Will Dividend Growth and Brand Revitalization Shift Canadian Tire's (TSX:CTC.A) Long-Term Trajectory?

Reviewed by Sasha Jovanovic

- Canadian Tire Corporation recently reported third-quarter and nine-month earnings, revealing sales growth to C$3.72 billion for the quarter but a decline in net income to C$169.1 million compared to the prior year.

- Despite the profit drop, the company announced its 16th consecutive annual dividend increase, continued share repurchases, and the re-launch of the Hudson's Bay Stripes brand as part of its wider growth initiatives.

- We'll examine how the ongoing commitment to dividend growth and brand revitalization may influence Canadian Tire's overall investment case.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Canadian Tire Corporation Investment Narrative Recap

To own Canadian Tire Corporation stock, you need to have confidence in its ability to grow and protect margins, despite softening net income and sector competition. Recent third-quarter results did not materially change the near-term catalyst of digital and omnichannel execution, but highlighted the pressure on profitability as one of the most immediate business risks.

Of the recent announcements, the ongoing share buyback, now totaling over 2.22 million shares repurchased since March, most directly connects to the company’s approach to shareholder returns and capital management. This supports the company’s commitment to returning capital to investors but does not directly offset the earnings pressure seen this quarter.

Yet despite consistent sales growth, what investors should also be alert to is the risk that operating cost pressures remain elevated and...

Read the full narrative on Canadian Tire Corporation (it's free!)

Canadian Tire Corporation's narrative projects CA$16.9 billion revenue and CA$732.2 million earnings by 2028. This requires a 0.4% yearly revenue decline and a CA$83.4 million decrease in earnings from CA$815.6 million today.

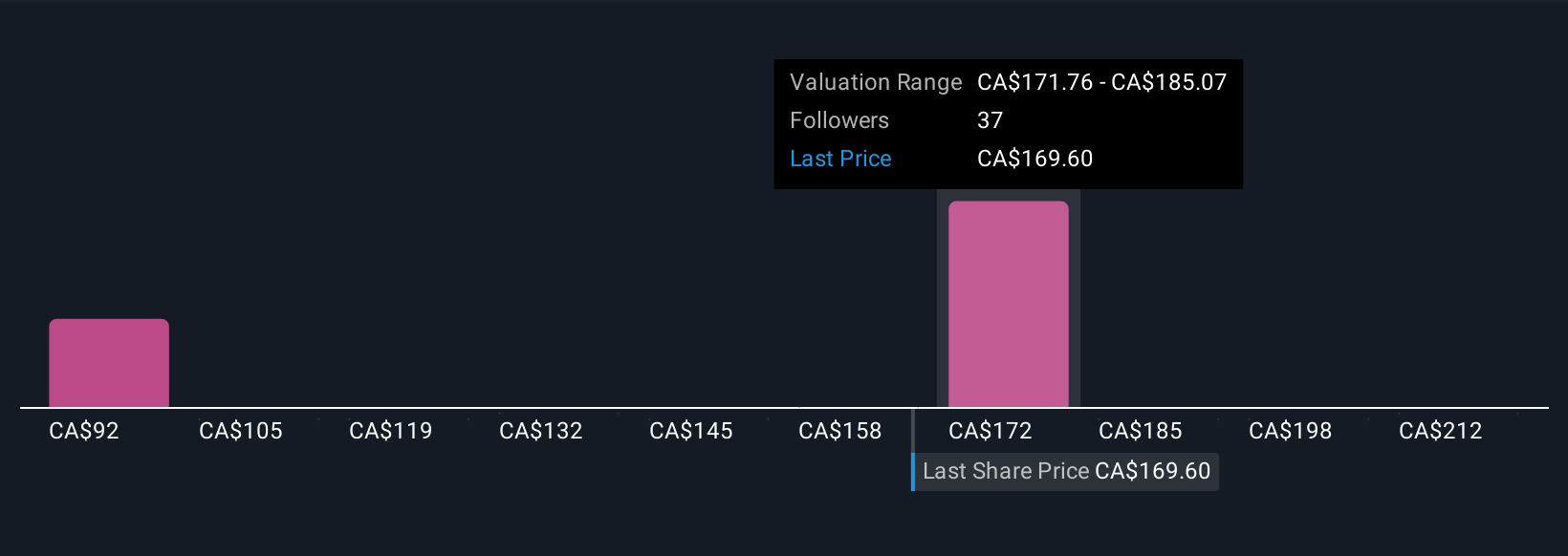

Uncover how Canadian Tire Corporation's forecasts yield a CA$174.91 fair value, in line with its current price.

Exploring Other Perspectives

Seven Simply Wall St Community contributors offered fair value estimates for Canadian Tire ranging from CA$126 to CA$225 per share. While opinions vary widely, caution remains given the ongoing margin pressures and cost risks facing the business, explore the full variety of perspectives to get a balanced view.

Explore 7 other fair value estimates on Canadian Tire Corporation - why the stock might be worth as much as 31% more than the current price!

Build Your Own Canadian Tire Corporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Tire Corporation research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian Tire Corporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Tire Corporation's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives