We Ran A Stock Scan For Earnings Growth And Canadian Net Real Estate Investment Trust (CVE:NET.UN) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Canadian Net Real Estate Investment Trust (CVE:NET.UN), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our analysis indicates that NET.UN is potentially undervalued!

How Quickly Is Canadian Net Real Estate Investment Trust Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Canadian Net Real Estate Investment Trust has achieved impressive annual EPS growth of 59%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Canadian Net Real Estate Investment Trust's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Canadian Net Real Estate Investment Trust is growing revenues, and EBIT margins improved by 4.9 percentage points to 76%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

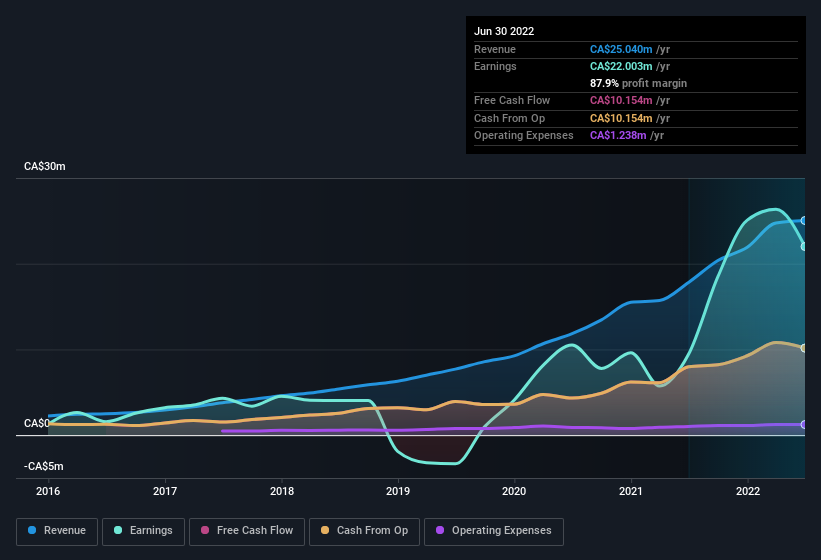

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Canadian Net Real Estate Investment Trust's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Canadian Net Real Estate Investment Trust Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Canadian Net Real Estate Investment Trust insiders refrain from selling stock during the year, but they also spent CA$110k buying it. This is a good look for the company as it paints an optimistic picture for the future. It is also worth noting that it was Independent Trustee Francois-Olivier Laplante who made the biggest single purchase, worth CA$27k, paying CA$6.54 per share.

On top of the insider buying, it's good to see that Canadian Net Real Estate Investment Trust insiders have a valuable investment in the business. As a matter of fact, their holding is valued at CA$19m. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 14% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Canadian Net Real Estate Investment Trust's CEO, Jason Parravano, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Canadian Net Real Estate Investment Trust with market caps under CA$267m is about CA$240k.

Canadian Net Real Estate Investment Trust offered total compensation worth CA$182k to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Canadian Net Real Estate Investment Trust To Your Watchlist?

Canadian Net Real Estate Investment Trust's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Canadian Net Real Estate Investment Trust belongs near the top of your watchlist. Before you take the next step you should know about the 4 warning signs for Canadian Net Real Estate Investment Trust (1 is concerning!) that we have uncovered.

The good news is that Canadian Net Real Estate Investment Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NET.UN

Canadian Net Real Estate Investment Trust

Canadian Net is an active Trust operating in the Canadian commercial real estate market.

6 star dividend payer with solid track record.

Market Insights

Community Narratives