TSX Penny Stocks Spotlight: Railtown AI Technologies Among 3 Noteworthy Picks

Reviewed by Simply Wall St

As the Canadian market navigates potential rate cuts and fiscal stimulus, investors are eyeing opportunities amidst volatility and elevated valuations. In this context, penny stocks—though an outdated term—remain a compelling area for those seeking to uncover smaller companies with strong financials and growth potential. This article highlights three such stocks that stand out for their balance sheet strength and promise, offering investors a chance to explore under-the-radar opportunities in the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.37M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.79 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.34 | CA$2.84M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.29 | CA$42.06M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.09 | CA$731.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.95 | CA$18.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.43 | CA$381.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.54 | CA$177.64M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.98 | CA$187.01M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.69 | CA$8.21M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Railtown AI Technologies (CNSX:RAIL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Railtown AI Technologies Inc. is a Canadian company focused on developing and commercializing software technology, with a market cap of CA$102.93 million.

Operations: Railtown AI Technologies Inc. has not reported any specific revenue segments at this time.

Market Cap: CA$102.93M

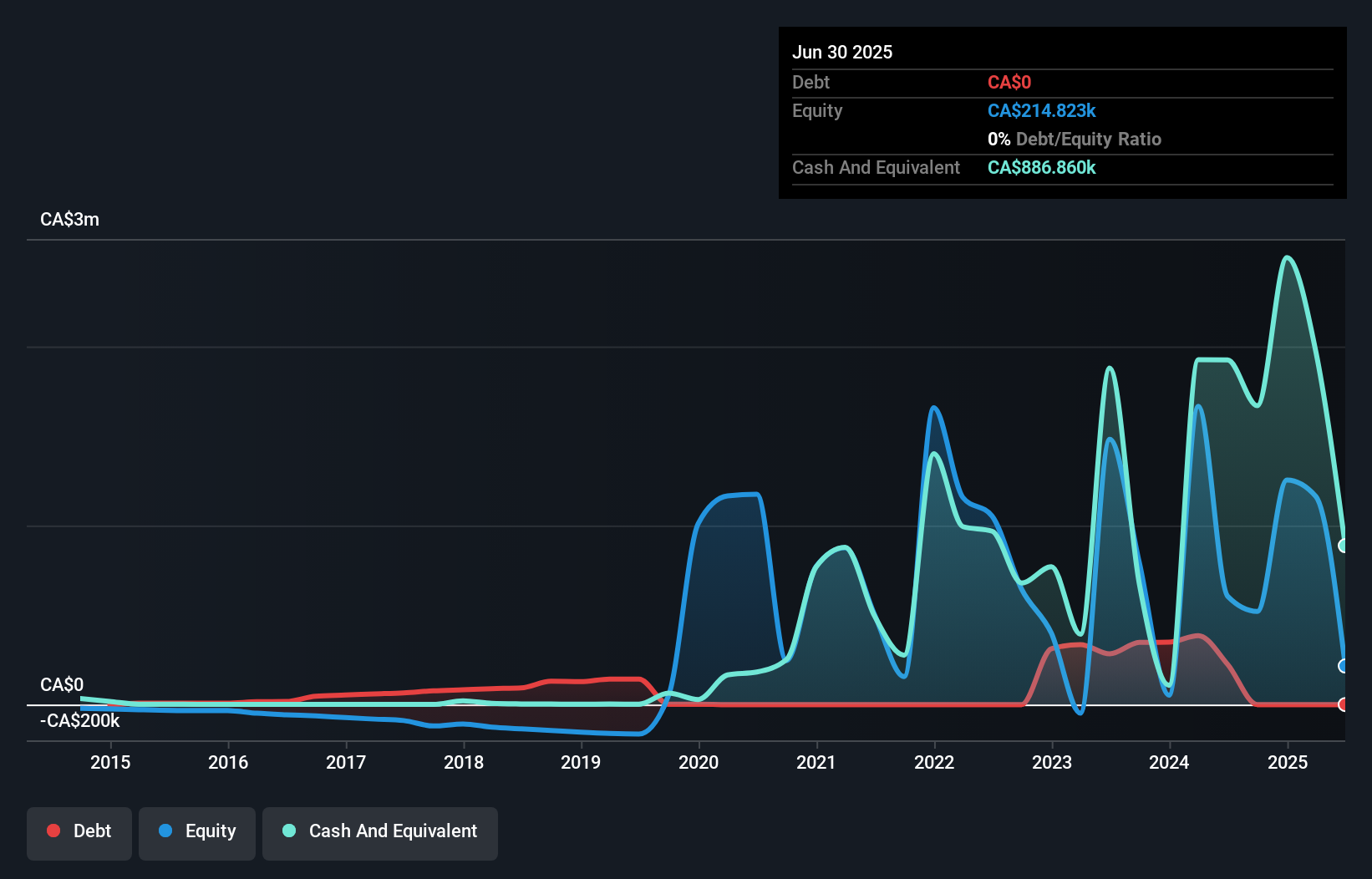

Railtown AI Technologies Inc., with a market cap of CA$102.93 million, remains pre-revenue, generating less than US$1 million. Despite being unprofitable and having a negative return on equity, recent strategic partnerships may enhance its growth prospects. Collaborations with AI Partnerships Corp and Ignite Sequence LLC aim to expand its AI technology footprint in the Middle East and financial analytics sectors, respectively. Additionally, the launch of Auto Triage within its Conductr platform showcases Railtown's commitment to innovation in software development. The company has raised capital through private placements but faces cash runway challenges without further funding.

- Jump into the full analysis health report here for a deeper understanding of Railtown AI Technologies.

- Assess Railtown AI Technologies' previous results with our detailed historical performance reports.

Bragg Gaming Group (TSX:BRAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bragg Gaming Group Inc. operates as an iGaming content and technology solutions provider, serving online and land-based gaming operators with proprietary and exclusive content, with a market cap of CA$98.49 million.

Operations: The company generates revenue primarily from its B2B Online Gaming segment, which accounts for €104.91 million.

Market Cap: CA$98.49M

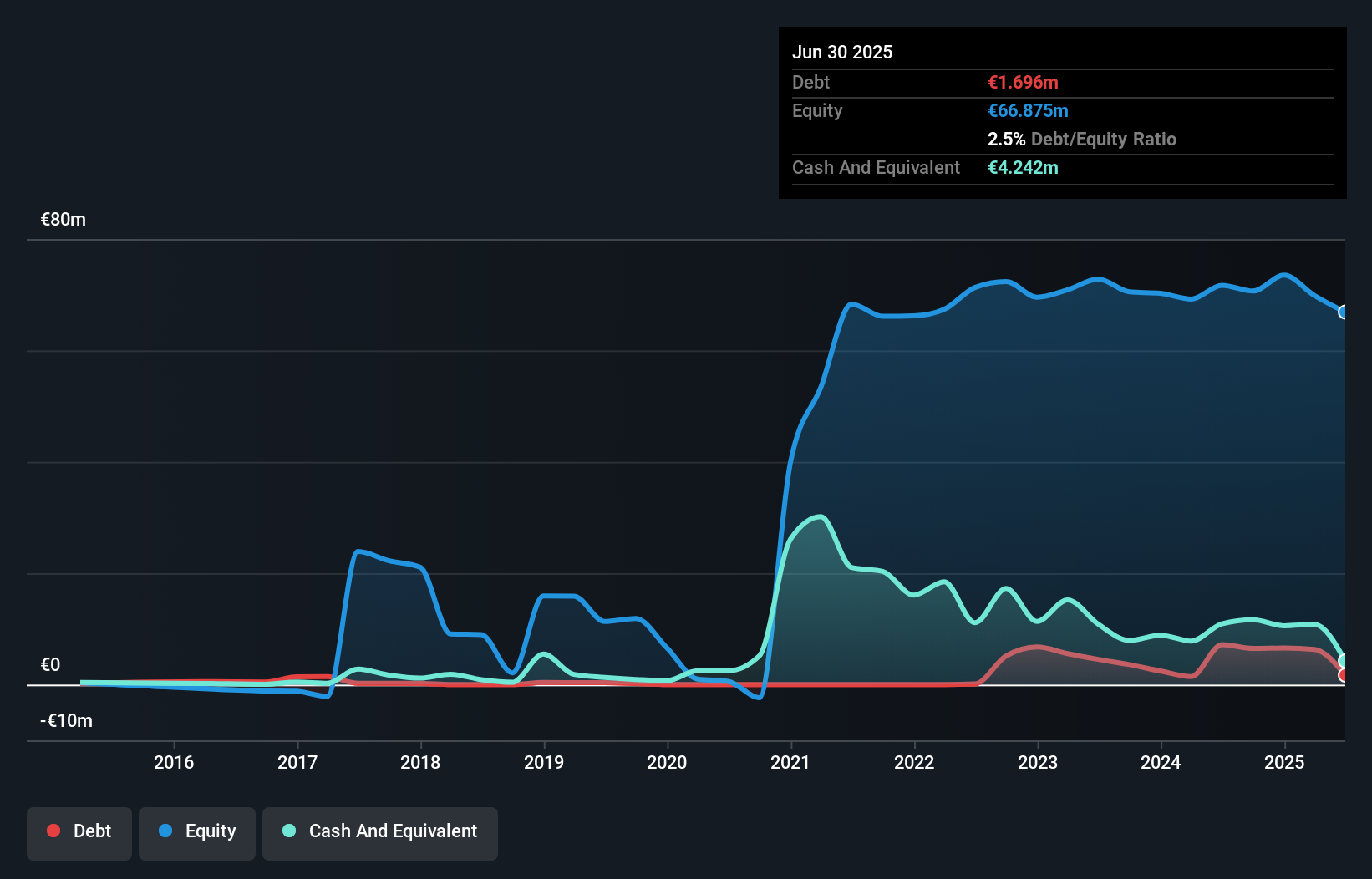

Bragg Gaming Group, with a market cap of CA$98.49 million, continues to navigate the penny stock landscape by leveraging its iGaming content and technology solutions. Despite being unprofitable, the company maintains a positive cash flow and more cash than debt, ensuring a sufficient runway for over three years. Recent developments include securing a USD 6 million credit facility with BMO to enhance financial stability and growth initiatives. Additionally, Bragg's strategic expansion into North American markets through partnerships like Fanatics Casino highlights its focus on diversifying revenue streams while addressing challenges in regulated markets like the Netherlands and Brazil.

- Click here and access our complete financial health analysis report to understand the dynamics of Bragg Gaming Group.

- Understand Bragg Gaming Group's earnings outlook by examining our growth report.

Grid Metals (TSXV:GRDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grid Metals Corp. is engaged in the exploration and development of base and precious metal mineral properties in Canada, with a market cap of CA$18.40 million.

Operations: Grid Metals Corp. currently does not report any revenue segments.

Market Cap: CA$18.4M

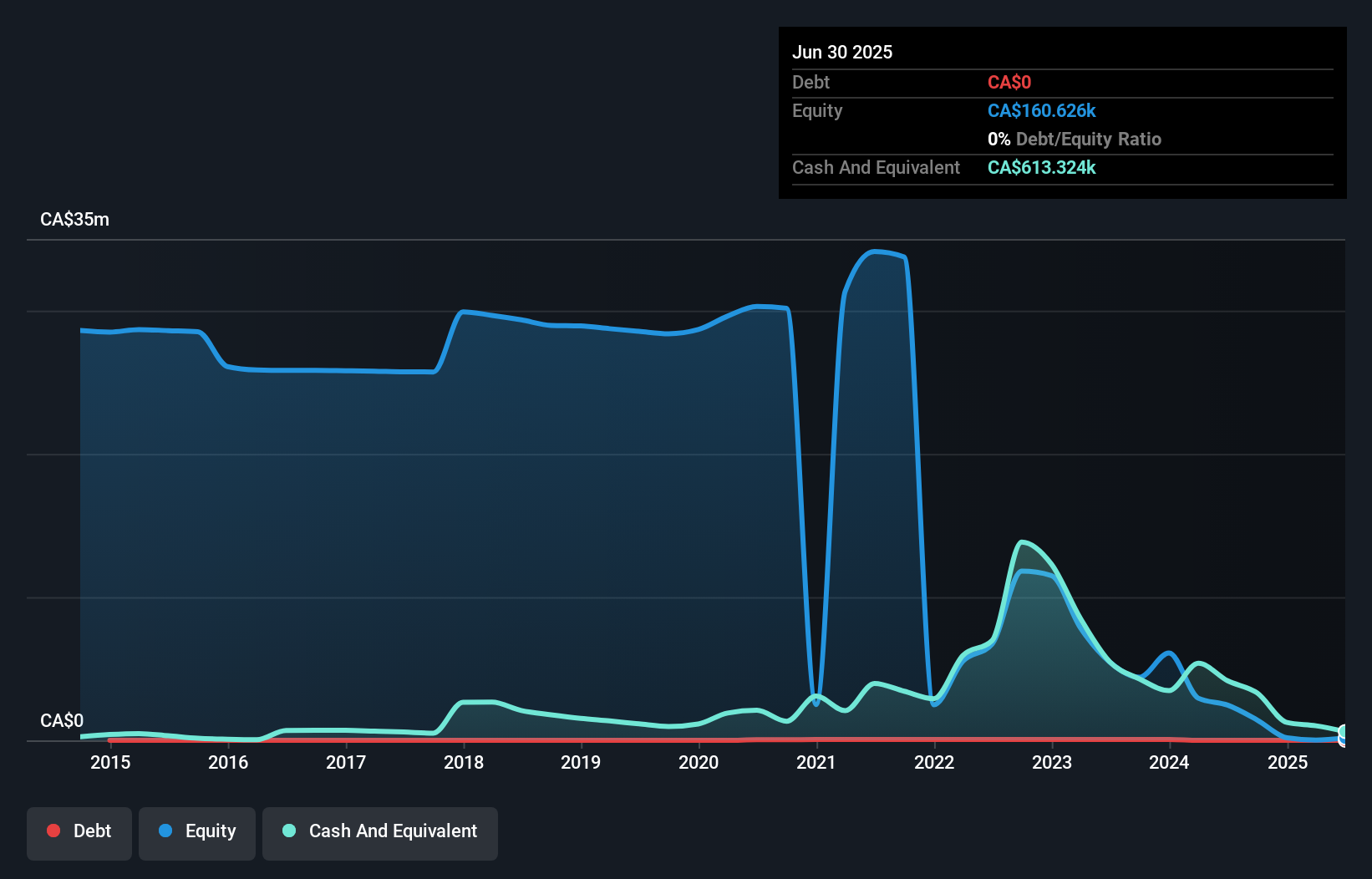

Grid Metals Corp., with a market cap of CA$18.40 million, is pre-revenue and currently unprofitable, yet it remains debt-free and has short-term assets exceeding liabilities. Recent developments include the discovery of semi-massive nickel sulfide mineralization at its Makwa Ni-Cu-PGE project in Manitoba, under a joint venture with Teck Resources Limited. This discovery at the Pavo Anomaly presents promising exploration potential, though the company faces challenges such as limited cash runway and high share price volatility. The board's relatively short tenure suggests new leadership navigating these opportunities and risks in Canada's mining sector.

- Dive into the specifics of Grid Metals here with our thorough balance sheet health report.

- Evaluate Grid Metals' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 409 TSX Penny Stocks selection here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:RAIL

Railtown AI Technologies

Engages in the development and commercialization of software technology in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives