Computer Modelling Group Ltd.'s (TSE:CMG) dividend is being reduced by 80% to CA$0.01 per share on 15th of September, in comparison to last year's comparable payment of CA$0.05. The yield is still above the industry average at 3.2%.

Computer Modelling Group's Payment Could Potentially Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, Computer Modelling Group's dividend made up quite a large proportion of earnings but only 63% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 6.2% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 52%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

See our latest analysis for Computer Modelling Group

Dividend Volatility

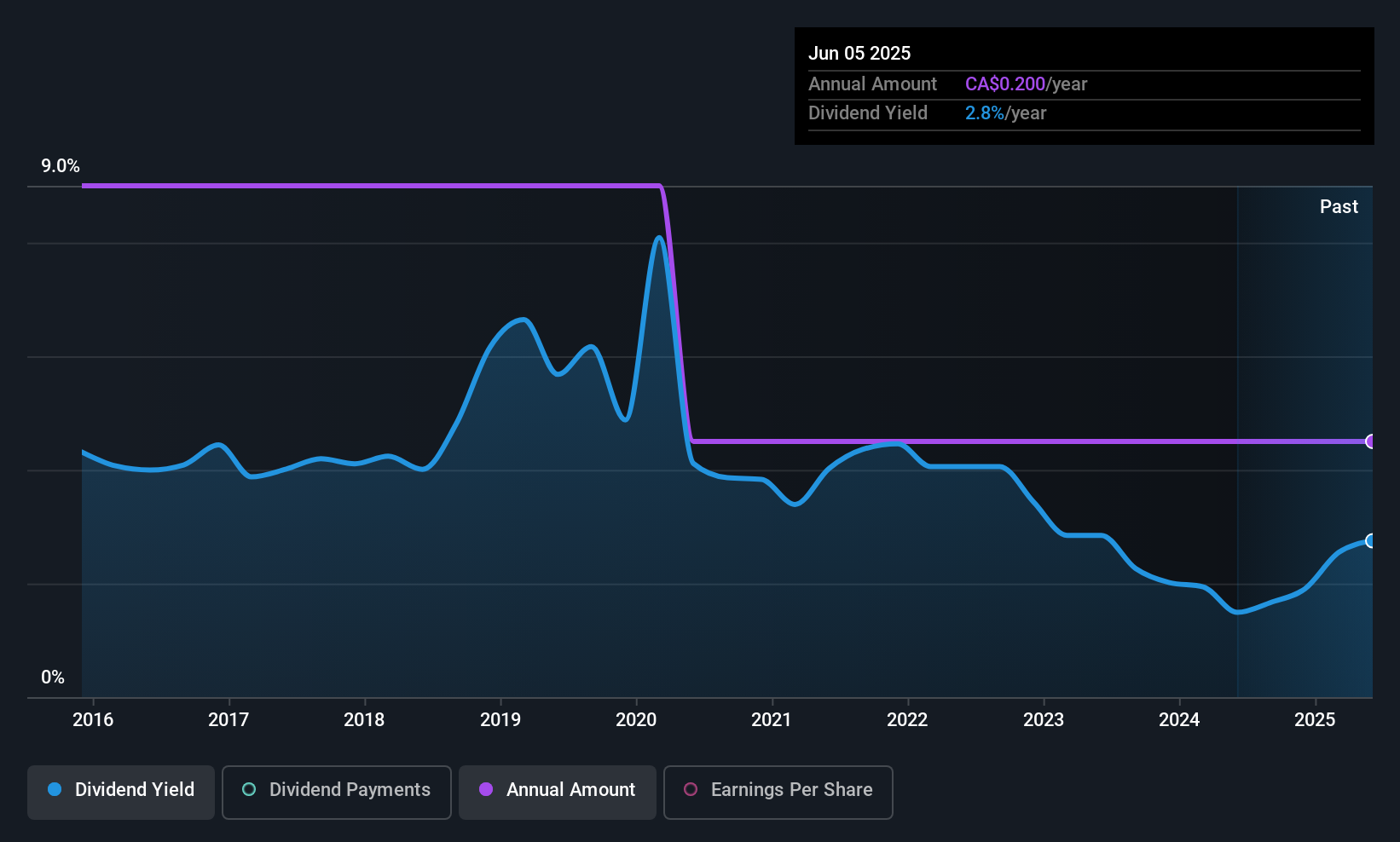

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the dividend has gone from CA$0.40 total annually to CA$0.20. This works out to be a decline of approximately 6.7% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth May Be Hard To Achieve

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Computer Modelling Group hasn't seen much change in its earnings per share over the last five years.

Our Thoughts On Computer Modelling Group's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Computer Modelling Group that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Very undervalued with excellent balance sheet.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Google - The world's first "Full Stack AI Sovereign"

Substantial founder ownership speaks to the strength of its business

Palantir: High-Quality AI Infrastructure, but Valuation Leaves Little Room for Error

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks