Does Melcor Real Estate Investment Trust (TSE:MR.UN) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Melcor Real Estate Investment Trust (TSE:MR.UN). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Melcor Real Estate Investment Trust

How Fast Is Melcor Real Estate Investment Trust Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Melcor Real Estate Investment Trust's EPS went from CA$0.031 to CA$0.44 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

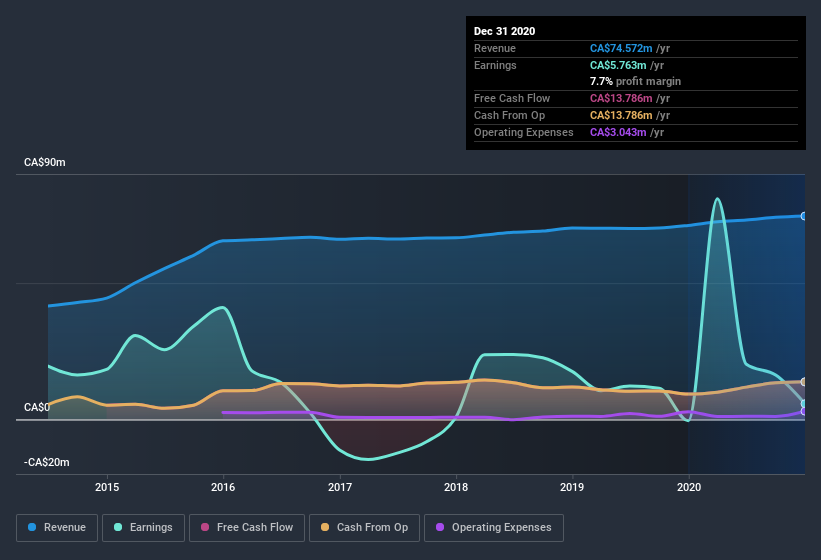

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Melcor Real Estate Investment Trust maintained stable EBIT margins over the last year, all while growing revenue 4.8% to CA$75m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Melcor Real Estate Investment Trust is no giant, with a market capitalization of CA$190m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Melcor Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Melcor Real Estate Investment Trust insiders refrain from selling stock during the year, but they also spent CA$230k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Timothy Melton for CA$78k worth of shares, at about CA$3.90 per share.

It's reassuring that Melcor Real Estate Investment Trust insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between CA$126m and CA$503m, like Melcor Real Estate Investment Trust, the median CEO pay is around CA$529k.

The Melcor Real Estate Investment Trust CEO received total compensation of just CA$194k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Melcor Real Estate Investment Trust Deserve A Spot On Your Watchlist?

Melcor Real Estate Investment Trust's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Melcor Real Estate Investment Trust is at an inflection point, given the EPS growth. For those chasing fast growth, then, I'd suggest to stock merits monitoring. We should say that we've discovered 4 warning signs for Melcor Real Estate Investment Trust (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Melcor Real Estate Investment Trust, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Melcor Real Estate Investment Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MR.UN

Melcor Real Estate Investment Trust

Melcor REIT is an unincorporated, open-ended real estate investment trust.

Fair value minimal.

Market Insights

Community Narratives