- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

Did Anticipation for New Stores and Digital Launches Just Shift Aritzia's (TSX:ATZ) Investment Narrative?

Reviewed by Sasha Jovanovic

- CIBC Capital Markets recently reiterated its positive outlook on Aritzia Inc. ahead of the company’s fiscal Q2 results, highlighting expectations for strong sales momentum fueled by new US stores and upcoming digital launches.

- Market optimism is further supported by anticipated benefits from seasonal factors and the planned openings of Aritzia’s new app and Flat Iron NYC flagship location.

- Let's explore how anticipation around the upcoming flagship store and app launch could alter Aritzia's medium-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Aritzia Investment Narrative Recap

To be an Aritzia shareholder today, you have to have confidence in the company's ability to sustain rapid US expansion while managing the risks of increased costs and execution with each new store. CIBC Capital Markets’ renewed positive outlook adds a sense of optimism, but this doesn’t materially alter the most important short-term catalyst: successful US store openings. The principal risk remains whether fresh investment in new locations can reliably convert into profitable and lasting sales growth.

The upcoming launch of Aritzia’s mobile app stands out as the company’s most relevant announcement. This digital move is expected to support anticipated sales momentum by improving customer engagement and supporting the retailer’s aim to diversify growth beyond physical boutiques. With the new app launch coinciding with key flagship store openings, Aritzia is leaning on digital and in-person channels to drive the next phase of revenue growth.

However, even with new openings and product launches, investors should be alert to the risk that...

Read the full narrative on Aritzia (it's free!)

Aritzia's narrative projects CA$4.3 billion revenue and CA$534.0 million earnings by 2028. This requires 13.8% yearly revenue growth and a CA$299.7 million earnings increase from the current earnings of CA$234.3 million.

Uncover how Aritzia's forecasts yield a CA$93.36 fair value, a 13% upside to its current price.

Exploring Other Perspectives

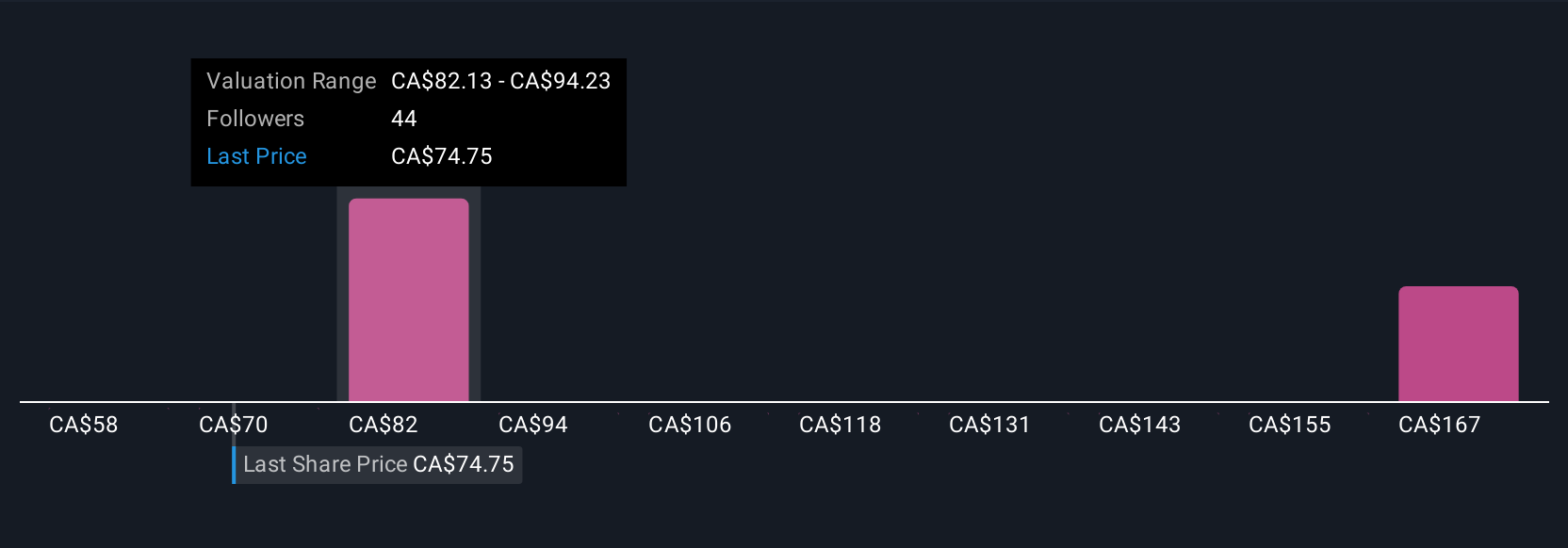

Simply Wall St Community members published 8 fair value estimates for Aritzia stock, spanning CA$57.92 to CA$172.98. While US expansion is a catalyst for higher sales, these diverse views underscore how outcomes for the business can be seen very differently by market participants, consider several perspectives before drawing your own conclusions.

Explore 8 other fair value estimates on Aritzia - why the stock might be worth over 2x more than the current price!

Build Your Own Aritzia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aritzia research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aritzia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aritzia's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with high growth potential.

Market Insights

Community Narratives