Assessing BlackBerry (TSX:BB) Valuation: Is the Market Pricing in Enough Growth?

Reviewed by Simply Wall St

If you have been tracking BlackBerry (TSX:BB), you might have noticed some recent movement that has investors taking a closer look. Often, when there is a sudden swing in a stock, the big question is whether it signals anything deeper about the company or whether it is just noise in a volatile market. For BlackBerry, the attention right now is less about a particular news headline and more about what its current performance might be telegraphing about future potential.

In the bigger picture, BlackBerry’s stock has seen ups and downs over the past year. The share price is up nearly 68% over the past twelve months, even as momentum has generally faded compared to earlier surges, with returns sliding over the past three months. This kind of uneven performance can make it tough to decide if markets are recalibrating expectations or simply reacting to broader sector trends.

With all this in mind, is BlackBerry now trading at a level that makes it undervalued, or are investors already pricing in any growth that could be on the horizon?

Price-to-Sales of 4.3x: Is it justified?

BlackBerry currently trades at a price-to-sales (P/S) ratio of 4.3x, which is slightly higher than the Canadian software industry average of 4.1x. This indicates the stock is somewhat expensive relative to peers in its sector based on this key valuation metric.

The P/S ratio measures how much investors are paying for each dollar of revenue generated by the company. In software and tech sectors, this multiple is commonly used due to variable profitability and revenue growth rates across firms.

While BlackBerry's higher multiple could reflect optimism about future revenue or profitability bouncing back, it also suggests the market may be factoring in growth that is not fully evident in the current numbers. Investors should consider whether projected improvements justify paying above-average prices for the stock today.

Result: Fair Value of $5.20 (ABOUT RIGHT)

See our latest analysis for BlackBerry.However, slowing revenue growth or a reversal in recent profit improvements could quickly pressure investor optimism and BlackBerry's current valuation.

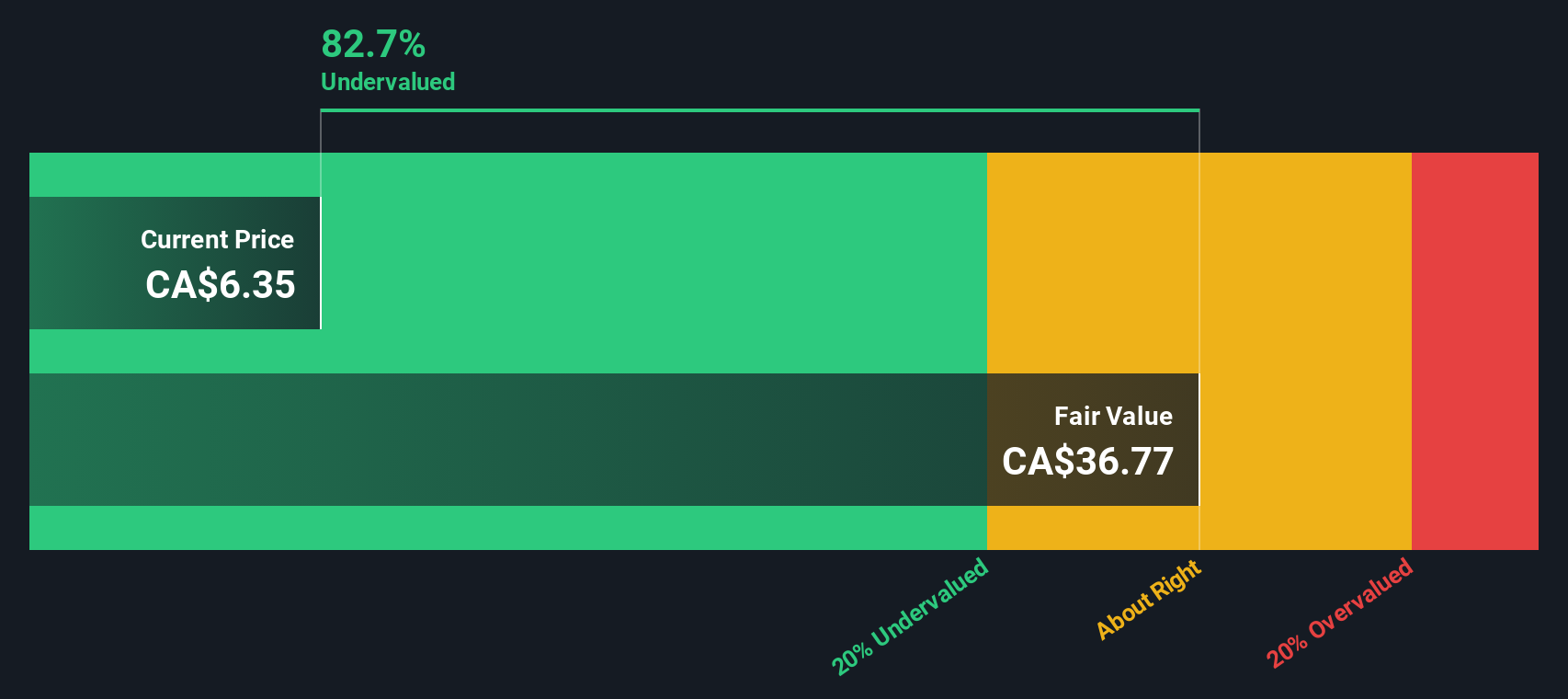

Find out about the key risks to this BlackBerry narrative.Another View: Discounted Cash Flow Says Undervalued

Looking from a different angle, our DCF model arrives at a strikingly different conclusion. It suggests the stock could be undervalued. This raises the question: is the market missing hidden potential, or does the DCF overlook real-world risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BlackBerry Narrative

If you see things differently or want to dig deeper into BlackBerry's outlook, take a few minutes to build your own perspective from the numbers. Do it your way Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Stay ahead of the crowd by tapping into investment opportunities beyond BlackBerry. You can put your money to work now and take charge of your portfolio’s future.

- Target high growth potential by searching for undervalued stocks based on cash flows that the market may be overlooking right now.

- Amplify income generation with access to dividend stocks with yields > 3% offering solid yields above 3% for consistent cash flow.

- Catch the AI wave by scouting AI penny stocks at the cutting edge of artificial intelligence innovation and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives