The CEO, President & Director of ZeU Technologies Inc. (CSE:ZEU), Francois Dumas, Just Bought 57% More Shares

Investors who take an interest in ZeU Technologies Inc. (CSE:ZEU) should definitely note that the CEO, President & Director, Francois Dumas, recently paid CA$0.25 per share to buy CA$215k worth of the stock. That certainly has us anticipating the best, especially since they thusly increased their own holding by 57%, potentially signalling some real optimism.

Check out our latest analysis for ZeU Technologies

ZeU Technologies Insider Transactions Over The Last Year

Notably, that recent purchase by Francois Dumas is the biggest insider purchase of ZeU Technologies shares that we've seen in the last year. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of CA$0.50. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

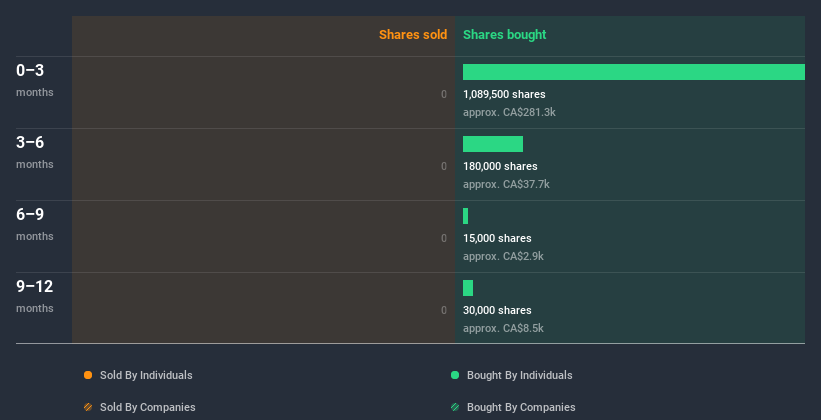

Francois Dumas purchased 1.31m shares over the year. The average price per share was CA$0.25. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does ZeU Technologies Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 7.6% of ZeU Technologies shares, worth about CA$1.0m, according to our data. Whilst better than nothing, we're not overly impressed by these holdings.

What Might The Insider Transactions At ZeU Technologies Tell Us?

The recent insider purchase is heartening. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that ZeU Technologies insiders are reasonably well aligned, and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, ZeU Technologies has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

But note: ZeU Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade ZeU Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZeU Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:ZEU

ZeU Technologies

Engages in the block-chain technology development business.

Medium-low and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion