Introducing Hydro66 Holdings (CSE:SIX), The Stock That Dropped 31% In The Last Year

Hydro66 Holdings Corp. (CSE:SIX) shareholders will doubtless be very grateful to see the share price up 40% in the last month. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 31% in the last year, significantly under-performing the market.

See our latest analysis for Hydro66 Holdings

Hydro66 Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Hydro66 Holdings's revenue didn't grow at all in the last year. In fact, it fell 19%. That looks pretty grim, at a glance. The stock price has languished lately, falling 31% in a year. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

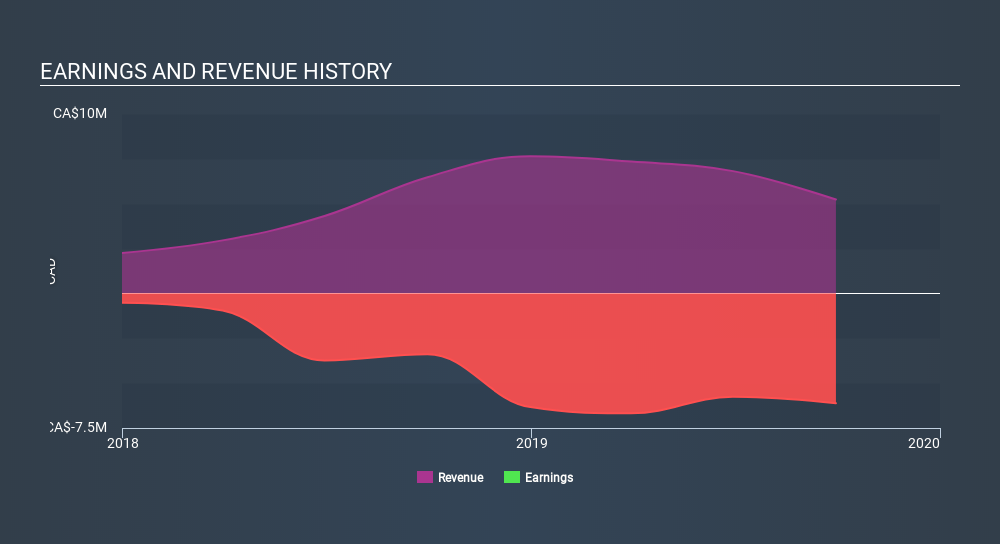

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Given that the market gained 13% in the last year, Hydro66 Holdings shareholders might be miffed that they lost 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Hydro66 Holdings (of which 3 don't sit too well with us!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:SIX

Slight with mediocre balance sheet.

Market Insights

Community Narratives