Is Absolute Software Corporation's (TSE:ABT) 3.5% Dividend Sustainable?

Is Absolute Software Corporation (TSE:ABT) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

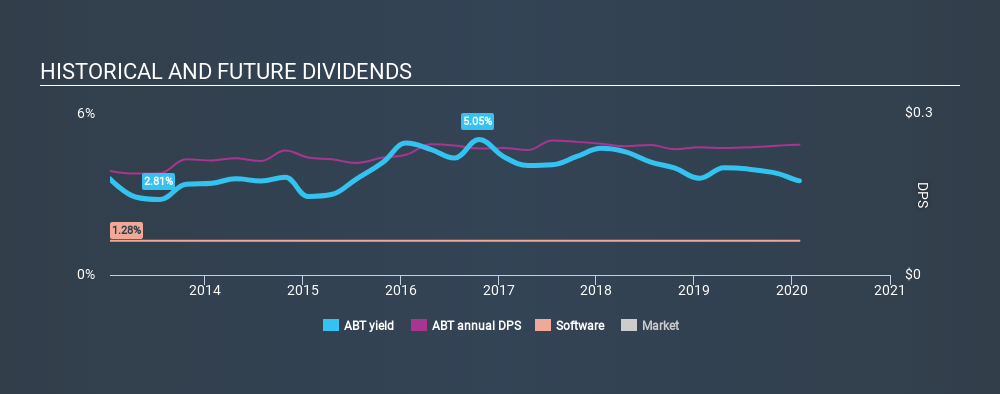

In this case, Absolute Software likely looks attractive to dividend investors, given its 3.5% dividend yield and seven-year payment history. It sure looks interesting on these metrics - but there's always more to the story . Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Absolute Software!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 103% of Absolute Software's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Absolute Software paid out 95% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Cash is slightly more important than profit from a dividend perspective, but given Absolute Software's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

While the above analysis focuses on dividends relative to a company's earnings, we do note Absolute Software's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Absolute Software every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Absolute Software has been paying a dividend for the past seven years. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past seven-year period, the first annual payment was US$0.19 in 2013, compared to US$0.24 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time. The dividends haven't grown at precisely 3.3% every year, but this is a useful way to average out the historical rate of growth.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Absolute Software has grown its earnings per share at 23% per annum over the past five years. Earnings per share have been growing very rapidly, although the company is also paying out virtually all of its profit in dividends. While EPS could grow fast enough to make the dividend sustainable, in this type of situation, we'd want to pay extra attention to any fragilities in the company's balance sheet.

We'd also point out that Absolute Software issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Absolute Software paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. With this information in mind, we think Absolute Software may not be an ideal dividend stock.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 6 analysts we track are forecasting for Absolute Software for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ABST

Absolute Software

Absolute Software Corporation develops, markets, and provides software services that support the management and security of computing devices, applications, data, and networks for various organizations.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives