- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

3 TSX Stocks Estimated To Be Up To 49.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the Canadian market navigates through potential rate cuts by the Bank of Canada and the Fed, investors are keeping a close eye on how these monetary policy shifts might influence economic stabilization and stock valuations. Amidst this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on market volatility and potential pullbacks; such stocks may offer opportunities for growth as they are estimated to be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$4.93 | CA$9.83 | 49.9% |

| Meren Energy (TSX:MER) | CA$1.84 | CA$3.03 | 39.3% |

| Magellan Aerospace (TSX:MAL) | CA$16.69 | CA$28.40 | 41.2% |

| Haivision Systems (TSX:HAI) | CA$5.08 | CA$9.41 | 46% |

| goeasy (TSX:GSY) | CA$204.44 | CA$377.89 | 45.9% |

| First Majestic Silver (TSX:AG) | CA$13.71 | CA$25.84 | 46.9% |

| Discovery Silver (TSX:DSV) | CA$4.55 | CA$8.07 | 43.6% |

| CareRx (TSX:CRRX) | CA$3.50 | CA$6.35 | 44.9% |

| BRP (TSX:DOO) | CA$87.45 | CA$143.69 | 39.1% |

| Aritzia (TSX:ATZ) | CA$88.90 | CA$175.67 | 49.4% |

Let's uncover some gems from our specialized screener.

Aritzia (TSX:ATZ)

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market cap of CA$9.96 billion.

Operations: The company generates revenue primarily from its apparel segment, which accounted for CA$2.90 billion.

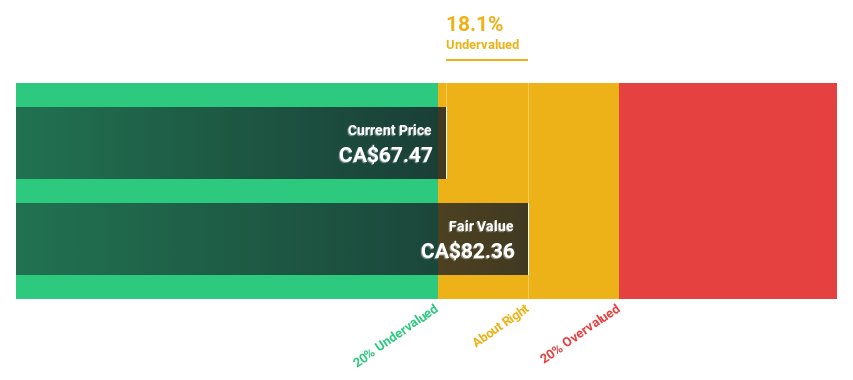

Estimated Discount To Fair Value: 49.4%

Aritzia's recent earnings report reveals a substantial increase in net income to CA$42.39 million, up from CA$15.83 million the previous year, alongside sales growth to CA$663.32 million. Trading at 49.4% below its estimated fair value of CA$175.67, Aritzia is notably undervalued based on cash flows and discounted cash flow analysis. With expected annual profit growth of 29.6%, surpassing market averages, Aritzia presents a compelling opportunity for investors focused on undervalued stocks in Canada.

- Our comprehensive growth report raises the possibility that Aritzia is poised for substantial financial growth.

- Click here to discover the nuances of Aritzia with our detailed financial health report.

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$694.29 million.

Operations: The company generates revenue from its Healthcare Software segment, amounting to CA$82.63 million.

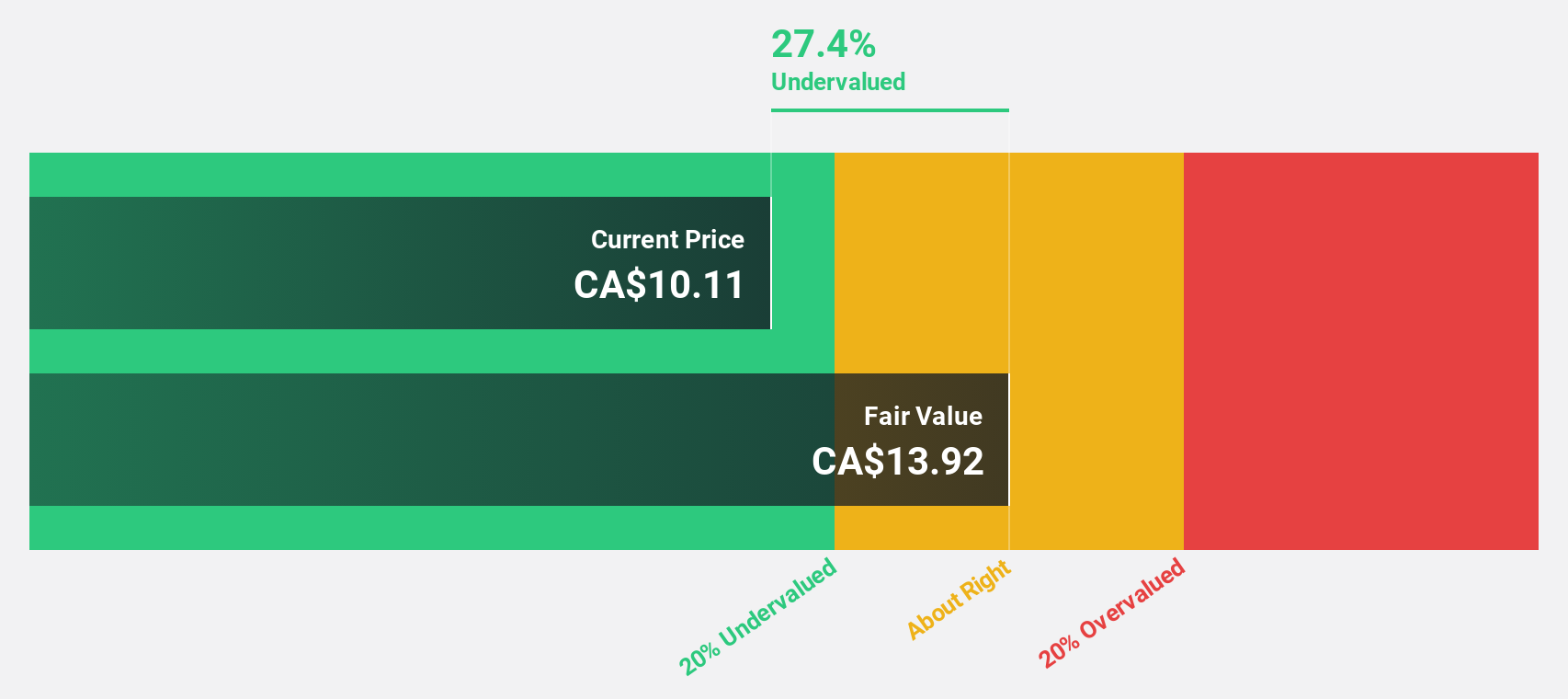

Estimated Discount To Fair Value: 38.7%

Vitalhub's earnings are forecast to grow significantly at 54.8% annually, outperforming the Canadian market. Despite recent shareholder dilution through a CA$65 million equity offering, the stock trades at CA$11.71, well below its estimated fair value of CA$19.1. Recent financial results show improved revenue and net income compared to last year, highlighting potential undervaluation based on cash flows despite significant insider selling and changes in auditing firms recently announced by the company.

- The analysis detailed in our Vitalhub growth report hints at robust future financial performance.

- Navigate through the intricacies of Vitalhub with our comprehensive financial health report here.

WELL Health Technologies (TSX:WELL)

Overview: WELL Health Technologies Corp. is a digital healthcare company focused on practitioners, operating in Canada, the United States, and internationally with a market cap of CA$1.19 billion.

Operations: WELL Health Technologies Corp. generates revenue from various segments, including CA$80.89 million from SaaS and Technology Services, CA$168.94 million from Specialized-provider Staffing, CA$229.16 million from Canadian Patient Services - Primary, CA$113.10 million from WELL Health USA Patient Services - Primary WISP, CA$152.50 million from Canadian Patient Services - Specialized Myhealth, and CA$241.55 million from WELL Health USA Patient Services - Specialized CRH Medical.

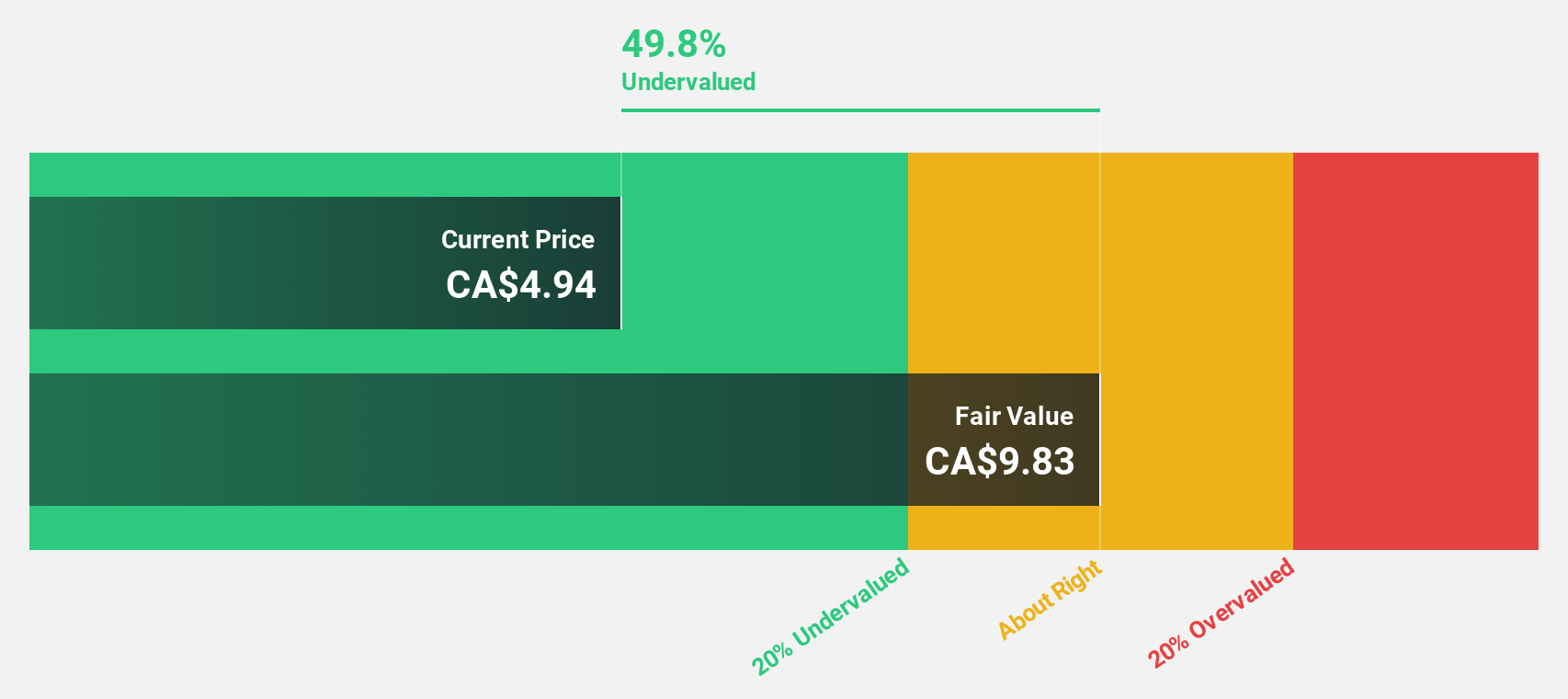

Estimated Discount To Fair Value: 49.9%

WELL Health Technologies, trading at CA$4.93, is considered undervalued based on cash flows with an estimated fair value of CA$9.83. Despite significant insider selling and a decline in net income to CA$12.15 million for Q2 2025 from the previous year, WELL's revenue grew to CA$356.67 million. Analysts forecast profitability within three years, supported by robust revenue growth projections and strategic expansions in primary care capacity across Canada.

- According our earnings growth report, there's an indication that WELL Health Technologies might be ready to expand.

- Get an in-depth perspective on WELL Health Technologies' balance sheet by reading our health report here.

Seize The Opportunity

- Click here to access our complete index of 27 Undervalued TSX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives