Melcor Developments Ltd. (TSE:MRD) is a stock with outstanding fundamental characteristics. When we build an investment case, we need to look at the stock with a holistic perspective. In the case of MRD, it is a well-regarded dividend payer that has been able to sustain great financial health over the past. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Melcor Developments here.

Adequate balance sheet average dividend payer

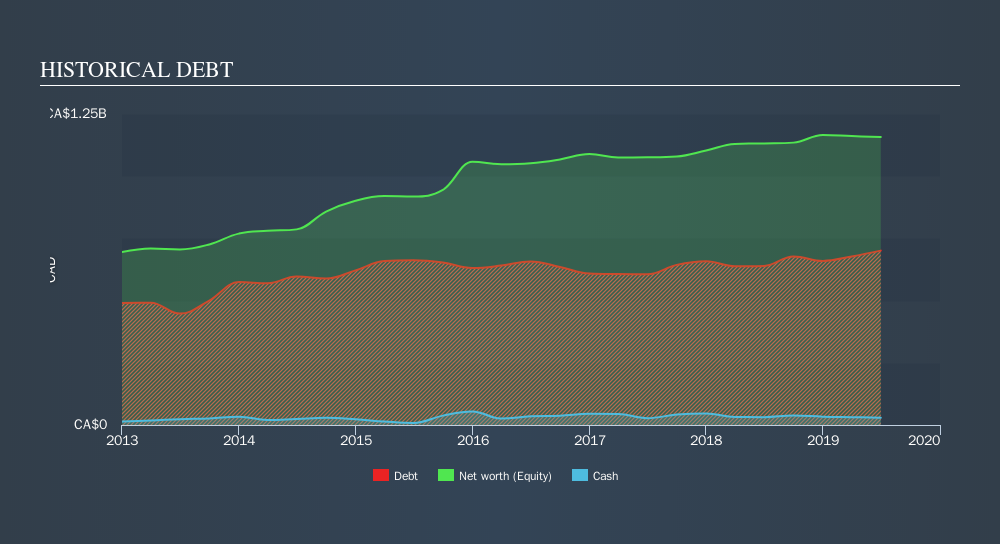

MRD's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This indicates that MRD has sufficient cash flows and proper cash management in place, which is a crucial insight into the health of the company. Debt funding requires timely payments on interest to lenders. MRD’s earnings sufficiently covered its interest in the prior year, which indicates there’s low risk associated with the company not being able to meet these key expenses.

For those seeking income streams from their portfolio, MRD is a robust dividend payer as well. Over the past decade, the company has consistently increased its dividend payout, reaching a yield of 3.9%.

Next Steps:

For Melcor Developments, I've put together three important factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for MRD’s future growth? Take a look at our free research report of analyst consensus for MRD’s outlook.

- Historical Performance: What has MRD's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of MRD? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:MRD

Melcor Developments

Operates as a real estate development company in the United States and Canada.

Solid track record and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion