When Roots Corporation (TSE:ROOT) reported its results to January 2021 its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for Roots

What Is Roots's Net Debt?

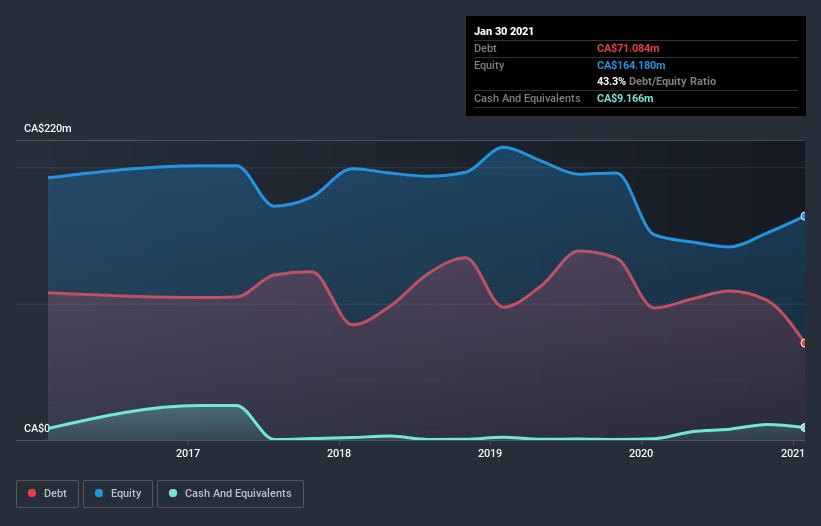

As you can see below, Roots had CA$71.1m of debt at January 2021, down from CA$96.7m a year prior. However, it does have CA$9.17m in cash offsetting this, leading to net debt of about CA$61.9m.

How Healthy Is Roots' Balance Sheet?

The latest balance sheet data shows that Roots had liabilities of CA$65.2m due within a year, and liabilities of CA$161.0m falling due after that. Offsetting these obligations, it had cash of CA$9.17m as well as receivables valued at CA$7.17m due within 12 months. So it has liabilities totalling CA$209.8m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of CA$152.8m, we think shareholders really should watch Roots's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Roots has a very low debt to EBITDA ratio of 1.1 so it is strange to see weak interest coverage, with last year's EBIT being only 2.1 times the interest expense. So one way or the other, it's clear the debt levels are not trivial. Importantly, Roots grew its EBIT by 85% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Roots can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Roots recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

We feel some trepidation about Roots's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its EBIT growth rate and conversion of EBIT to free cash flow were encouraging signs. Looking at all the angles mentioned above, it does seem to us that Roots is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Roots (2 are significant!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Roots, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ROOT

Roots

Designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives