BlackBerry (TSX:BB) Q3 2026: Stable $13M Net Income Backs Bullish Turnaround Narrative

Reviewed by Simply Wall St

BlackBerry (TSX:BB) just posted its Q3 2026 scorecard, printing total revenue of about $141.8 million with basic EPS of roughly $0.02, underlining a quarter where top line scale and per share profitability both remained firmly in focus. The company has seen revenue hold in a tight band over recent periods, moving from $141.7 million in Q4 2025 to $121.7 million in Q1 2026 and $129.6 million in Q2 2026 before landing at $141.8 million this quarter. Basic EPS has stepped from a loss of about $0.01 in Q4 2025 to modest profits of roughly $0.00 to $0.02 across the last three quarters, setting up a story that is all about how margins and underlying profitability trends shape sentiment around this latest print.

See our full analysis for BlackBerry.With the numbers on the table, the next step is to see how this earnings profile lines up with the big narratives around BlackBerry's growth, profitability and long term turnaround story.

Curious how numbers become stories that shape markets? Explore Community Narratives

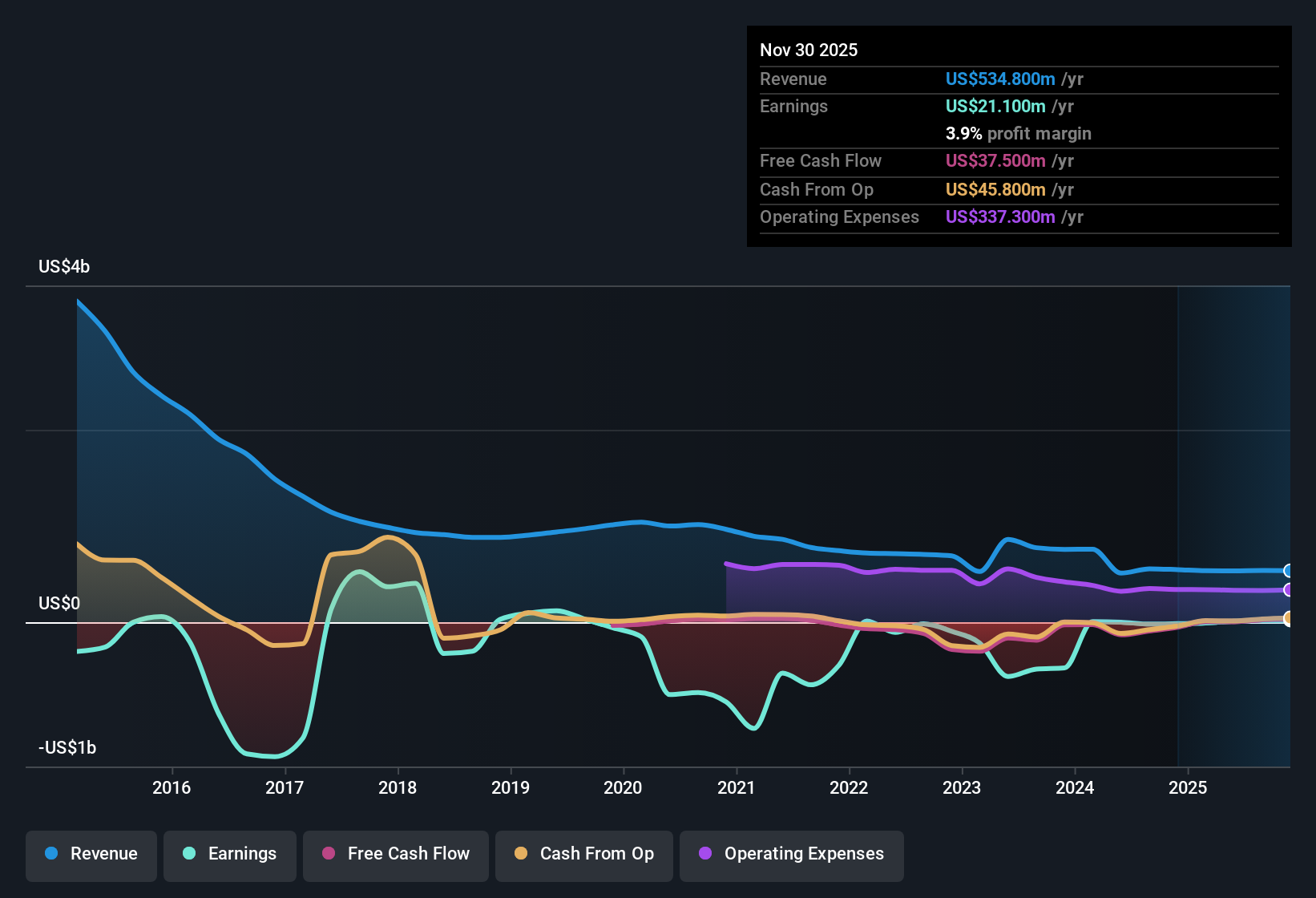

TTM net income flips from losses to $21.1 million

- Over the last twelve months, BlackBerry moved from a net loss of $19.4 million in Q2 2025 to positive net income of $21.1 million, while trailing revenue stayed broadly stable around the mid $500 million level.

- What is striking for a bullish take is how this profit swing lines up with forecasts of about 29.7% annual earnings growth.

- Trailing basic EPS shifted from negative 0.033 USD in Q2 2025 to positive 0.036 USD by Q3 2026, matching the narrative that the company has recently become profitable.

- Because revenue over the same trailing periods only moved modestly from $554.7 million to $534.8 million, the improvement in net income suggests bulls are leaning heavily on margin and efficiency gains rather than rapid top line expansion.

Quarterly profitability steadies around $13 million

- Within the current fiscal year, net income excluding extra items has held near $13 million for two consecutive periods, rising from $1.9 million in Q1 2026 to $13.3 million in Q2 and $13.7 million in Q3, even as quarterly revenue ranged between $121.7 million and $141.8 million.

- For a bullish narrative that sees BlackBerry as a turnaround, this pattern of steady quarterly profit growth is a key proof point.

- Basic EPS has moved from 0.003 USD in Q1 2026 to roughly 0.022 USD in Q2 and 0.023 USD in Q3, which supports the idea that profitability is becoming more consistent rather than a one off jump.

- At the same time, earlier periods showed negative net income despite similar trailing revenue levels, so the current run rate has to be sustained to show that this newer profit level is durable rather than just a short phase.

Mixed valuation, high P/E at 105x

- On valuation, the shares trade around 5.18 while sitting slightly below an estimated DCF fair value of about 5.50, yet the trailing price to earnings multiple of roughly 105 times is well above the Canadian software industry at 49.2 times and a peer average of 66.8 times.

- Critics highlight that this high multiple leaves less room for error even with improving profits.

- Although earnings are forecast to grow about 29.7% per year and revenue about 6.5% per year, the premium P/E suggests the market already prices in a good portion of that growth.

- The fact that the last twelve month figures include a one off loss of $32.7 million means reported earnings were temporarily depressed, so investors need to separate that effect from the ongoing profit level when judging whether a 105 times multiple is justified.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BlackBerry's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite BlackBerry's recent return to profitability, its elevated 105 times earnings multiple and modest revenue growth leave little margin for error if expectations slip.

If that kind of stretched pricing makes you uneasy, use our these 914 undervalued stocks based on cash flows to immediately focus on ideas where current cash flows better justify the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion