Bitfarms (TSX:BITF) Is Up 18.0% After Panther Creek AI Partnership Announcement—What’s Changed

Reviewed by Sasha Jovanovic

- In the past week, Bitfarms announced a new partnership with T5 Data Centers at its Panther Creek campus to support its ambitions in high-performance computing (HPC) and AI infrastructure, amid a broader rally in Bitcoin prices that boosted sentiment across U.S. crypto-related equities.

- While this move signals Bitfarms' intent to diversify beyond Bitcoin mining, ongoing regulatory uncertainty regarding the conversion of its Quebec mining assets to HPC use remains a significant challenge.

- We’ll explore how the Panther Creek partnership could influence Bitfarms’ pivot to HPC and AI services within its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bitfarms Investment Narrative Recap

Bitfarms appeals to shareholders who believe in the growing institutional adoption of Bitcoin and the company's transition toward high-performance computing (HPC) and AI infrastructure. The recent T5 Data Centers partnership underscores this pivot, but regulatory approval to convert Quebec mining assets for HPC use remains the most important near-term catalyst, and also the biggest risk to its business, as unresolved regulatory delays could materially limit diversification efforts.

The Panther Creek partnership with T5 is the most directly relevant recent announcement, supporting Bitfarms’ attempt to generate contracted, high-margin revenue from beyond Bitcoin mining. This collaboration represents a tangible step in aligning with the global trend toward green, flexible tech infrastructure, yet the timing and eventual realization of its impact depend heavily on regulatory clarity around asset conversion in Quebec.

However, investors should be mindful that despite recent progress, long-awaited regulatory clarity around Quebec asset conversion could...

Read the full narrative on Bitfarms (it's free!)

Bitfarms' outlook anticipates $504.8 million in revenue and $58.8 million in earnings by 2028. This scenario is based on a forecast annual revenue growth rate of 27.1% and an earnings increase of $145 million from current earnings of $-86.2 million.

Uncover how Bitfarms' forecasts yield a CA$4.51 fair value, a 7% upside to its current price.

Exploring Other Perspectives

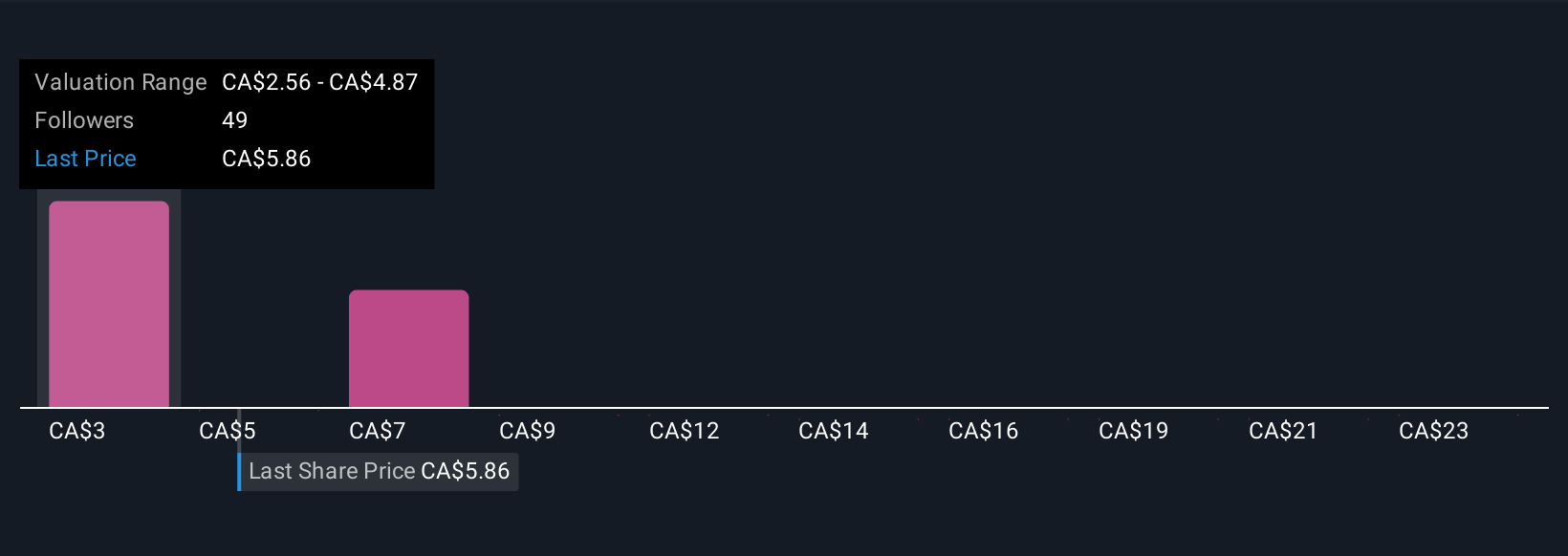

Ten private investors in the Simply Wall St Community estimate fair values for Bitfarms ranging from US$2.56 to US$25.68 per share. With this diversity of outlooks, it’s critical to keep in mind that regulatory approval for HPC conversion is still the pivotal short-term factor affecting the company’s ability to diversify and grow outside Bitcoin mining.

Explore 10 other fair value estimates on Bitfarms - why the stock might be worth over 6x more than the current price!

Build Your Own Bitfarms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitfarms research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bitfarms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitfarms' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitfarms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BITF

Bitfarms

Operates integrated bitcoin data centers in Canada, the United States, Paraguay, and Argentina.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives