- Canada

- /

- Food and Staples Retail

- /

- TSXV:MNOW

Is Mednow (CVE:MNOW) In A Good Position To Deliver On Growth Plans?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Mednow (CVE:MNOW) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Mednow

How Long Is Mednow's Cash Runway?

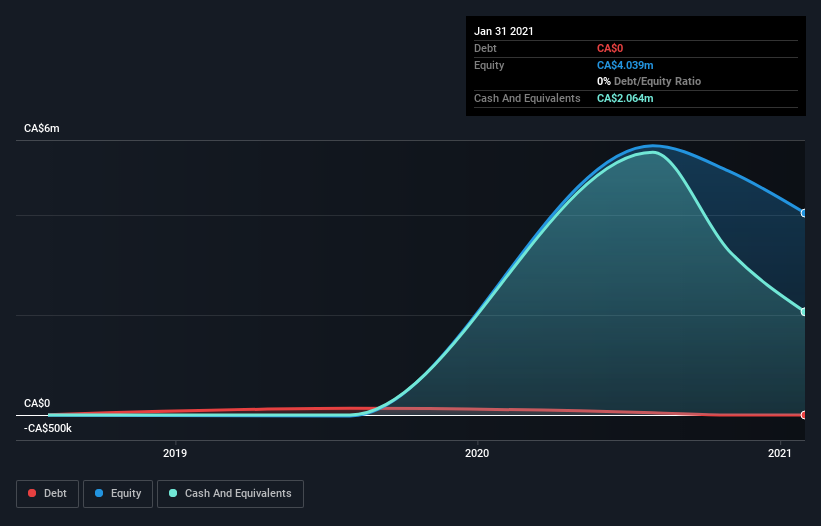

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In January 2021, Mednow had CA$2.1m in cash, and was debt-free. Looking at the last year, the company burnt through CA$2.3m. That means it had a cash runway of around 11 months as of January 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Is Mednow's Cash Burn Changing Over Time?

In our view, Mednow doesn't yet produce significant amounts of operating revenue, since it reported just CA$166k in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Remarkably, it actually increased its cash burn by 600% in the last year. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. Mednow makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Mednow Raise Cash?

Given its cash burn trajectory, Mednow shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of CA$35m, Mednow's CA$2.3m in cash burn equates to about 6.6% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Mednow's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Mednow's cash burn relative to its market cap was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Taking a deeper dive, we've spotted 4 warning signs for Mednow you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:MNOW

Mednow

A healthcare company, develops and operates a proprietary web and mobile application to facilitate the sale and distribution of prescription medications and the delivery of virtual care, telemedicine services, and doctor home visits in Canada.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives