- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

How Investors May Respond To Primaris REIT (TSX:PMZ.UN) Equity Raise and Distribution Affirmation Amid Expansion Plans

Reviewed by Sasha Jovanovic

- Primaris Real Estate Investment Trust recently completed a follow-on equity offering, raising CAD 147.5 million by issuing 10,000,000 common units at CAD 14.75 per unit, and affirmed a monthly distribution of CAD 0.0717 per unit for October 2025.

- This equity raise affects the company's capital structure at a time when it is also moving forward with significant debt financing and an acquisition plan.

- We'll look at how the recent equity offering, combined with new debt financing, shapes the company's investment narrative and future priorities.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Primaris Real Estate Investment Trust's Investment Narrative?

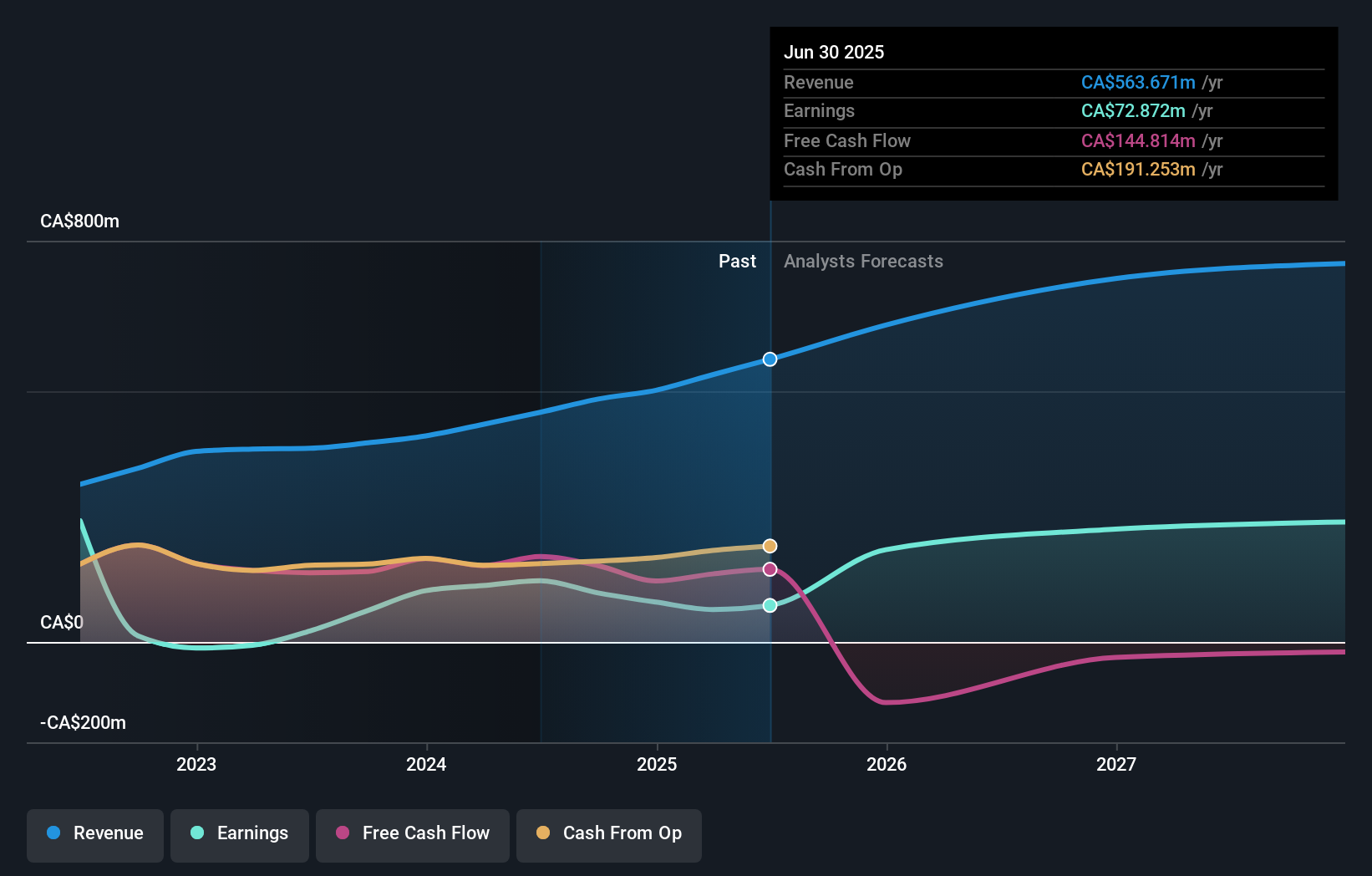

To be a shareholder in Primaris Real Estate Investment Trust, you need to back a story centered on long-term earnings growth, income stability, and disciplined capital management. The latest CAD 147.5 million equity raise and CAD 250 million debt placement signal a shift in capitalization that could be pivotal for funding upcoming acquisitions and green initiatives. On one hand, the Trust maintains its monthly distribution, which reassures income-focused investors in the short term. On the other, increased leverage combined with further equity dilution could heighten sensitivity to interest rate moves and put pressure on near-term profitability metrics, especially with the stock already trading at a premium to peers. The material impact of these combined moves lies in how effectively management can deploy new capital amid evolving market dynamics, with the upcoming earnings release likely to clarify shifting catalysts and risks for shareholders. Yet despite those recurring distributions, rising leverage may introduce new risk factors investors should be aware of.

Primaris Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Primaris Real Estate Investment Trust - why the stock might be worth just CA$18.16!

Build Your Own Primaris Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primaris Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Primaris Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primaris Real Estate Investment Trust's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in enclosed shopping centres in Canadian markets.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives