- Canada

- /

- Specialty Stores

- /

- TSX:PET

Is Pet Valu’s Expanded Frozen Food Focus Reshaping the Investment Case for TSX:PET?

Reviewed by Sasha Jovanovic

- Earlier this month, Stifel Canada conducted a tour of Pet Valu Holdings' updated store design, which features an expanded frozen product section with up to six cooler doors at the front to boost shopper visibility.

- The focus on frozen pet food, an area less impacted by online competition, is designed to enhance in-store traffic and will be extended to 120 corporate locations by the end of the year.

- We'll examine how the rollout of prominent in-store frozen offerings could reshape Pet Valu's investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Pet Valu Holdings Investment Narrative Recap

To own Pet Valu Holdings as a shareholder, you likely need to believe the business can keep driving steady in-store sales growth despite heightened online competition and its Canada-only footprint. The rollout of expanded frozen food sections could provide a near-term boost by drawing more customers into stores, but it does not fundamentally shift the primary short-term catalysts (same-store sales growth) or the biggest risk, exposure to Canadian economic conditions, at this stage.

Among recent developments, the opening of Pet Valu’s new Calgary distribution center stands out, aligning with efforts to improve supply chain efficiency and meet growing store demands. While this project supports operational catalysts like network expansion and cost savings, the overall success still hinges on maintaining robust customer engagement through in-store enhancements like the frozen food push.

However, with Canada’s consumer spending trends remaining uneven, investors should be mindful that ...

Read the full narrative on Pet Valu Holdings (it's free!)

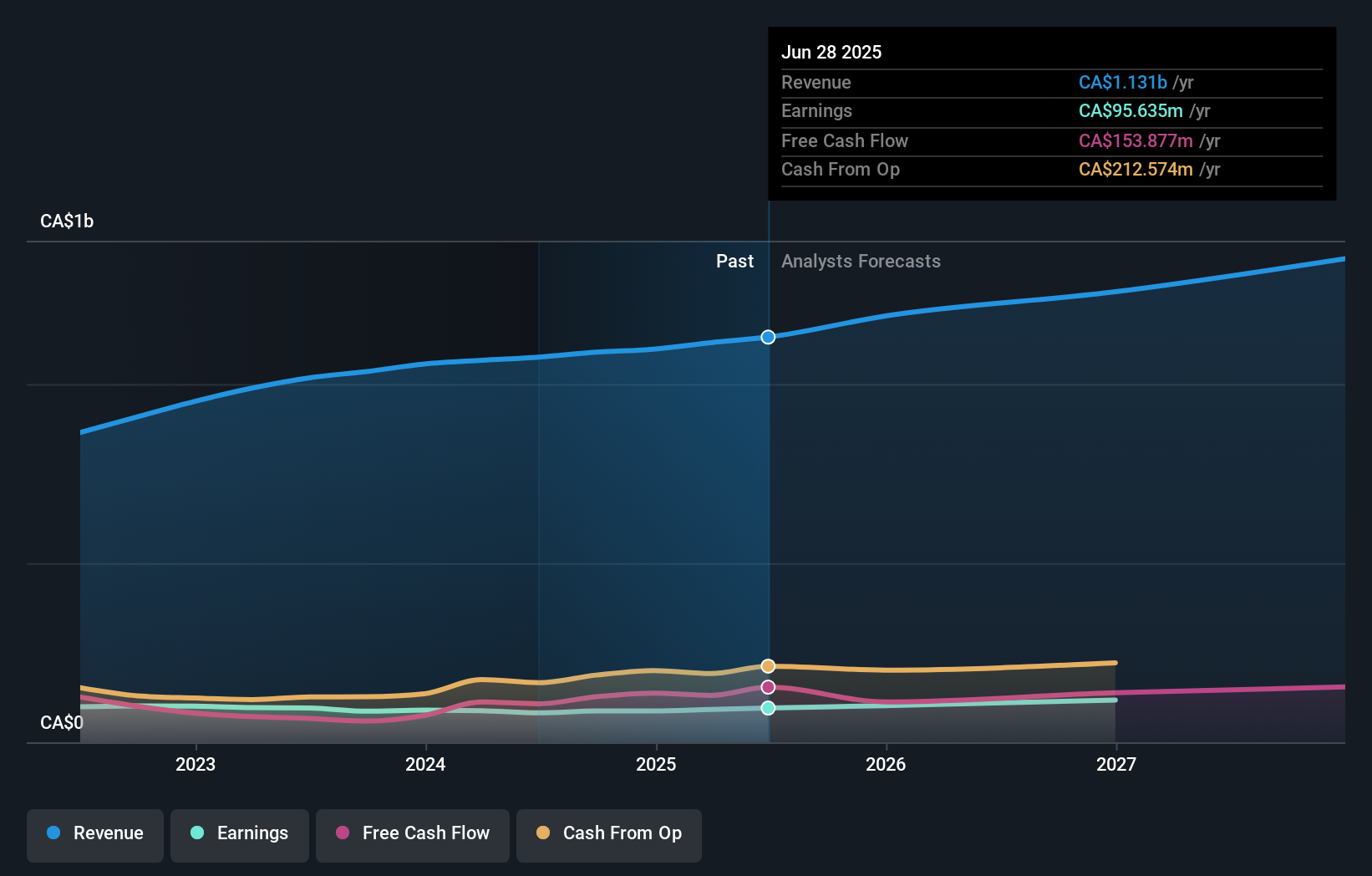

Pet Valu Holdings’ outlook anticipates CA$1.4 billion in revenue and CA$143.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.2% and a CA$47.5 million earnings increase from the current CA$95.6 million.

Uncover how Pet Valu Holdings' forecasts yield a CA$41.45 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Pet Valu’s fair value between CA$41.45 and CA$42.51, offering just two tightly grouped perspectives. Store-centric initiatives may help offset digital competition, but views on performance can vary widely, consider comparing different viewpoints on what drives value in specialty retail.

Explore 2 other fair value estimates on Pet Valu Holdings - why the stock might be worth just CA$41.45!

Build Your Own Pet Valu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pet Valu Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pet Valu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pet Valu Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PET

Pet Valu Holdings

Engages in the retail and wholesale of pet foods and pet-related supplies for dogs, cats, fish, birds, reptiles, and small animals in Canada.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives