Exploring Undervalued Small Caps In Global With Insider Actions

Reviewed by Simply Wall St

Amid a backdrop of record highs in major U.S. stock indexes and robust job growth, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown notable performance gains, reflecting investor optimism in the small-cap segment. As global markets navigate through economic indicators such as resilient job creation and fluctuating manufacturing activity, exploring stocks that are perceived to be undervalued with significant insider actions can offer intriguing opportunities for investors seeking potential value plays in this dynamic environment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Daiwa House Logistics Trust | 11.4x | 6.9x | 27.65% | ★★★★★☆ |

| A.G. BARR | 19.1x | 1.8x | 47.41% | ★★★★☆☆ |

| Nexus Industrial REIT | 7.1x | 3.2x | 19.38% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 45.61% | ★★★★☆☆ |

| Absolent Air Care Group | 25.3x | 2.0x | 45.12% | ★★★☆☆☆ |

| Westshore Terminals Investment | 15.3x | 4.2x | 34.64% | ★★★☆☆☆ |

| CVS Group | 45.2x | 1.3x | 38.43% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.8x | 1.9x | 11.68% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.7x | 0.7x | 9.92% | ★★★☆☆☆ |

| John Mattson Fastighetsföretagen | 8.7x | 7.5x | -120.10% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sinofert Holdings is a company engaged in the production and distribution of fertilizers, with a market cap of approximately CN¥9.32 billion.

Operations: Sinofert Holdings generates revenue primarily from its Basic Business and Growth Business segments, with the latter contributing significantly to overall income. The company's cost of goods sold (COGS) consistently constitutes a major portion of its expenses, impacting gross profit margins. Notably, the gross profit margin has shown an upward trend, reaching 11.76% by the end of 2024.

PE: 8.4x

Sinofert Holdings, a smaller player in the industry, has caught attention with its recent strategic moves and financial activities. The announcement of a special dividend of HK$0.0246 per share reflects potential shareholder value enhancement, while insider confidence is evident through recent share purchases by key figures. The company is focusing on expanding its carbon-one chemical product line with a new formamide project valued at RMB 15 million. Despite relying on external borrowing for funding, earnings are projected to grow by 14.7% annually, suggesting potential for future growth amidst these developments.

- Dive into the specifics of Sinofert Holdings here with our thorough valuation report.

Understand Sinofert Holdings' track record by examining our Past report.

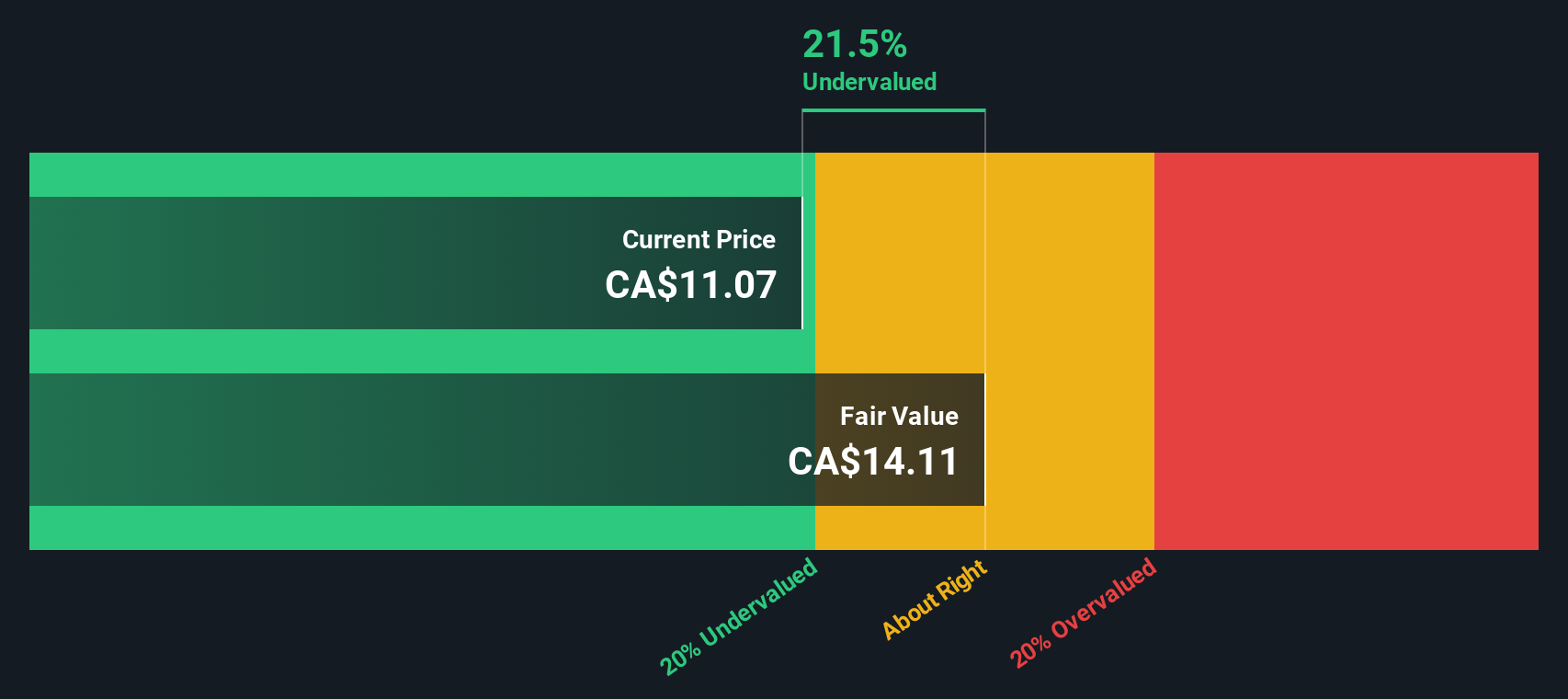

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the industrial chemicals sector, focusing on electrochemicals and sulphur and water chemicals, with a market cap of CA$1.06 billion.

Operations: Chemtrade Logistics Income Fund generates revenue primarily from its Electrochemicals segment, contributing CA$764.36 million, and its Sulphur and Water Chemicals segment, which contributes CA$1.08 billion. The company has seen fluctuations in its gross profit margin, reaching 22.77% most recently. Operating expenses include significant general and administrative costs that have varied across periods but were noted at CA$147.17 million in the latest quarter analyzed.

PE: 9.5x

Chemtrade Logistics Income Fund, a smaller player in its industry, has seen insider confidence with share purchases from April to June 2025. The company reported Q1 2025 sales of C$466.32 million, up from C$418.23 million the previous year, and net income rose to C$49.07 million. Despite a high debt level and declining profit margins now at 7.3%, Chemtrade's consistent cash dividends of C$0.0575 per unit reflect stability amidst growth prospects of 5.53% annually in earnings forecasted ahead.

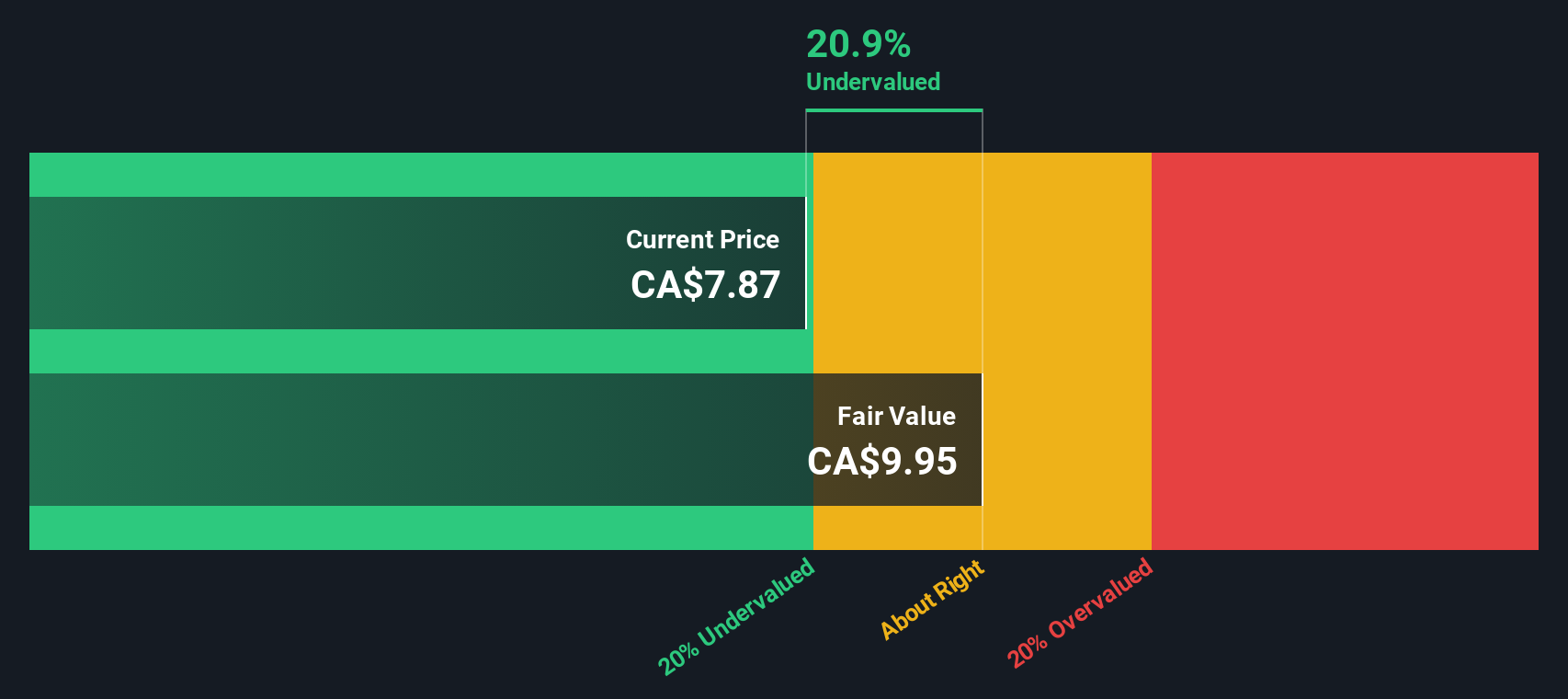

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing a portfolio of industrial properties, with a market capitalization of approximately CA$1.19 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with a recent figure of CA$180.60 million. The cost of goods sold (COGS) stands at CA$50.44 million, leading to a gross profit margin of 72.07%. Operating expenses are recorded at CA$7.91 million, impacting the net income which is reported as CA$80.36 million for the latest period analyzed.

PE: 7.1x

Nexus Industrial REIT, a smaller player in the real estate sector, is currently priced attractively. Despite a projected revenue growth of 4.91% annually, earnings are expected to decline by an average of 15.6% over the next three years. The company's recent first-quarter sales rose to C$44.75 million from C$41.6 million last year, though net income decreased significantly to C$33.15 million from C$43.67 million previously reported. Insider confidence has been demonstrated through share purchases in early 2025, suggesting potential optimism about future prospects despite current challenges such as high-risk funding and insufficient interest coverage by earnings.

- Click to explore a detailed breakdown of our findings in Nexus Industrial REIT's valuation report.

Explore historical data to track Nexus Industrial REIT's performance over time in our Past section.

Summing It All Up

- Reveal the 127 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:297

Sinofert Holdings

An investment holding company, engages in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives