Does BlackBerry’s Slipping Share Price Reflect Its Software Transformation Potential?

Reviewed by Bailey Pemberton

Is BlackBerry’s Share Price Telling the Full Story?

BlackBerry has been through several reinventions, and its stock still divides opinion between nostalgic skeptics and believers in its cybersecurity and IoT pivot. Understanding whether today’s share price reflects that evolving story means digging deeper than headline moves.

Over the last week, month, and year, the stock has slipped, with returns of -12.2% over 7 days, -12.1% over 30 days, and -1.7% over the last year, all against a backdrop of a -42.8% decline over five years but a 12.1% gain over three years. That mixed track record can easily obscure whether the current price is an overreaction or an opportunity.

Recent attention has centered on BlackBerry’s ongoing transformation into a software focused business, particularly its cybersecurity offerings and QNX platform used in connected and autonomous vehicles. At the same time, strategic reviews and periodic speculation about asset sales or restructuring have kept the name on traders’ radar, adding volatility as the market reassesses what the company is really worth.

Simply Wall St currently gives BlackBerry a valuation score of 1 out of 6, suggesting it screens as undervalued on only one of six key checks, which may not sound impressive at first glance. However, those checks rely on specific models. In the sections that follow we will unpack different valuation approaches, then finish by looking at a more nuanced way to understand what the market might be missing in BlackBerry’s story.

BlackBerry scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BlackBerry Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For BlackBerry, the 2 stage Free Cash Flow to Equity model starts from last twelve month free cash flow of about $31.4 Million and builds up to analyst and extrapolated forecasts.

Analysts see free cash flow rising steadily, with projections climbing to around $136 Million by 2030. Beyond the explicit analyst horizon, Simply Wall St extrapolates growth using gradually slowing rates, which still indicate a meaningful improvement from today’s levels as the software and cybersecurity businesses scale.

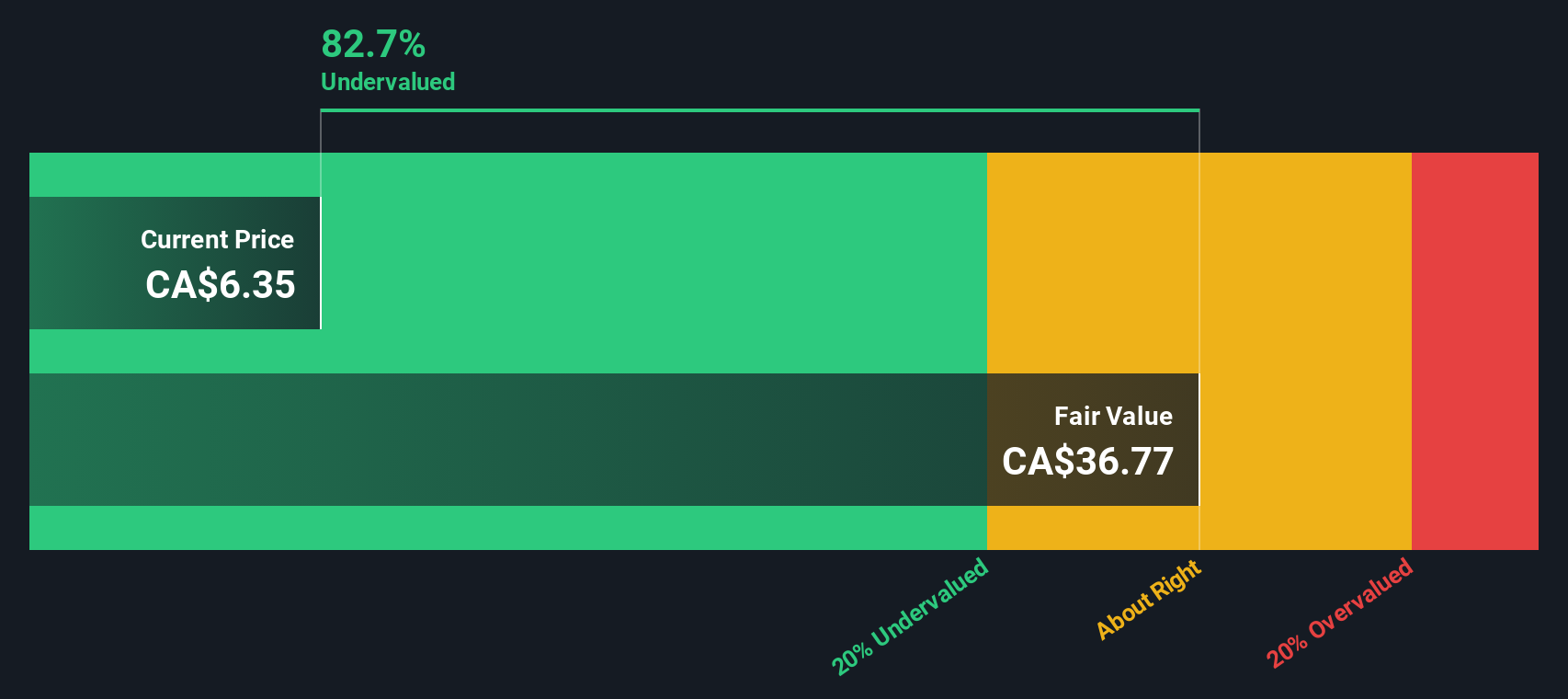

On this basis, the model arrives at an intrinsic value of about $6.19 per share. Compared with the current market price, the DCF suggests BlackBerry is trading at roughly a 16.3% discount, which indicates that investors are paying less than the modelled value of its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BlackBerry is undervalued by 16.3%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: BlackBerry Price vs Earnings

For profitable companies, the Price to Earnings, or PE, ratio is a useful shorthand for how many dollars investors are willing to pay for each dollar of current earnings. It captures both what the business is earning today and what the market expects those earnings to do in the future.

Generally, faster growing and lower risk businesses justify higher PE ratios, while slower growth or higher uncertainty call for lower multiples. BlackBerry currently trades on a PE of about 105x, well above the broader Software industry average of roughly 50x and the peer group average of around 67x, which at face value makes the stock look expensive.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating the PE BlackBerry should trade on, given its specific earnings growth outlook, margins, risk profile, size, and industry. For BlackBerry, that Fair Ratio is about 36x, which is more tailored than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming it should trade like the average software name. Set against the current 105x PE, this suggests the market is paying a substantial premium to what those fundamentals support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BlackBerry Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple but powerful way to connect your view of a company’s story with the numbers behind it. A Narrative is your own structured perspective on a business, where you spell out what you think will happen to its revenue, earnings, and margins, and then translate that into a fair value estimate. Narratives on Simply Wall St, available to millions of investors through the Community page, make this process easy and accessible by guiding you from story, to forecast, to fair value in a few clear steps. Once you have a Narrative, you can compare your fair value to the current share price to decide whether BlackBerry looks like a buy, a hold, or a sell, and the Narrative will automatically update as new information like earnings releases or major news comes in. For example, one BlackBerry Narrative might focus on potential benefits from cybersecurity growth, while another might assume slower adoption and a much lower fair value. Both Narratives are visible side by side for you to evaluate.

Do you think there's more to the story for BlackBerry? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion