- Canada

- /

- Oil and Gas

- /

- TSX:MER

TSX Stocks Estimated To Be Trading Below Intrinsic Value In September 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a period marked by elevated inflation and potential volatility, investors are keenly observing how these factors might influence stock valuations on the TSX. In this environment, identifying stocks trading below their intrinsic value can be a strategic move, offering opportunities for those looking to position themselves advantageously amidst fluctuating economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$11.37 | CA$20.70 | 45.1% |

| Versamet Royalties (TSXV:VMET) | CA$1.60 | CA$2.81 | 43.1% |

| TerraVest Industries (TSX:TVK) | CA$137.46 | CA$267.04 | 48.5% |

| Meren Energy (TSX:MER) | CA$1.76 | CA$3.05 | 42.4% |

| goeasy (TSX:GSY) | CA$209.38 | CA$377.93 | 44.6% |

| First Majestic Silver (TSX:AG) | CA$13.06 | CA$26.11 | 50% |

| Endeavour Mining (TSX:EDV) | CA$53.35 | CA$97.70 | 45.4% |

| Discovery Silver (TSX:DSV) | CA$4.62 | CA$8.18 | 43.5% |

| CareRx (TSX:CRRX) | CA$3.32 | CA$6.23 | 46.7% |

| BRP (TSX:DOO) | CA$89.17 | CA$162.05 | 45% |

Here we highlight a subset of our preferred stocks from the screener.

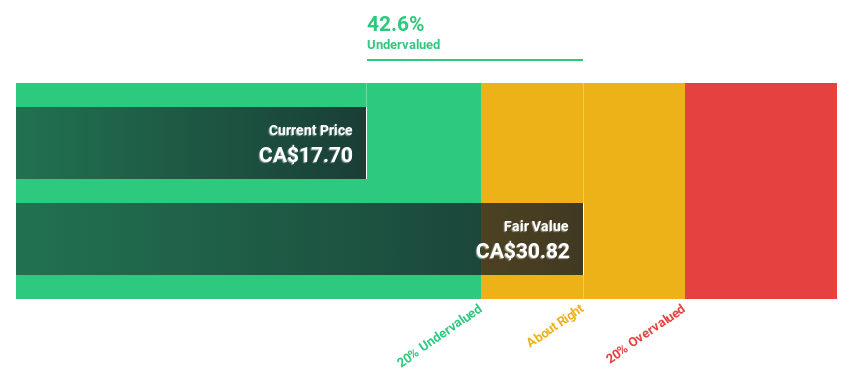

Groupe Dynamite (TSX:GRGD)

Overview: Groupe Dynamite Inc. designs, distributes, and sells women’s apparel under the Dynamite and Garage brand names in Canada and the United States, with a market cap of CA$4.45 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Groupe Dynamite Inc., so I am unable to summarize them.

Estimated Discount To Fair Value: 33%

Groupe Dynamite's recent earnings report shows strong sales growth, with second-quarter sales reaching CAD 326.43 million, up from CAD 239.1 million a year ago. The company is trading at CA$47.61, significantly below its estimated fair value of CA$71.02, suggesting it is undervalued based on cash flows. Forecasts indicate revenue and earnings growth rates surpassing the Canadian market averages, while a robust buyback program further enhances shareholder value by reducing share count and potentially increasing EPS over time.

- Our expertly prepared growth report on Groupe Dynamite implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Groupe Dynamite with our comprehensive financial health report here.

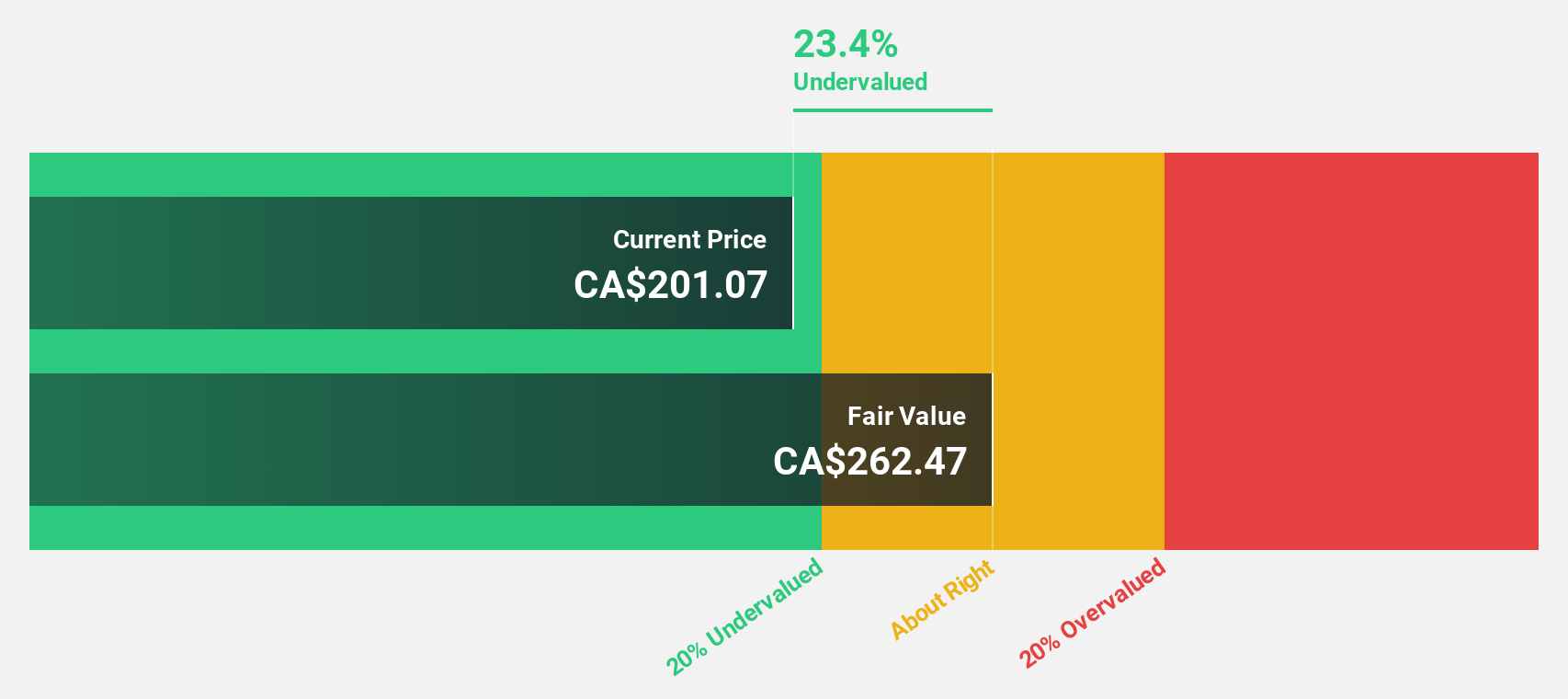

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada and has a market cap of CA$5.34 billion.

Operations: The company's revenue segment primarily consists of Supply Chain Management Software and Solutions, generating $514.67 million.

Estimated Discount To Fair Value: 31.8%

Kinaxis, trading at CA$186.58, is significantly undervalued based on cash flows with an estimated fair value of CA$273.56. Recent client wins like Shimadzu Corporation and PL Developments highlight the strength of its Maestro platform in supply chain management, enhancing future revenue prospects. Despite slower revenue growth forecasts compared to earnings, Kinaxis's earnings are expected to grow substantially at 39.2% annually over the next three years, outpacing Canadian market averages and indicating potential for increased profitability.

- Our growth report here indicates Kinaxis may be poised for an improving outlook.

- Take a closer look at Kinaxis' balance sheet health here in our report.

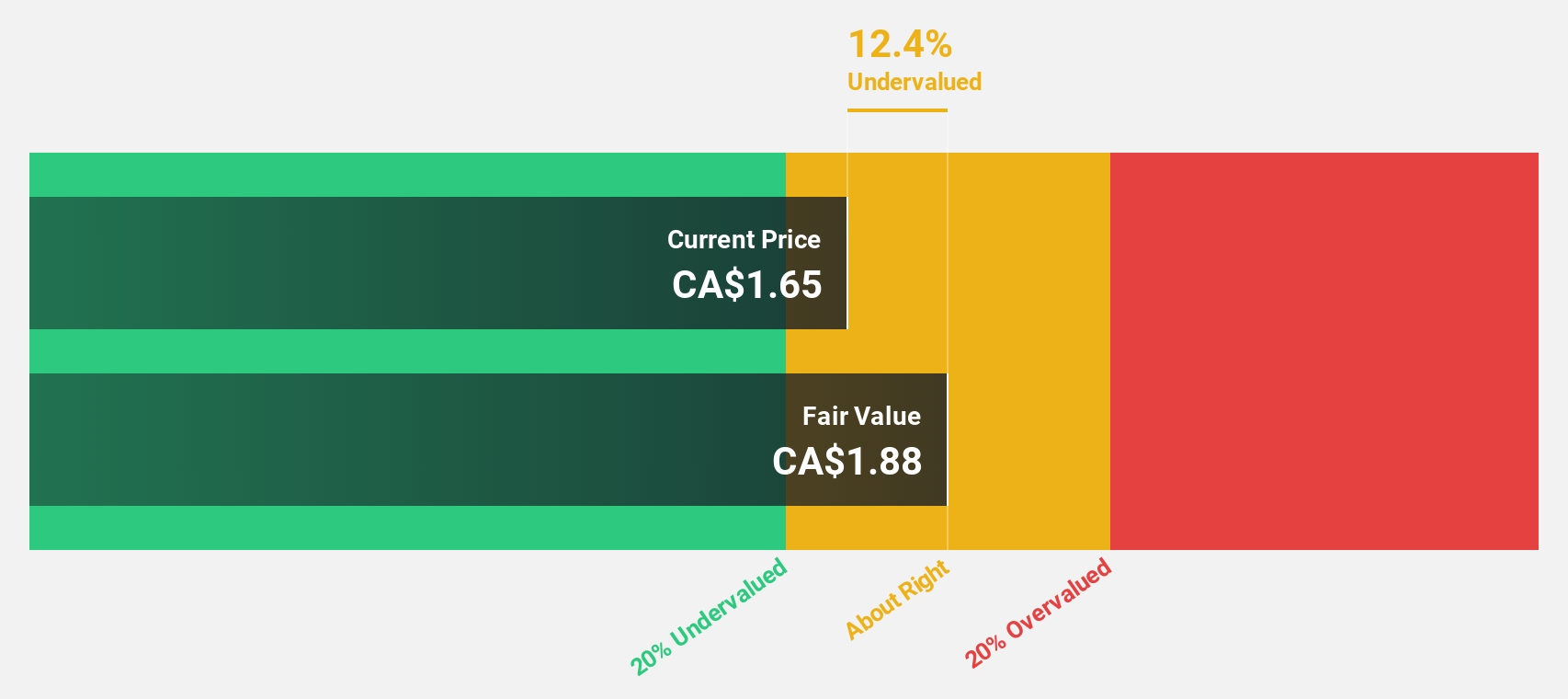

Meren Energy (TSX:MER)

Overview: Meren Energy Inc., along with its subsidiaries, is engaged in oil and gas exploration and production across Nigeria, Namibia, South Africa, and Equatorial Guinea, with a market cap of CA$1.17 billion.

Operations: Meren Energy Inc. generates revenue through its exploration and production activities in the oil and gas sectors across Nigeria, Namibia, South Africa, and Equatorial Guinea.

Estimated Discount To Fair Value: 42.4%

Meren Energy, trading at CA$1.76, is significantly undervalued with a fair value estimate of CA$3.05, reflecting its potential based on cash flows. Despite recent executive changes and a dividend not fully covered by earnings or free cash flow, the company reported strong earnings growth and revised production guidance upwards for 2025. While shareholders faced dilution last year, Meren's revenue is forecast to grow faster than the Canadian market at 22.4% annually.

- According our earnings growth report, there's an indication that Meren Energy might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Meren Energy.

Key Takeaways

- Discover the full array of 25 Undervalued TSX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MER

Meren Energy

Operates as an oil and gas exploration and production company in Nigeria, Namibia, South Africa, and Equatorial Guinea.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives