Here's Why We Think Morguard Real Estate Investment Trust's (TSE:MRT.UN) CEO Compensation Looks Fair

Key Insights

- Morguard Real Estate Investment Trust to hold its Annual General Meeting on 7th of May

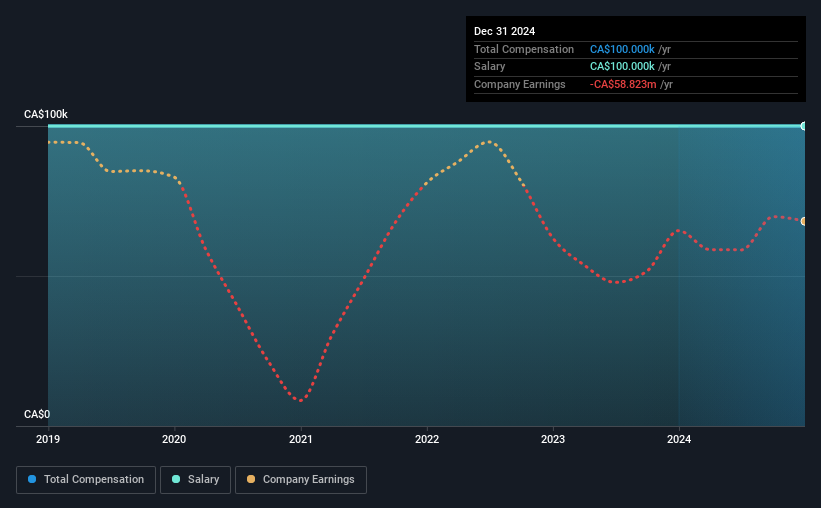

- Total pay for CEO Kuldip Sahi includes CA$100.0k salary

- The total compensation is 86% less than the average for the industry

- Over the past one year, Morguard Real Estate Investment Trust's FFO fell by 3.2% and over the past three years, the total shareholder return was 20%

Performance at Morguard Real Estate Investment Trust (TSE:MRT.UN) has been rather uninspiring recently and shareholders may be wondering how CEO Kuldip Sahi plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 7th of May. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Morguard Real Estate Investment Trust

How Does Total Compensation For Kuldip Sahi Compare With Other Companies In The Industry?

At the time of writing, our data shows that Morguard Real Estate Investment Trust has a market capitalization of CA$363m, and reported total annual CEO compensation of CA$100k for the year to December 2024. There was no change in the compensation compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$100k.

On comparing similar companies from the Canadian REITs industry with market caps ranging from CA$138m to CA$551m, we found that the median CEO total compensation was CA$725k. Accordingly, Morguard Real Estate Investment Trust pays its CEO under the industry median. Moreover, Kuldip Sahi also holds CA$6.8m worth of Morguard Real Estate Investment Trust stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$100k | CA$100k | 100% |

| Other | - | - | - |

| Total Compensation | CA$100k | CA$100k | 100% |

Speaking on an industry level, nearly 48% of total compensation represents salary, while the remainder of 52% is other remuneration. On a company level, Morguard Real Estate Investment Trust prefers to reward its CEO through a salary, opting not to pay Kuldip Sahi through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Morguard Real Estate Investment Trust's Growth Numbers

Over the last one year, Morguard Real Estate Investment Trust has shrunk its funds from operations (FFO) by 3.2% . In the last year, its revenue is up 1.6%.

The decline in FFO is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in FFO. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Morguard Real Estate Investment Trust Been A Good Investment?

Morguard Real Estate Investment Trust has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Morguard Real Estate Investment Trust pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Morguard Real Estate Investment Trust that investors should be aware of in a dynamic business environment.

Important note: Morguard Real Estate Investment Trust is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MRT.UN

Morguard Real Estate Investment Trust

The Trust is a closed-end real estate investment trust, which owns a diversified portfolio of 46 retail, office and industrial income producing properties in Canada with a book value of $2.3 billion and approximately 8.2 million square feet of leasable space.

Fair value with moderate growth potential.

Market Insights

Community Narratives