- Canada

- /

- Oil and Gas

- /

- TSXV:AXL

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market remained flat over the last week, but it has seen a significant 21% rise over the past year, with earnings projected to grow by 16% annually. For investors willing to explore beyond established companies, penny stocks offer intriguing possibilities. Although the term may seem outdated, these smaller or newer companies can still provide a unique blend of affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.74 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.39 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$584.03M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Mining Corp. focuses on acquiring, exploring, and developing mineral resource properties in Mexico with a market cap of CA$227.90 million.

Operations: Prime Mining Corp. has not reported any revenue segments.

Market Cap: CA$227.9M

Prime Mining Corp. is a pre-revenue company with a focus on mineral resource development in Mexico, boasting a market cap of CA$227.90 million. The recent Mineral Resource Estimate highlights substantial growth in both open pit and underground resources, validating its strategy for high-recovery operations. Despite being debt-free and having experienced management, Prime remains unprofitable with significant insider selling noted recently. It has less than one year of cash runway but holds short-term assets exceeding liabilities by CA$20 million. Shareholders have faced dilution as the company continues to invest heavily in exploration and development activities at Los Reyes Project.

- Click to explore a detailed breakdown of our findings in Prime Mining's financial health report.

- Understand Prime Mining's earnings outlook by examining our growth report.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company focused on acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$112.92 million.

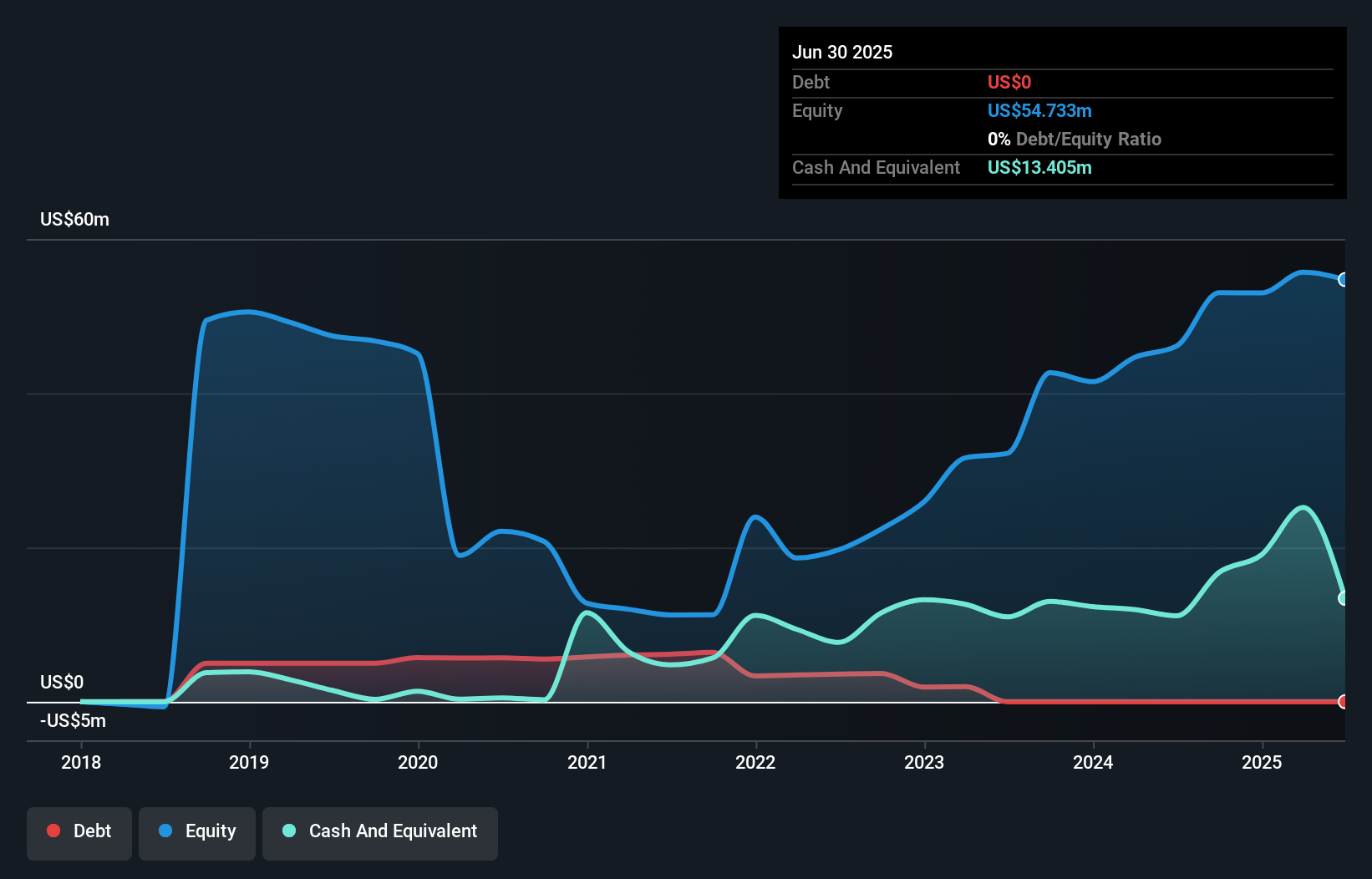

Operations: The company's revenue is derived entirely from its Oil & Gas - Exploration & Production segment, totaling $56.95 million.

Market Cap: CA$112.92M

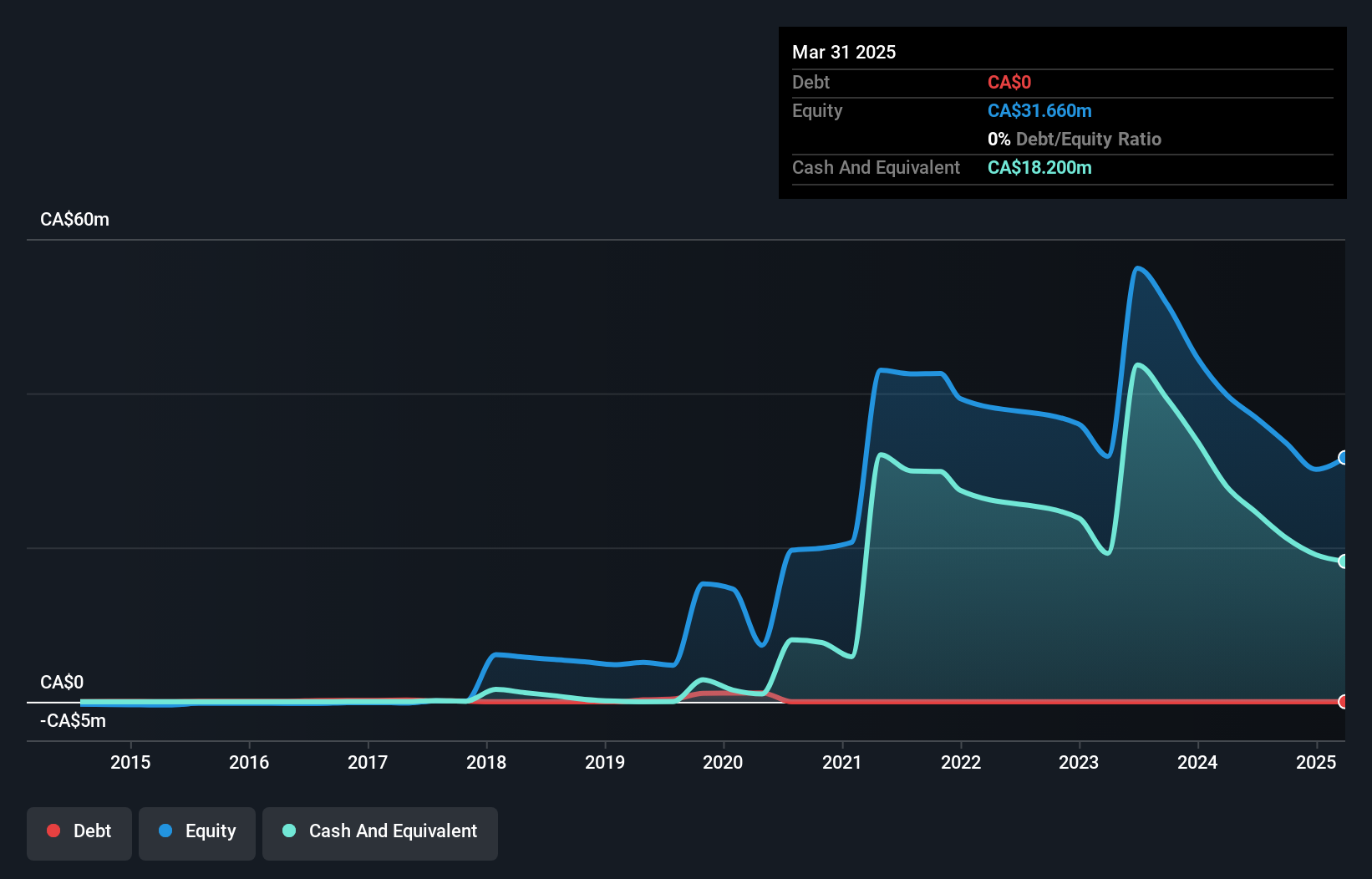

Arrow Exploration Corp., with a market cap of CA$112.92 million, is focused on oil and gas production, primarily in Colombia. The company has no debt, which reduces financial risk. Recent operational updates reveal increased production from the Carrizales Norte B pad wells, notably CNB HZ-6 and CNB HZ-5, contributing to a net corporate production exceeding 5,305 BOE/D. Despite recent negative earnings growth due to lower profit margins compared to last year, Arrow's strategic investments in infrastructure like water disposal facilities aim to enhance efficiency and support future growth prospects while maintaining a cash position over $18 million as of November 2024.

- Dive into the specifics of Arrow Exploration here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Arrow Exploration's future.

TNR Gold (TSXV:TNR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TNR Gold Corp. is involved in acquiring and exploring mineral properties, with a market cap of CA$9.50 million.

Operations: No revenue segments are reported.

Market Cap: CA$9.5M

TNR Gold Corp., with a market cap of CA$9.50 million, is pre-revenue and currently unprofitable, yet it has reduced its losses significantly over the past five years. The company recently completed an oversubscribed private placement raising CA$309,000, enhancing its short-term financial position despite having only a one-month cash runway based on prior free cash flow. TNR's management and board are experienced, averaging 7.2 and 5.3 years in tenure respectively. Although the stock exhibits high volatility compared to most Canadian stocks, there was no meaningful shareholder dilution in the past year, maintaining investor equity stability.

- Navigate through the intricacies of TNR Gold with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into TNR Gold's track record.

Key Takeaways

- Investigate our full lineup of 964 TSX Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AXL

Arrow Exploration

A junior oil and gas company, engages in the acquisition, exploration, development, and production of oil and gas properties in Colombia and Western Canada.

Flawless balance sheet low.