Bitfarms (TSE:BITF) shareholder returns have been incredible, earning 506% in 3 years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Not every pick can be a winner, but when you pick the right stock, you can win big. For example, the Bitfarms Ltd. (TSE:BITF) share price is up a whopping 506% in the last three years, a handsome return for long term holders. It's also good to see the share price up 76% over the last quarter. It really delights us to see such great share price performance for investors.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Bitfarms

SWOT Analysis for Bitfarms

- Debt is not viewed as a risk.

- Expensive based on P/S ratio and estimated fair value.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Has less than 3 years of cash runway based on current free cash flow.

- Not expected to become profitable over the next 3 years.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Bitfarms actually saw its earnings per share (EPS) drop 92% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

It may well be that Bitfarms revenue growth rate of 50% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

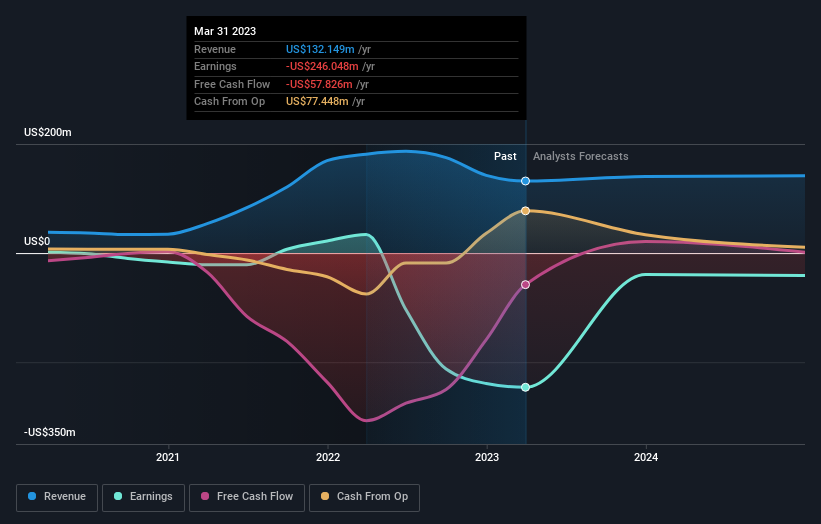

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Bitfarms stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pleasingly, Bitfarms' total shareholder return last year was 22%. That falls short of the 82% it has made, for shareholders, each year, over three years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Bitfarms has 3 warning signs we think you should be aware of.

But note: Bitfarms may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

If you're looking to trade Bitfarms, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bitfarms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BITF

Bitfarms

Operates integrated bitcoin data centers in Canada, the United States, Paraguay, and Argentina.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives