- Canada

- /

- Industrial REITs

- /

- TSX:NXR.UN

Did Nexus Real Estate Investment Trust's (CVE:NXR.UN) Share Price Deserve to Gain 12%?

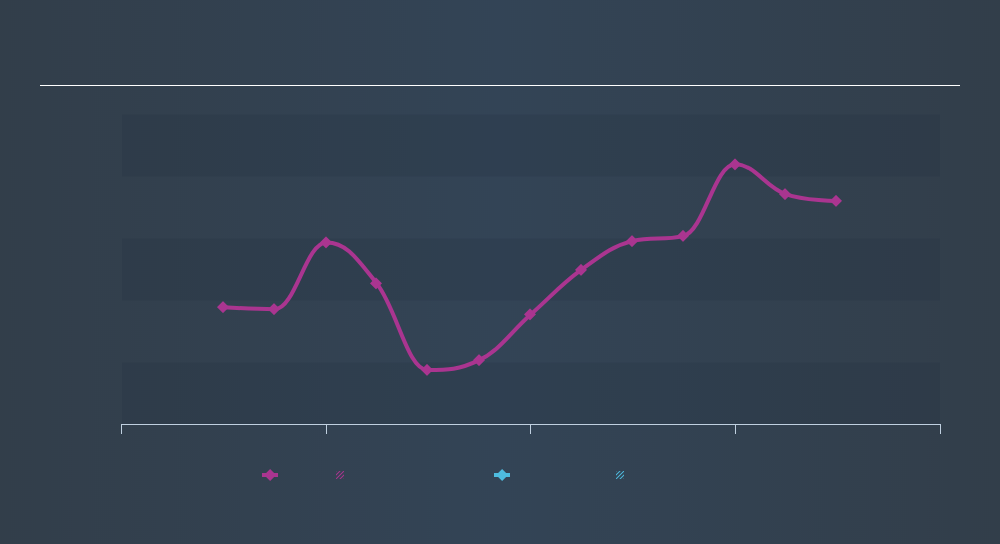

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Nexus Real Estate Investment Trust (CVE:NXR.UN), which is up 12%, over three years, soundly beating the market return of 6.5% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 7.3%, including dividends.

View our latest analysis for Nexus Real Estate Investment Trust

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Nexus Real Estate Investment Trust was able to grow its EPS at 24% per year over three years, sending the share price higher. The average annual share price increase of 3.8% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.47.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Nexus Real Estate Investment Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Nexus Real Estate Investment Trust the TSR over the last 3 years was 43%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Nexus Real Estate Investment Trust has rewarded shareholders with a total shareholder return of 7.3% in the last twelve months. Of course, that includes the dividend. However, that falls short of the 9.1% TSR per annum it has made for shareholders, each year, over five years. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:NXR.UN

Nexus Industrial REIT

A growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties.

Established dividend payer moderate.

Market Insights

Community Narratives