- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

February 2025's Stock Selections Possibly Priced Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate adjustments from central banks and competitive pressures in the tech sector, investors are keenly observing fluctuations across major indices. The recent volatility, fueled by geopolitical tensions and AI competition fears, underscores the importance of identifying stocks that may be trading below their estimated fair value. In such an environment, a good stock is often characterized by strong fundamentals and resilience to external shocks, making it potentially attractive for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (NasdaqGS:ONB) | US$24.45 | US$48.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.91 | 50% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.86 | CN¥41.63 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.14 | SEK165.53 | 49.8% |

| Solum (KOSE:A248070) | ₩18800.00 | ₩37257.19 | 49.5% |

| AbbVie (NYSE:ABBV) | US$192.97 | US$385.39 | 49.9% |

| Semiconductor Manufacturing International (SEHK:981) | HK$47.90 | HK$95.26 | 49.7% |

| Verra Mobility (NasdaqCM:VRRM) | US$25.88 | US$51.66 | 49.9% |

| Facephi Biometria (BME:FACE) | €2.24 | €4.46 | 49.7% |

| Sandfire Resources (ASX:SFR) | A$10.33 | A$20.47 | 49.5% |

We're going to check out a few of the best picks from our screener tool.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market capitalization of SGD15.04 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

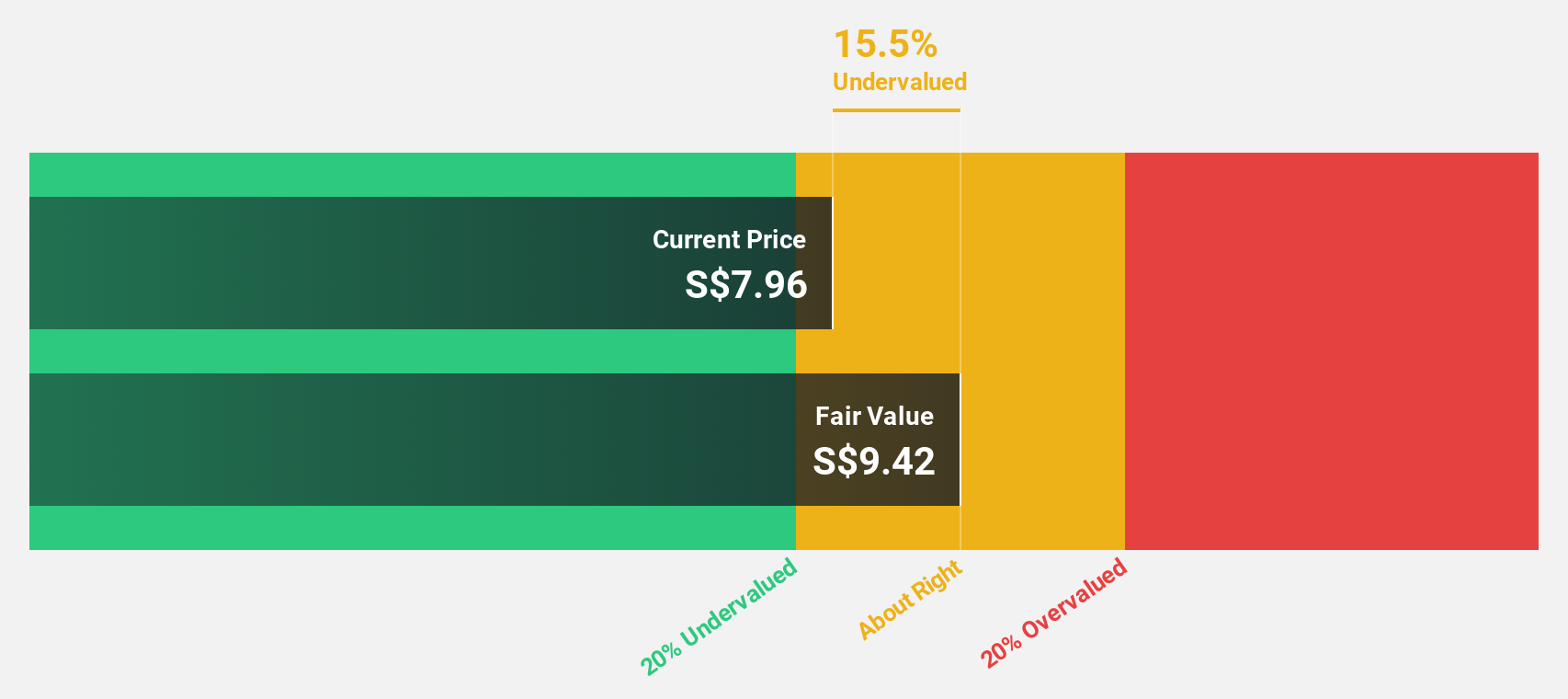

Estimated Discount To Fair Value: 39.6%

Singapore Technologies Engineering is trading at S$4.83, significantly below its estimated fair value of S$7.99, suggesting it may be undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow at 11.36% annually, outpacing the Singapore market's average growth rate of 11.2%. However, its debt coverage by operating cash flow is weak and the dividend track record remains unstable despite recent affirmations of a third-quarter dividend payout.

- In light of our recent growth report, it seems possible that Singapore Technologies Engineering's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

Innodisk (TPEX:5289)

Overview: Innodisk Corporation researches, develops, manufactures, and sells industrial embedded storage devices across various global markets, with a market cap of NT$20.60 billion.

Operations: The company's revenue from the research and development of various industrial memory storage devices is NT$8.82 billion.

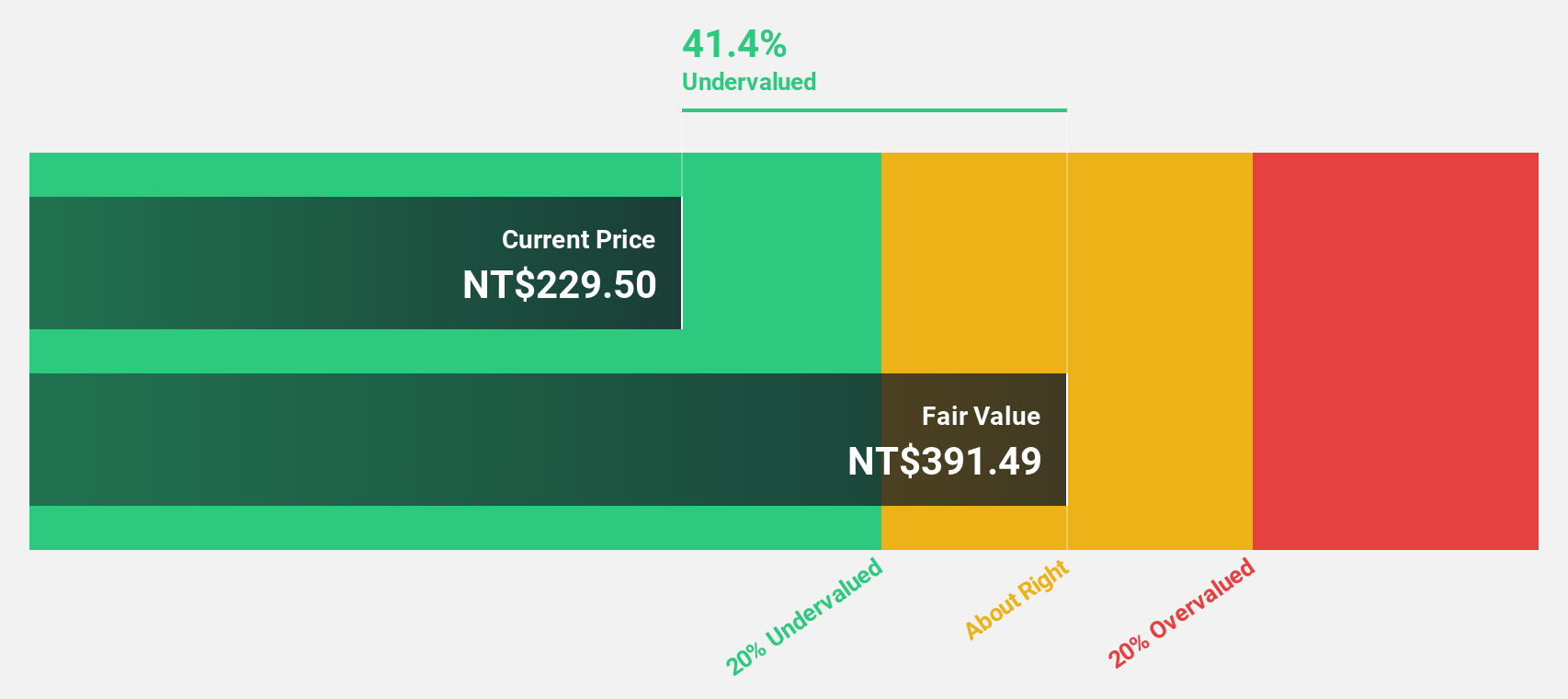

Estimated Discount To Fair Value: 47.9%

Innodisk is trading significantly below its estimated fair value of NT$432.59, presenting a potential undervaluation opportunity based on discounted cash flow analysis. Despite recent earnings declines, analysts forecast strong annual profit growth of 22.1%, surpassing the Taiwanese market average. However, the dividend yield of 4.43% is not well-supported by free cash flows, and non-cash earnings are notably high, which may affect perceived quality of earnings in the short term.

- Our growth report here indicates Innodisk may be poised for an improving outlook.

- Navigate through the intricacies of Innodisk with our comprehensive financial health report here.

Groupe Dynamite (TSX:GRGD)

Overview: Groupe Dynamite Inc. operates fashion retail stores in North America with a market cap of CA$1.74 billion.

Operations: The company generates CA$927.05 million in revenue from its apparel segment.

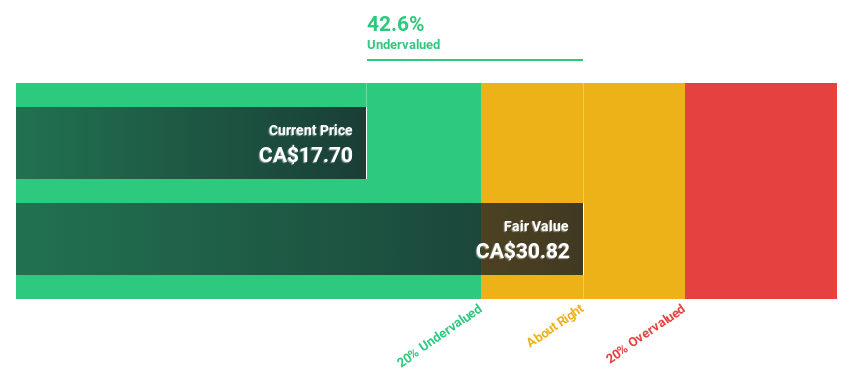

Estimated Discount To Fair Value: 45%

Groupe Dynamite is trading at CA$17.75, significantly below its estimated fair value of CA$32.3, suggesting a potential undervaluation based on discounted cash flow analysis. Although burdened by high debt levels, the company's earnings grew 66.5% last year and are forecast to increase by 16.6% annually, outpacing the Canadian market's growth rate of 16.1%. Analysts expect a stock price rise of over 50%, reflecting positive sentiment despite moderate revenue growth expectations.

- Our earnings growth report unveils the potential for significant increases in Groupe Dynamite's future results.

- Click here to discover the nuances of Groupe Dynamite with our detailed financial health report.

Summing It All Up

- Gain an insight into the universe of 921 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives