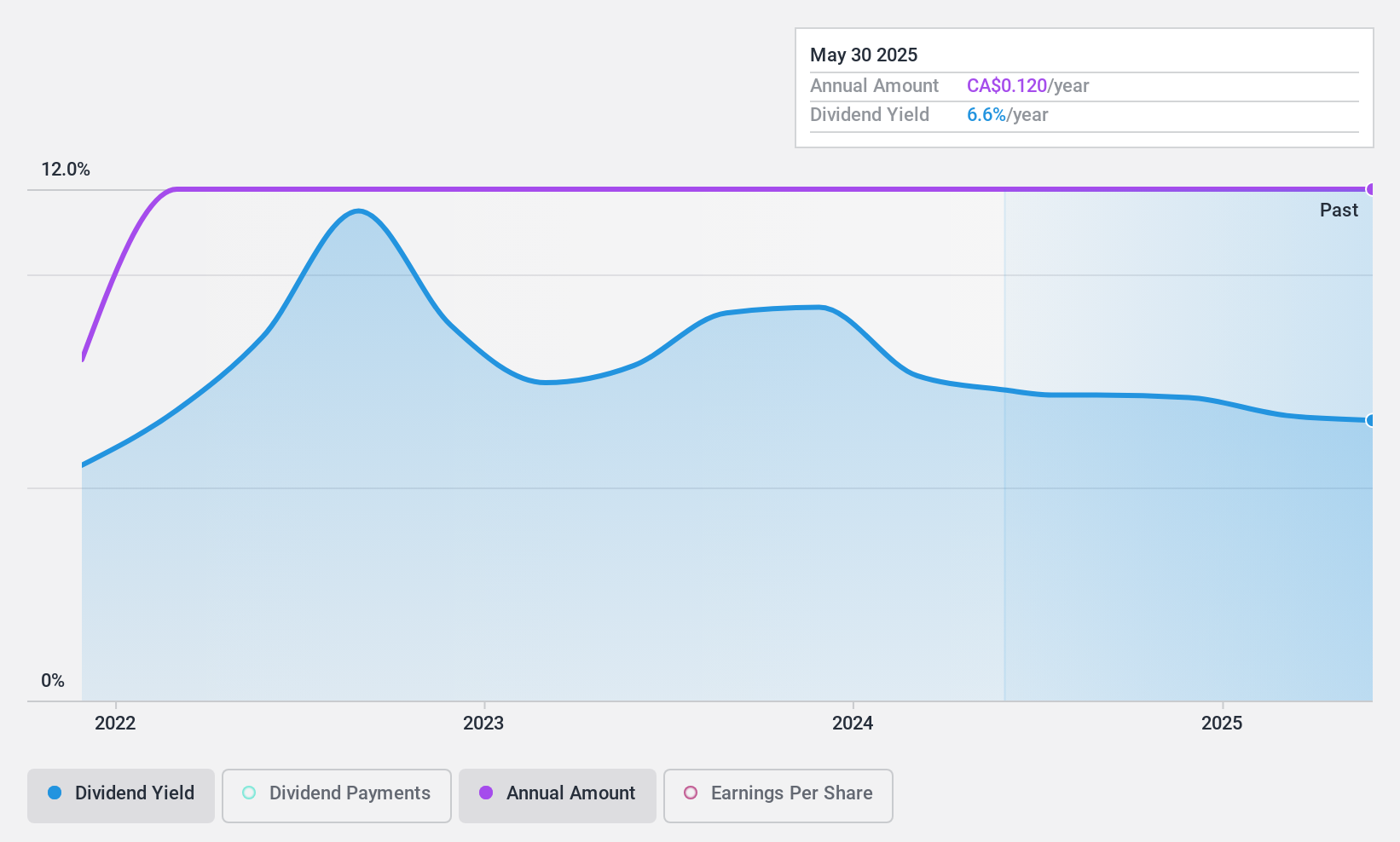

Dividend Yield: 7.0%

Amerigo Resources offers a competitive dividend yield of 7.02%, ranking it among the top 25% in Canada. Despite this, its dividend history is unstable, with payments being volatile over the past three years. However, dividends are well-covered by earnings and cash flows, with payout ratios at 72.7% and 36.8%, respectively. Recent Q3 results show improved financial performance, reporting sales of US$45.44 million and net income of US$2.78 million compared to losses previously.

- Click here and access our complete dividend analysis report to understand the dynamics of Amerigo Resources.

- Our valuation report unveils the possibility Amerigo Resources' shares may be trading at a discount.

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial services company worldwide with a market cap of CA$242.72 billion.

Operations: Royal Bank of Canada's revenue segments include Personal & Commercial Banking (CA$21.78 billion), Wealth Management (CA$17.92 billion), Capital Markets (CA$11.19 billion), and Insurance (CA$5.86 billion).

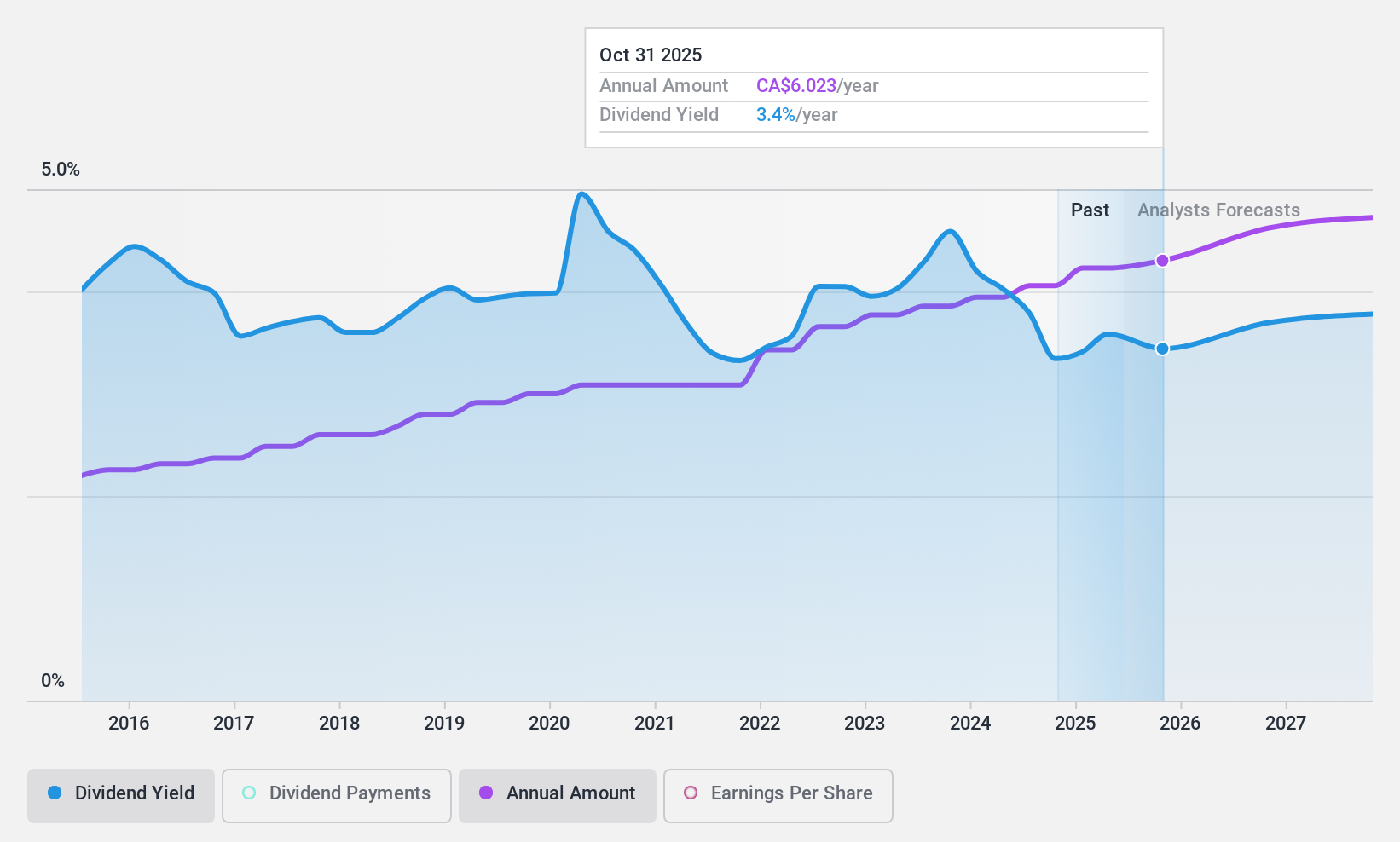

Dividend Yield: 3.3%

Royal Bank of Canada provides a stable dividend, currently yielding 3.31%, with a payout ratio of 49% indicating strong coverage by earnings. Over the past decade, dividends have grown consistently with little volatility. Despite trading below its estimated fair value, the yield is lower than Canada's top quartile dividend payers. Recent fixed-income offerings and strategic financial maneuvers reflect robust capital management, supporting its ability to sustain future dividend payments effectively.

- Take a closer look at Royal Bank of Canada's potential here in our dividend report.

- Our expertly prepared valuation report Royal Bank of Canada implies its share price may be too high.

Where To Now?

- Unlock our comprehensive list of 30 Top TSX Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AD.UN

Alaris Equity Partners Income Trust

A private equity firm specializing in management buyouts, growth capital, lower & middle market, later stage, industry consolidation, growth capital, and mature investments.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives