- Canada

- /

- Residential REITs

- /

- TSX:MRG.UN

We Discuss Why Morguard North American Residential Real Estate Investment Trust's (TSE:MRG.UN) CEO May Deserve A Higher Pay Packet

Shareholders will probably not be disappointed by the robust results at Morguard North American Residential Real Estate Investment Trust (TSE:MRG.UN) recently and they will be keeping this in mind as they go into the AGM on 05 May 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Morguard North American Residential Real Estate Investment Trust

Comparing Morguard North American Residential Real Estate Investment Trust's CEO Compensation With the industry

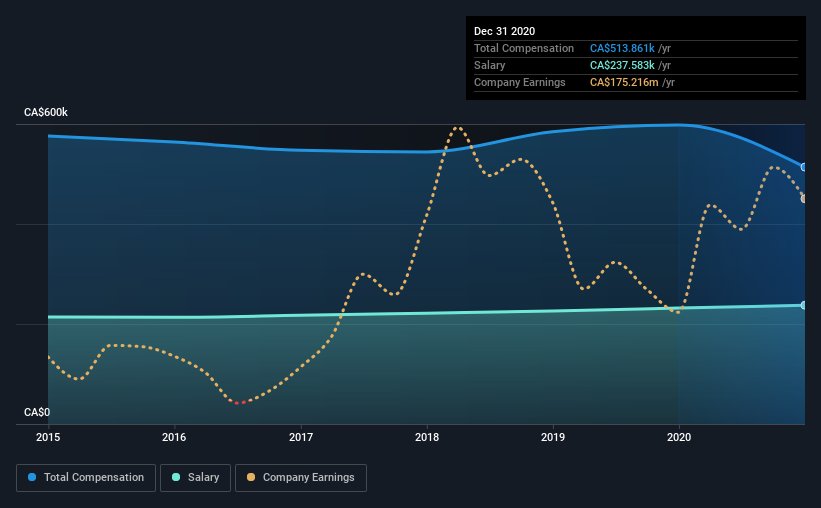

According to our data, Morguard North American Residential Real Estate Investment Trust has a market capitalization of CA$878m, and paid its CEO total annual compensation worth CA$514k over the year to December 2020. Notably, that's a decrease of 14% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$238k.

In comparison with other companies in the industry with market capitalizations ranging from CA$495m to CA$2.0b, the reported median CEO total compensation was CA$1.9m. This suggests that Kuldip Sahi is paid below the industry median. Furthermore, Kuldip Sahi directly owns CA$11m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$238k | CA$232k | 46% |

| Other | CA$276k | CA$366k | 54% |

| Total Compensation | CA$514k | CA$598k | 100% |

Talking in terms of the industry, salary represented approximately 33% of total compensation out of all the companies we analyzed, while other remuneration made up 67% of the pie. Morguard North American Residential Real Estate Investment Trust is paying a higher share of its remuneration through a salary in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Morguard North American Residential Real Estate Investment Trust's Growth

Morguard North American Residential Real Estate Investment Trust has seen its funds from operations (FFO) increase by 4.9% per year over the past three years. It saw its revenue drop 2.8% over the last year.

We generally like to see a little revenue growth, but the modest improvement in FFO is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Morguard North American Residential Real Estate Investment Trust Been A Good Investment?

Morguard North American Residential Real Estate Investment Trust has generated a total shareholder return of 27% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Morguard North American Residential Real Estate Investment Trust (1 is potentially serious!) that you should be aware of before investing here.

Important note: Morguard North American Residential Real Estate Investment Trust is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Morguard North American Residential Real Estate Investment Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MRG.UN

Morguard North American Residential Real Estate Investment Trust

The REIT is an unincorporated, open-ended real estate investment trust established under and governed by the laws of the Province of Ontario.

Established dividend payer and good value.

Market Insights

Community Narratives