The Canadian market is navigating a complex landscape, with potential tariff escalations posing risks to economic growth and inflation. Despite these challenges, the fundamental backdrop remains supportive, offering opportunities for diversification and strategic investment. Penny stocks, though an older term, continue to represent smaller or newer companies that can provide surprising value; by focusing on those with robust financials and a clear growth trajectory, investors may find promising opportunities in this sector.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.24M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.63 | CA$444.19M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.54 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.23M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.97 | CA$993.59M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.96 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. is involved in the acquisition, exploration, and advancement of mineral properties in Canada, with a market cap of CA$272.51 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, with reported earnings of $54.33 million.

Market Cap: CA$272.51M

Avino Silver & Gold Mines Ltd. is demonstrating robust growth, with earnings surging 180.1% over the past year and exceeding industry averages. The company maintains a strong balance sheet, with $26 million in cash and no significant debt, allowing it to fund La Preciosa's development from reserves. Recent production guidance anticipates 2.5 to 2.8 million silver equivalent ounces for 2025, leveraging both Avino Mine and La Preciosa resources. Despite low return on equity at 3.1%, Avino's stable financial position and strategic mine developments position it well within the penny stock landscape for potential growth opportunities in Canada's mining sector.

- Get an in-depth perspective on Avino Silver & Gold Mines' performance by reading our balance sheet health report here.

- Gain insights into Avino Silver & Gold Mines' future direction by reviewing our growth report.

BuildDirect.com Technologies (TSXV:BILD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BuildDirect.com Technologies Inc. operates an online marketplace for buying and selling building materials across the United States, Canada, and internationally, with a market cap of CA$46.24 million.

Operations: The company's revenue is derived from two segments: BuildDirect, generating $14.81 million, and Independent Retailers, contributing $50.85 million.

Market Cap: CA$46.24M

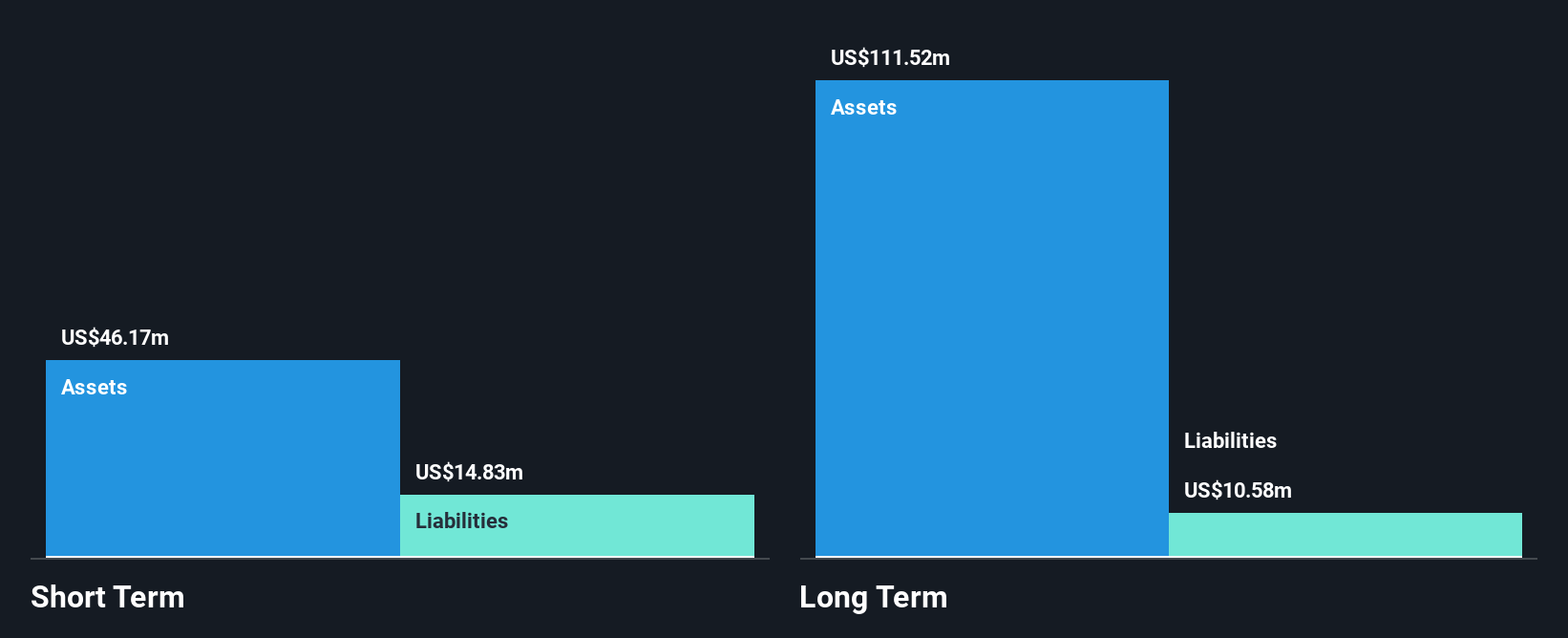

BuildDirect.com Technologies Inc. is navigating its challenges as a penny stock with strategic initiatives and financial maneuvers. The company, while unprofitable, has reduced losses over five years at a rate of 25.9% annually and maintains a sufficient cash runway exceeding three years due to positive free cash flow growth. Recent corporate guidance anticipates fourth-quarter 2024 revenue between US$16 million and US$16.9 million, suggesting potential revenue stabilization. BuildDirect's high net debt to equity ratio at 253% presents risks; however, secured revolving credit facilities from RBC offer liquidity for working capital and debt restructuring efforts amid ongoing acquisition pursuits in North America.

- Dive into the specifics of BuildDirect.com Technologies here with our thorough balance sheet health report.

- Examine BuildDirect.com Technologies' past performance report to understand how it has performed in prior years.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tornado Infrastructure Equipment Ltd. designs, fabricates, manufactures, and sells hydrovac trucks in North America and China, with a market cap of CA$154.06 million.

Operations: The company generates revenue from two primary markets, with CA$34.37 million from Canada and CA$97.71 million from the United States.

Market Cap: CA$154.06M

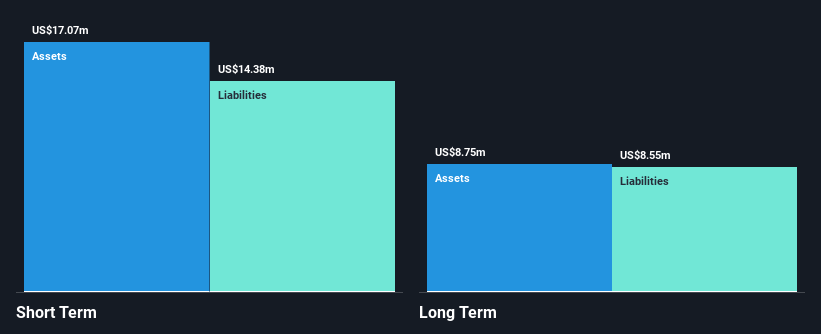

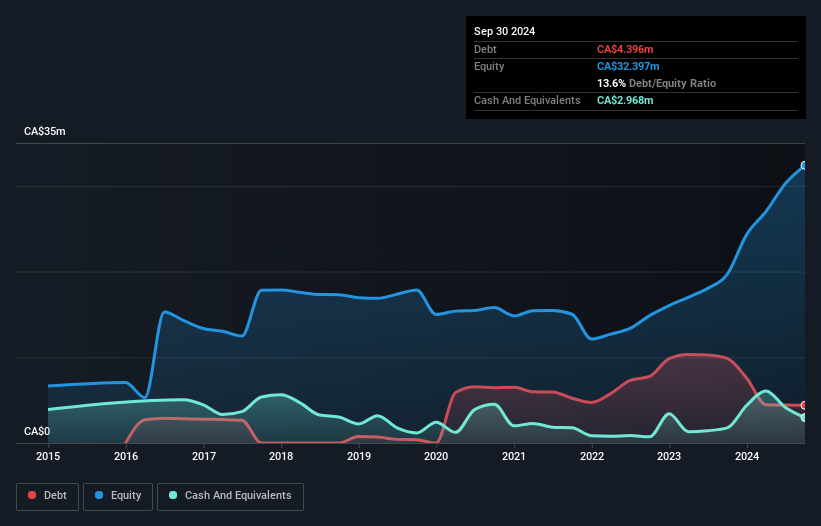

Tornado Infrastructure Equipment Ltd. is making strategic moves to enhance its market position, notably through the launch of Tornado Equipment Finance Ltd., which aims to provide flexible financial solutions for Canadian customers, potentially boosting revenue streams. The company reported significant earnings growth with a net profit margin improvement from 3.6% to 8.7%, supported by strong cash flow and satisfactory debt management, including a low net debt-to-equity ratio of 4.4%. Its recent expansion into the U.S., marked by new subsidiaries and local production initiatives, aligns with its strategy to capitalize on growing demand in North America while maintaining high-quality earnings and stable volatility.

- Navigate through the intricacies of Tornado Infrastructure Equipment with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Tornado Infrastructure Equipment's future.

Taking Advantage

- Unlock our comprehensive list of 943 TSX Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tornado Infrastructure Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TGH

Tornado Infrastructure Equipment

Through its subsidiaries, designs, fabricates, manufactures, and sells hydrovac trucks in North America.

Flawless balance sheet and good value.

Market Insights

Community Narratives