The Canadian market is currently navigating a period of economic uncertainty, highlighted by a recent rate cut from the Bank of Canada in response to potential U.S. tariff impacts, while the U.S. economy shows continued growth. In such times, investors often turn to penny stocks as a way to explore opportunities in smaller or newer companies that might offer both value and growth potential. Despite their vintage name, penny stocks can still be relevant investments when they are backed by strong financials and stability, offering hidden value for those willing to look beyond larger market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$180.96M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.73 | CA$1.03B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.38 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.14 | CA$226.29M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

eXeBlock Technology (CNSX:XBLK.X)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: eXeBlock Technology Corporation designs and develops software applications with a market cap of CA$8.03 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$8.03M

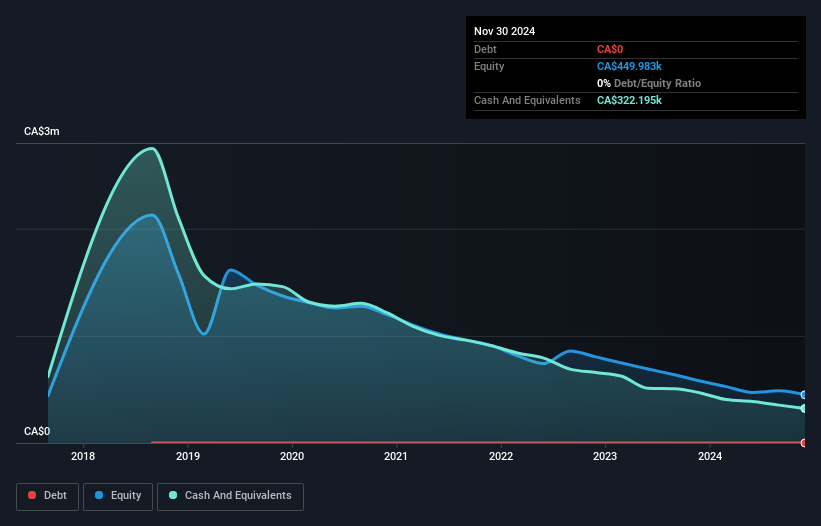

eXeBlock Technology Corporation, with a market cap of CA$8.03 million, is currently pre-revenue and unprofitable, having reported a net loss for the year ending August 31, 2024. Despite its financial challenges and auditor's concerns about its ability to continue as a going concern, the company maintains no debt and has sufficient cash runway for over a year. Recent private placements have bolstered its financial position by issuing shares and warrants to raise capital. The board of directors has an average tenure of 7.4 years, indicating experienced oversight amidst high share price volatility and increased weekly returns volatility over the past year.

- Click to explore a detailed breakdown of our findings in eXeBlock Technology's financial health report.

- Learn about eXeBlock Technology's historical performance here.

Pacific Booker Minerals (TSXV:BKM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pacific Booker Minerals Inc. is involved in the exploration of mineral properties in Canada, with a market capitalization of CA$16.31 million.

Operations: Pacific Booker Minerals Inc. has not reported any revenue segments.

Market Cap: CA$16.31M

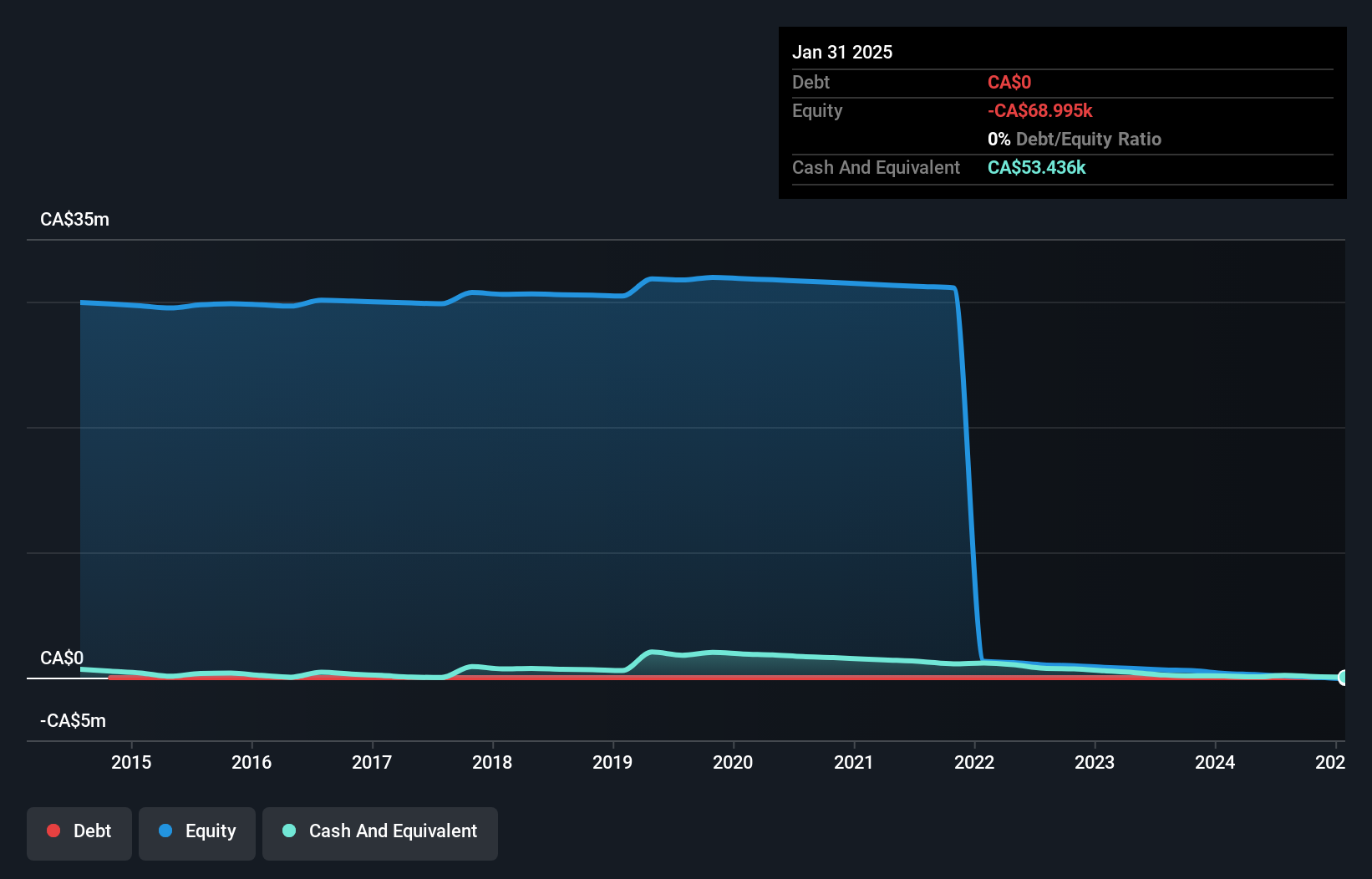

Pacific Booker Minerals Inc., with a market cap of CA$16.31 million, is pre-revenue and unprofitable, reporting increased net losses for the third quarter and nine months ending October 31, 2024. Despite its financial challenges, the company remains debt-free and has a cash runway sufficient for over a year if free cash flow trends continue. The board's extensive experience with an average tenure of 19.7 years provides seasoned oversight amidst high share price volatility and increased weekly returns volatility over the past year. Short-term liabilities exceed short-term assets, highlighting potential liquidity concerns in the near term.

- Jump into the full analysis health report here for a deeper understanding of Pacific Booker Minerals.

- Review our historical performance report to gain insights into Pacific Booker Minerals' track record.

Atlas Salt (TSXV:SALT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Salt Inc. is involved in the valuation, exploration, development, and production of industrial mineral properties in Newfoundland and Labrador, Canada, with a market cap of CA$59.15 million.

Operations: Currently, there are no reported revenue segments for Atlas Salt Inc.

Market Cap: CA$59.15M

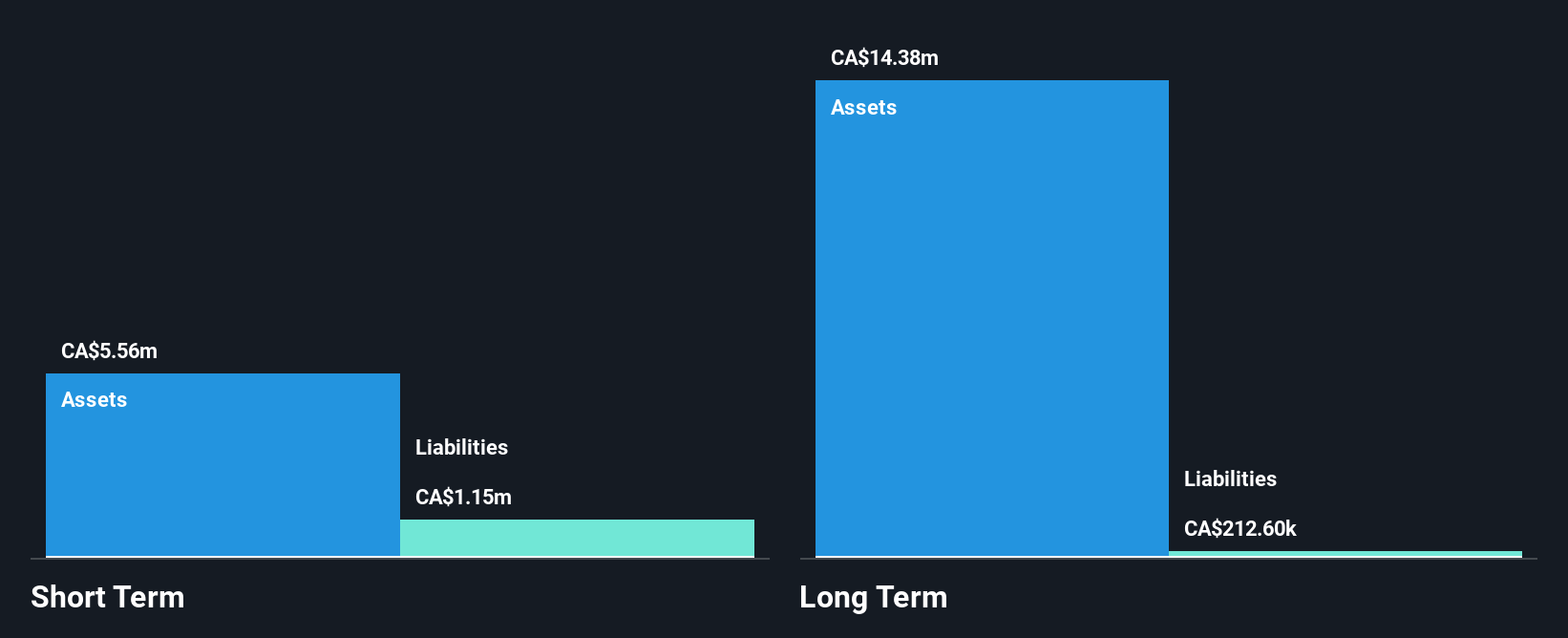

Atlas Salt Inc., with a market cap of CA$59.15 million, remains pre-revenue and unprofitable, reporting an increased net loss for the third quarter of 2024. Despite these challenges, the company is debt-free and maintains a sufficient cash runway for nearly two years if current free cash flow trends persist. Its short-term assets significantly exceed both short-term and long-term liabilities, suggesting strong liquidity management. The board's average tenure of 4.8 years indicates seasoned oversight; however, the management team is relatively new with an average tenure of 1.4 years, which may affect strategic stability amidst stable weekly volatility in share price.

- Unlock comprehensive insights into our analysis of Atlas Salt stock in this financial health report.

- Evaluate Atlas Salt's historical performance by accessing our past performance report.

Taking Advantage

- Access the full spectrum of 934 TSX Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:XBLK.X

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)