Dollarama (TSX:DOL): Examining Valuation After Shares Move Above 200-Day Moving Average

Reviewed by Simply Wall St

Dollarama (TSX:DOL) has caught the market’s eye as its stock recently crossed above the two hundred day moving average. This technical milestone is sparking new discussions about the stock’s latest trend.

See our latest analysis for Dollarama.

Dollarama’s momentum has really picked up over the year, with a year-to-date share price return of 41% and a stellar 1-year total shareholder return of 36.19%. The latest move above its two hundred day moving average comes after steady gains and highlights growing optimism among investors, even as there has been no major headline event.

If you’re intrigued by what sparks lasting outperformance, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

This steady rally has left investors wondering whether Dollarama is still trading below its true value or if the company’s growth prospects are already reflected in the current share price. Is there a genuine buying opportunity, or has the market priced in future gains?

Most Popular Narrative: Fairly Valued

With Dollarama’s fair value set at CA$198.81 and the last close at CA$197.68, the current share price lines up closely with the narrative estimate. This suggests that consensus views the stock as roughly in line with fundamentals.

The company’s aggressive international expansion, including opening Dollarcity’s first store in Mexico and acquiring Australia’s largest discount retailer, unlocks new, large addressable markets. This positions Dollarama for multi-year top-line revenue growth through broader geographic and demographic exposure.

Curious about what numbers make this stock’s premium seem worth it? Find out which future earnings leaps, shrinking margins, and bold expansion forecasts are shaping this fair value. The details behind this consensus might surprise you.

Result: Fair Value of $198.81 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from rapid overseas expansion and potential margin pressure from higher international costs could present challenges to the current fair value outlook.

Find out about the key risks to this Dollarama narrative.

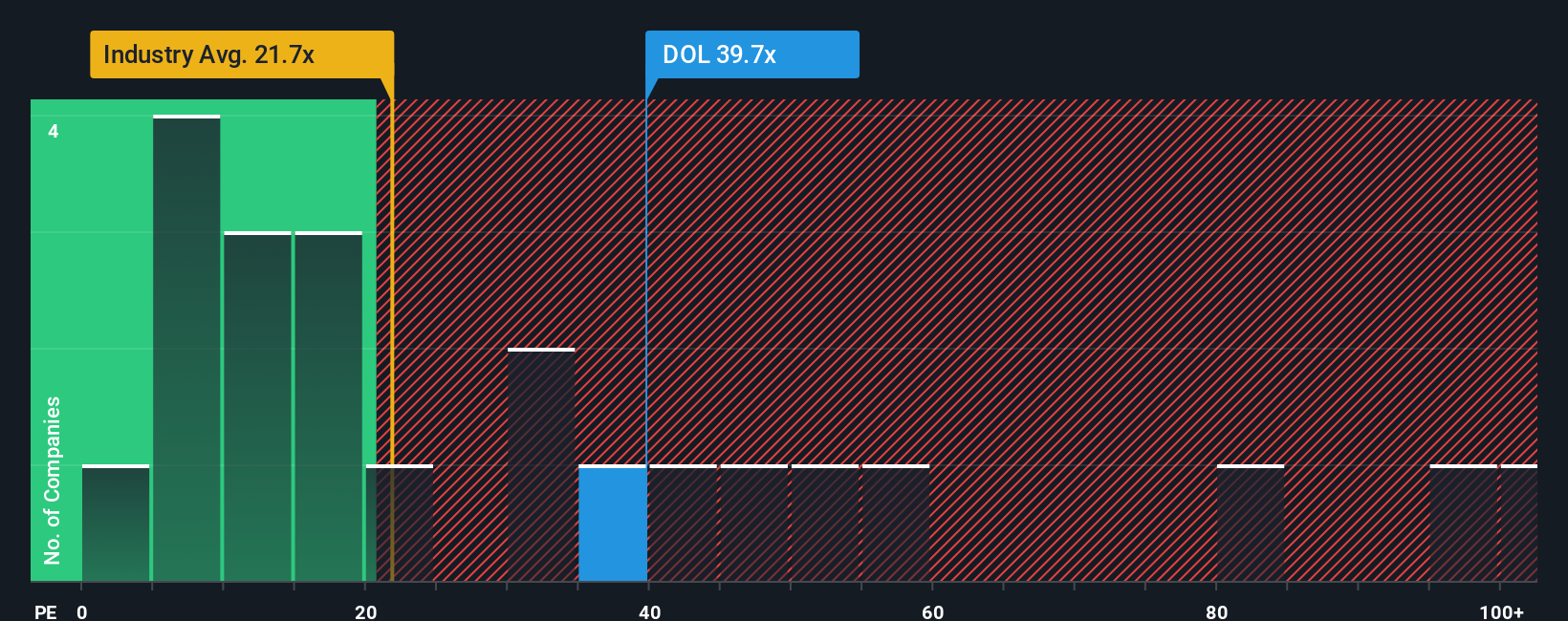

Another View: What Multiples Reveal

Taking a look beyond fair value estimates, Dollarama’s price-to-earnings ratio sits at 42.9x. This level is not just above its industry peers (19x to 20.2x), but also well above its own fair ratio of 29.4x. This sharp premium suggests investors expect exceptional future growth and stability. But what happens if that optimism fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollarama Narrative

If you see something different in the data, or want to dive in yourself, you can build your own Dollarama story in just minutes, your way. Do it your way

A great starting point for your Dollarama research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your potential to just one company when there is a world of top-rated opportunities waiting for you? Use the Simply Wall Street Screener and seize your chance to spot tomorrow’s winners before others catch on.

- Earn from tomorrow’s technological leap by checking out these 26 quantum computing stocks, where innovators are unlocking new possibilities with quantum breakthroughs.

- Strengthen your portfolio with steady income by tapping into these 16 dividend stocks with yields > 3%, focused on stocks offering attractive yields above 3%.

- Get ahead of market shifts by investigating these 26 AI penny stocks, featuring companies at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives