Exploring TSX's Top Undervalued Small Caps With Insider Action In December 2024

Reviewed by Simply Wall St

As the Canadian market navigates political uncertainties and recent pullbacks, it remains buoyed by strong economic fundamentals and easing inflation, positioning it for potential growth despite leadership transitions. In this environment, identifying small-cap stocks with solid financials and insider activity can offer intriguing opportunities for investors looking to capitalize on market volatility.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.1x | 0.3x | 37.71% | ★★★★★★ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 43.63% | ★★★★★☆ |

| Calfrac Well Services | 11.5x | 0.2x | 37.46% | ★★★★★☆ |

| Nexus Industrial REIT | 12.5x | 3.1x | 28.71% | ★★★★★☆ |

| Aris Mining | NA | 1.2x | 45.59% | ★★★★★☆ |

| First National Financial | 13.4x | 3.8x | 43.47% | ★★★★☆☆ |

| Baytex Energy | NA | 0.8x | -109.64% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -108.28% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 19.92% | ★★★☆☆☆ |

| StorageVault Canada | NA | 4.9x | -676.91% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

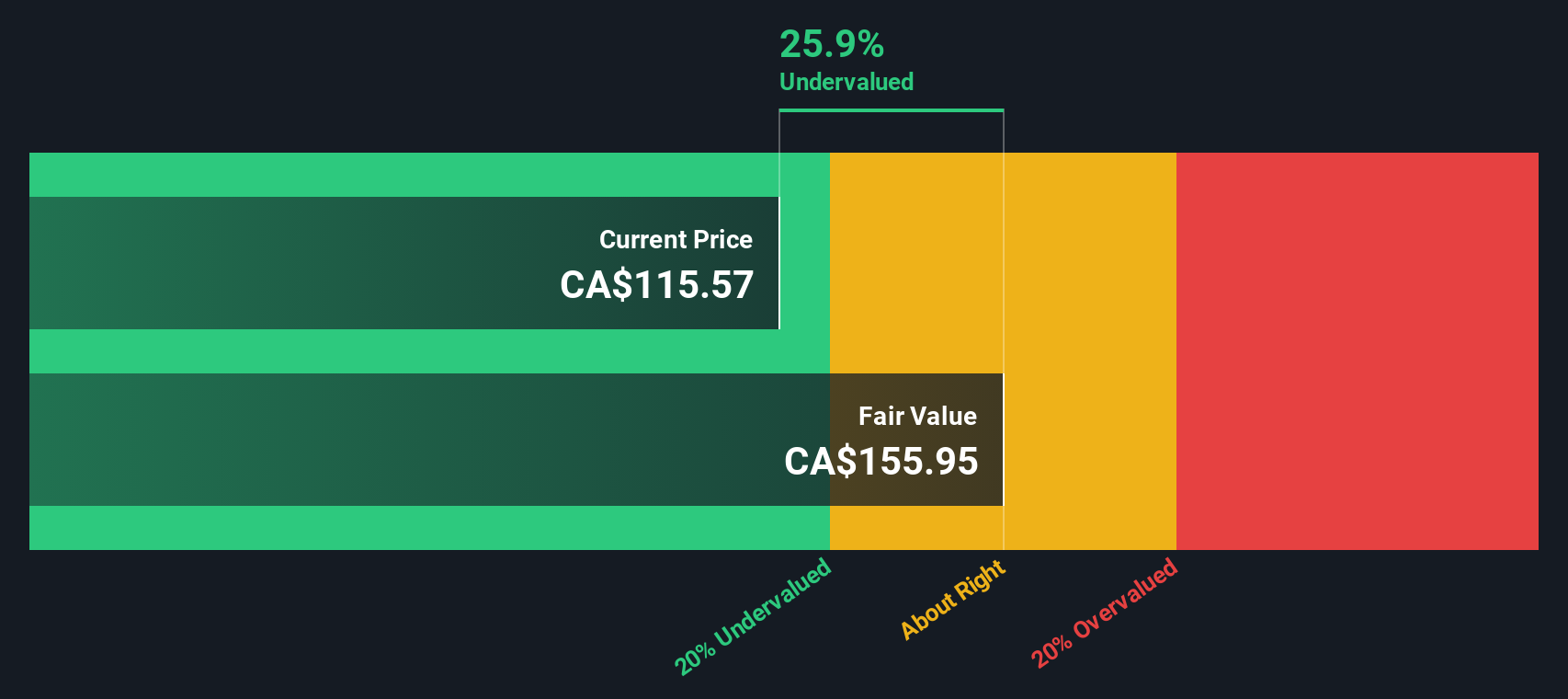

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of CA$1.56 billion.

Operations: The company's revenue is primarily derived from the manufacture and sale of transformers, with a recent gross profit margin of 33.46%. Operating expenses include significant allocations to sales and marketing, as well as general and administrative costs.

PE: 22.3x

Hammond Power Solutions, a Canadian company in the transformer industry, recently reported third-quarter sales of C$191.97 million, up from C$179.52 million year-over-year, with net income rising to C$16.31 million. Insider confidence is evident as Dahra Granovsky purchased 1,500 shares for approximately C$175,538 between September and December 2024. The company's earnings are projected to grow by 11% annually despite relying solely on external borrowing for funding, highlighting potential growth amid higher risk factors.

- Click to explore a detailed breakdown of our findings in Hammond Power Solutions' valuation report.

-

Gain insights into Hammond Power Solutions' past trends and performance with our Past report.

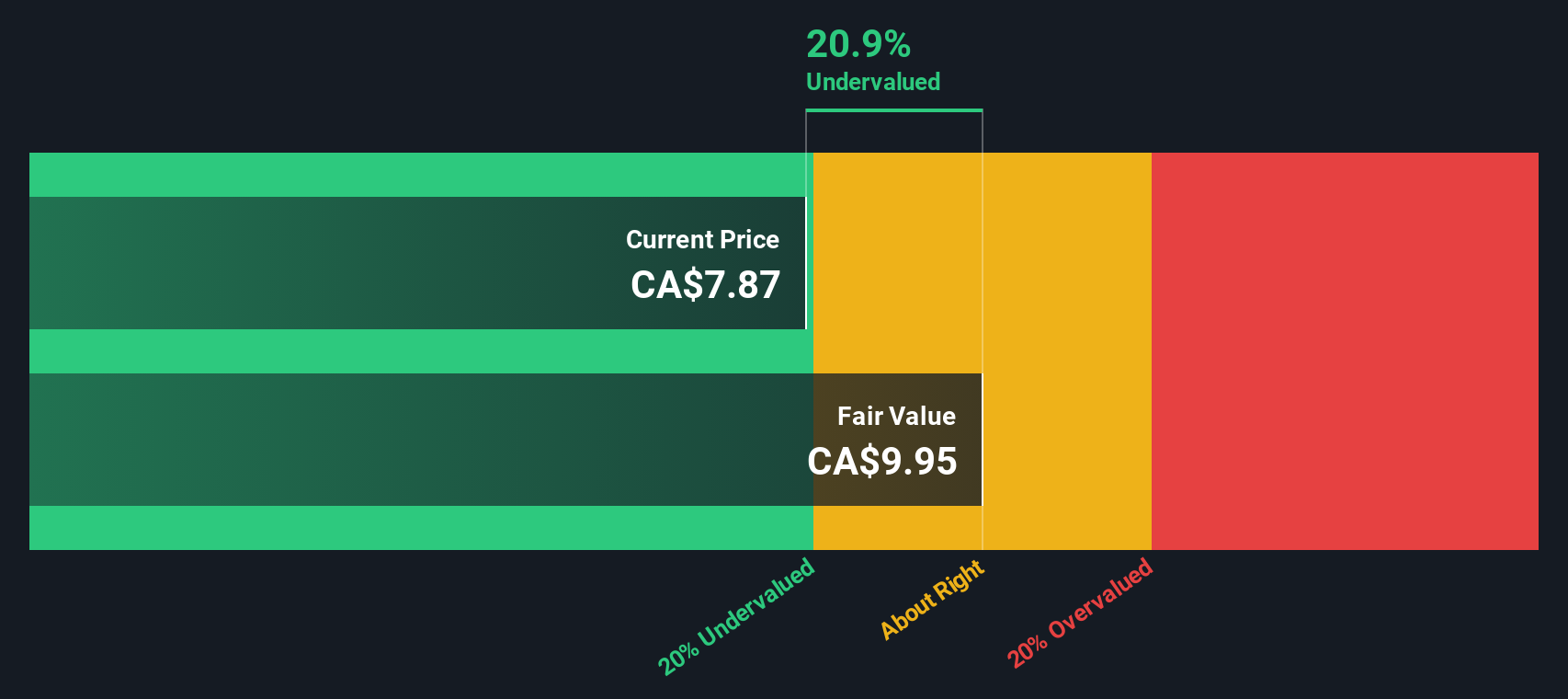

H&R Real Estate Investment Trust (TSX:HR.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: H&R Real Estate Investment Trust is a Canadian-based REIT with a market capitalization of CA$3.93 billion, focused on managing and developing properties across office, retail, industrial, and residential sectors.

Operations: H&R Real Estate Investment Trust generates revenue primarily from its Office and Residential segments, with significant contributions from Retail and Industrial sectors. The company's gross profit margin has shown a notable trend, reaching 82.57% in early 2020 before stabilizing around the mid-60s percentage range in subsequent periods.

PE: -9.4x

H&R Real Estate Investment Trust, a smaller player in the Canadian market, recently reported a challenging quarter with CAD 200.34 million in sales and a net loss of CAD 9.72 million for Q3 2024. Despite these setbacks, insider confidence is evident as they have been purchasing shares throughout the year, signaling potential optimism about future prospects. The company declared a monthly distribution of CAD 0.05 per unit for November, maintaining shareholder returns amidst financial pressures from external borrowing sources.

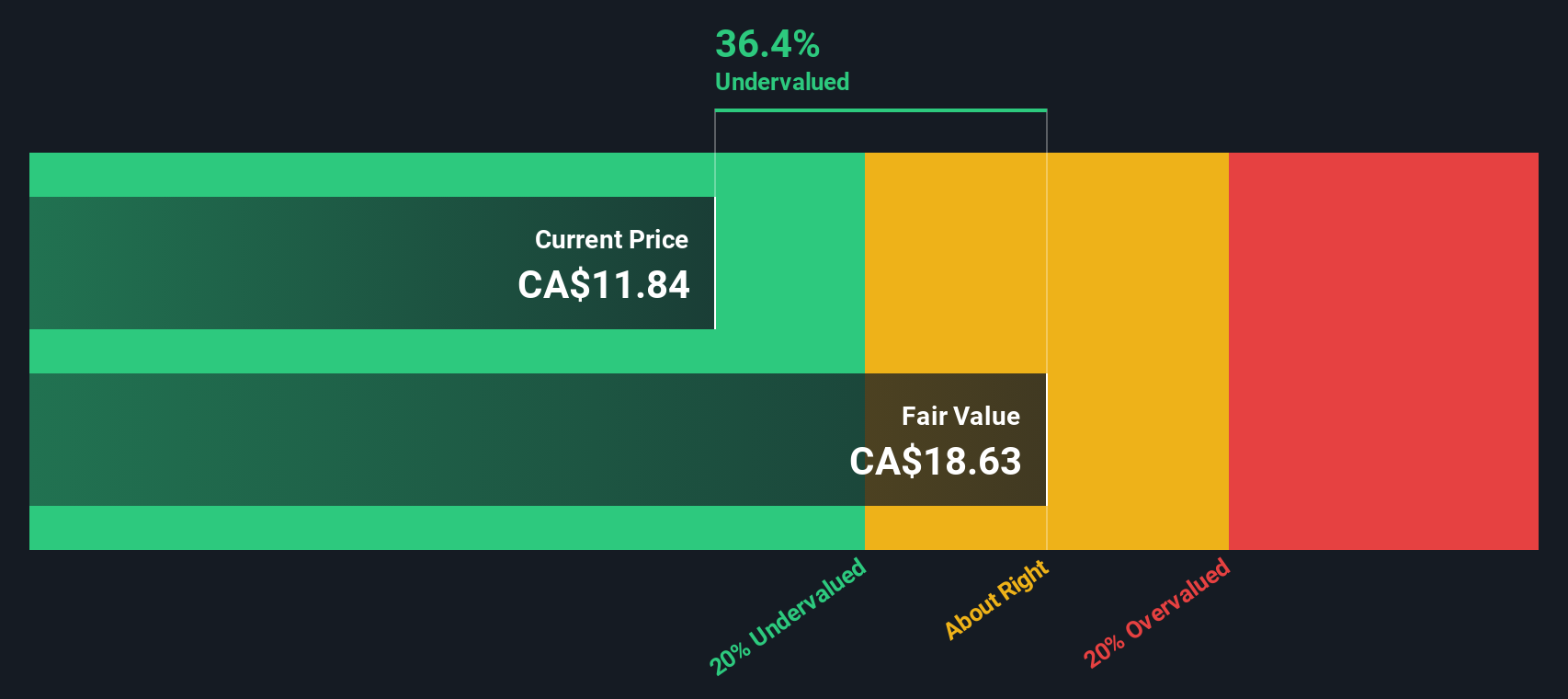

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing a portfolio of industrial properties, with a market capitalization of approximately CA$1.19 billion.

Operations: Nexus Industrial REIT generates revenue primarily from investment properties, with the latest reported revenue at CA$172.86 million. The company's gross profit margin has shown a trend around 71% in recent periods. Operating expenses are consistently managed, with general and administrative costs being a notable component.

PE: 12.5x

Nexus Industrial REIT, a smaller player in the Canadian market, shows mixed financial health. Recent earnings reveal a net loss of C$45.99 million for Q3 2024, contrasting with last year's C$76.95 million profit. Despite this, sales increased to C$45.53 million from C$39.75 million year-over-year. The company forecasts 12% annual earnings growth but grapples with high-risk external funding and interest coverage issues. Insider confidence is reflected through recent share purchases, suggesting potential optimism among insiders about future prospects despite current challenges.

Where To Now?

- Investigate our full lineup of 25 Undervalued TSX Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HR.UN

H&R Real Estate Investment Trust

H&R REIT is one of Canada's largest real estate investment trusts with total assets of approximately $9.6 billion as at September 30, 2025.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026