- Canada

- /

- Specialty Stores

- /

- TSX:GBT

Did Changing Sentiment Drive BMTC Group's (TSE:GBT) Share Price Down By 12%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the BMTC Group Inc. (TSE:GBT) share price slid 12% over twelve months. That falls noticeably short of the market return of around 0.7%. On the bright side, the stock is actually up 6.8% in the last three years. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

Check out our latest analysis for BMTC Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the BMTC Group share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth. It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

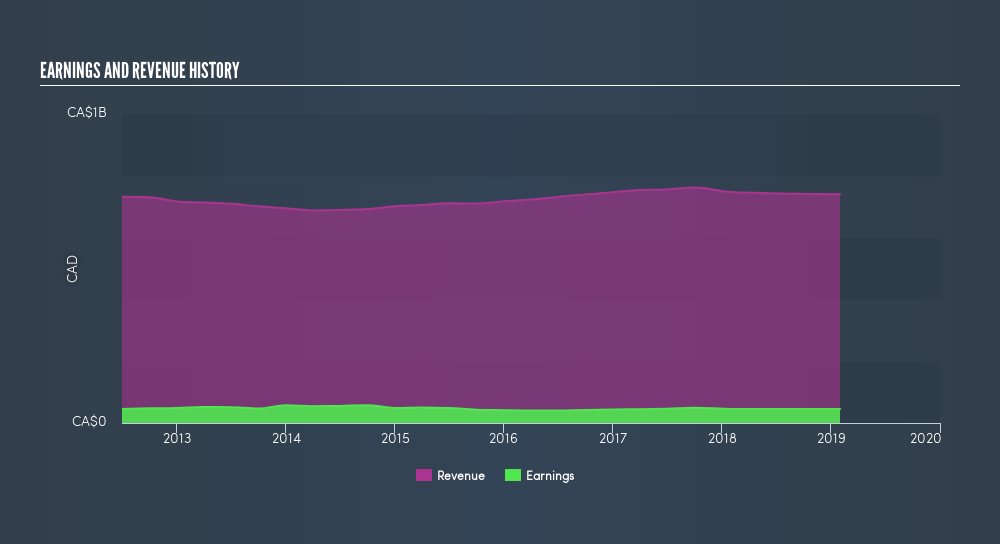

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for BMTC Group in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between BMTC Group's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for BMTC Group shareholders, and that cash payout explains why its total shareholder loss of 10%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 0.7% in the last year, BMTC Group shareholders lost 10% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of BMTC Group by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:GBT

BMTC Group

Manages and operates a retail network of furniture, household appliances, and electronic products in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives