Canadian Tire (TSX:CTC.A) Valuation in Focus After Q3 Earnings, Dividend Hike, and Brand Launch Update

Reviewed by Simply Wall St

Canadian Tire Corporation (TSX:CTC.A) just released its third quarter earnings, highlighting slight sales growth but a dip in net income compared to last year. The company also increased its annual dividend for the 16th consecutive year.

See our latest analysis for Canadian Tire Corporation.

Canadian Tire’s recent moves, including a minor revenue uptick, higher dividend, and branded product launch, have kept investors engaged, with the share price up 11.8% year-to-date. Notably, total shareholder return over the past year stands at 17.8%, showing steady momentum as the company balances new initiatives with ongoing buybacks.

If you’re curious where the next wave of high-potential companies with strong insider signals might emerge, it’s a great time to discover fast growing stocks with high insider ownership

With the share price posting solid gains this year, investors may wonder if Canadian Tire’s current valuation offers untapped upside or if the market has already accounted for the company’s future growth potential. Is there room to buy in?

Most Popular Narrative: 1.8% Undervalued

With Canadian Tire Corporation closing at CA$171.80 and the narrative fair value at CA$174.91, the valuation gap remains narrow. This keeps investors on alert for any changes in cost clarity or execution that might shift this balance.

Ongoing investments in store refreshes, loyalty programs, and supply chain optimization are expected to drive cost efficiencies over time. However, the current and projected increase in fixed and variable costs, combined with wage and utility inflation, could pressure net margins and delay anticipated operating leverage improvements.

What if the real secret behind this valuation is the tension between shrinking profit margins and ambitious growth investments? The most-followed narrative is betting on a future shaped by declining earnings and a tougher retail landscape. Want to find out which bold financial assumptions unlock this target price? Dive in and see what is fueling the calculations behind Canadian Tire’s next move.

Result: Fair Value of $174.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong customer loyalty from the expanding Triangle Rewards program and rapid digital upgrades could challenge expectations. These factors could drive higher revenue than analysts currently anticipate.

Find out about the key risks to this Canadian Tire Corporation narrative.

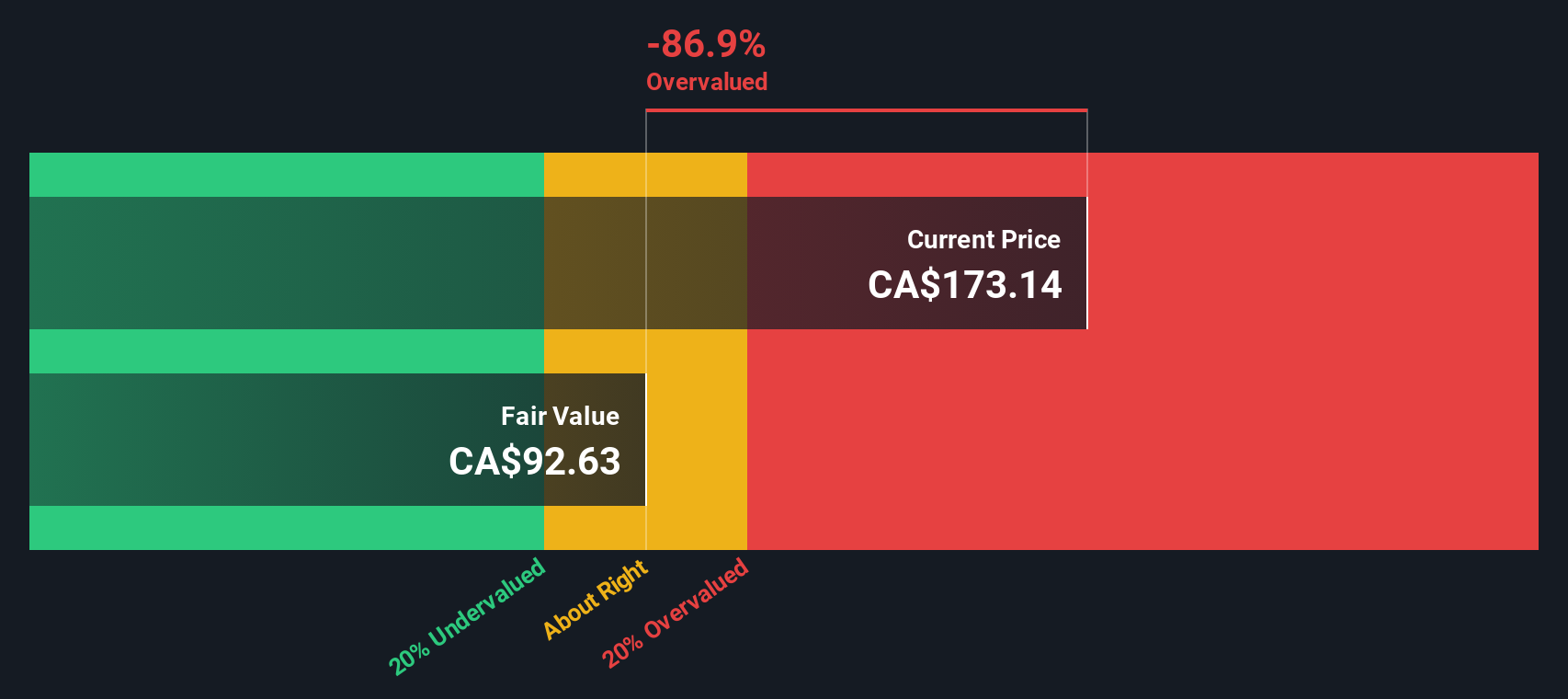

Another View: Discounted Cash Flow Raises Questions

Looking through the lens of our SWS DCF model, a distinctly different picture emerges. This method estimates Canadian Tire’s fair value at CA$126.44, which is well below its current share price, implying the stock could be overvalued based on future cash flows. Which valuation approach tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canadian Tire Corporation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canadian Tire Corporation Narrative

If you have a different perspective or want to chart your own course, use our tools to build your personal view in just a few minutes: Do it your way.

A great starting point for your Canadian Tire Corporation research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now and unlock your next opportunity. These fast-moving markets do not wait. Use these handpicked routes to spot winning trends before the crowd.

- Tap into next-generation breakthroughs by evaluating these 25 AI penny stocks poised to reshape industries with artificial intelligence advancements.

- Secure consistent income streams by reviewing these 16 dividend stocks with yields > 3% offering above-average yields and the potential for stronger portfolio stability.

- Gain early access to growth potential with these 3575 penny stocks with strong financials that could outperform as overlooked companies make their mark.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives